Get the free disclaimer of inheritance form california template

Show details

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which he/she refuses to accept an estate which has been conveyed to him/her. In this instrument, the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is disclaimer by beneficiary of

A 'disclaimer by beneficiary of' is a legal document in which a beneficiary formally declines to accept an inheritance or gift.

pdfFiller scores top ratings on review platforms

Very simple and easy to use. Has saved me a lot of time completing documents for work.

I am very exciting to learn the high tech (cloud) and it is very effective.

Who needs disclaimer of inheritance california?

Explore how professionals across industries use pdfFiller.

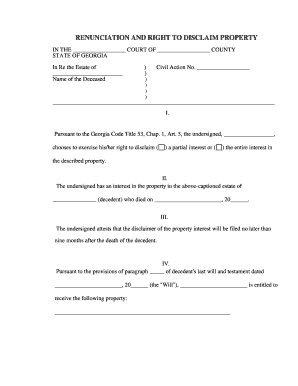

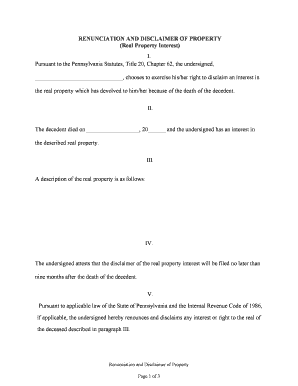

Comprehensive Guide to the Disclaimer by Beneficiary of Form

What is a disclaimer by the beneficiary?

A disclaimer by a beneficiary is a legal document that allows an individual to refuse their inheritance from an estate or trust. This process is significant in estate planning as it can impact tax liabilities and the future distribution of assets. Understanding the implications of disclaiming an inheritance is essential for potential beneficiaries.

-

Disclaimers can help beneficiaries avoid unexpected tax burdens and allow reallocation of assets according to the estate plan.

-

Beneficiaries should be aware that disclaiming an inheritance can have lasting legal effects, including affecting other beneficiaries' rights.

Why might beneficiaries choose to disclaim an inheritance?

Beneficiaries might opt to disclaim their inheritance for various reasons, including tax implications and personal circumstances. Sometimes accepting an inheritance can lead to taxable income, which is a factor many individuals consider seriously when making their decision.

-

Receiving an inheritance can have tax consequences, especially if the assets generate income.

-

Debts or financial obligations may lead a beneficiary to renounce an inheritance in order to avoid complications.

-

Disclaiming can also provide flexibility for beneficiaries in future estate planning endeavors, allowing others to inherit.

How do you complete the disclaimer process?

Completing the disclaimer process involves several steps that ensure the document is properly prepared and submitted. Beneficiaries should first gather necessary personal information, including their name, address, and relationship to the trustor.

-

Ensure you have your name, address, and your relationship to the trustor ready.

-

Fill out the disclaimer form accurately, detailing the trustee and trustor information as needed.

-

Clearly state the exact interest being disclaimed and the reason behind the disclaimer.

What are the critical components of the disclaimer form?

The disclaimer form must be comprehensive and contain all necessary details for it to be valid and effective. This includes basic identification fields as well as information regarding the interest being disclaimed.

-

Both the trustee and trustor need to be clearly identified in the document.

-

Specify the type of inheritance being disclaimed, whether it be income or principal assets.

-

Make sure to meet all signature requirements, which may include notarization and witness verification for legality.

What role does the trustee play in the disclaimer process?

The trustee has a critical role in managing the disclaimer as they must understand their responsibilities when presented with a disclaimer. The way a disclaimer is executed can also affect both the trust as a whole and the interests of other beneficiaries.

-

The trustee must assess the disclaimer and ensure that it is compliant with the legal framework.

-

A disclaimer can alter the distribution of trust assets, often necessitating a reevaluation of remaining beneficiaries' rights.

-

After receiving a disclaimer, the trustee must follow specific legal protocols to manage the trust effectively.

What are the potential outcomes after disclaiming an inheritance?

Disclaiming an inheritance triggers different potential outcomes based on individual state laws and specific circumstances surrounding the disclaimer. Understanding what happens next is crucial for beneficiaries.

-

The beneficiary forfeits any rights to the disclaimed inheritance, which can lead to confusion without proper documentation.

-

Disclaimed property typically gets redistributed among remaining beneficiaries according to the terms of the trust or estate.

-

Different states may interpret disclaimers differently, potentially leading to legal disputes or complications.

What state-specific compliance should you consider?

Each state has unique laws regarding disclaimers, making it vital to understand local regulations. For example, California has specific requirements that differ from those of Virginia, which can affect how the disclaimer is executed.

-

Familiarize yourself with California's regulations on disclaimers to ensure compliance and avoid legal pitfalls.

-

It is essential to consider local estate planning laws and how they apply to disclaimers.

-

Ensure that all necessary documentation aligns with state agency requirements to avoid delays or complications.

How can pdfFiller assist with disclaimer form needs?

Using pdfFiller simplifies the process of filling out and managing disclaimer forms. The platform's interactive tools make it easy to edit, sign, and securely store documents from anywhere in a user-friendly environment.

-

Easily fill out disclaimer forms online with guided instructions and templates tailored for various needs.

-

Utilize pdfFiller's capabilities for editing and eSigning documents safely in the cloud.

-

Many users praise pdfFiller for its ease of use, reducing the frustration often associated with document management.

How to fill out the disclaimer of inheritance california

-

1.Open the PDFfiller platform and log in to your account.

-

2.Search for 'disclaimer by beneficiary of' in the template library.

-

3.Select the relevant template and open it for editing.

-

4.Fill in your name and contact information at the top of the document.

-

5.Identify the estate or property for which you are disclaiming the inheritance.

-

6.Clearly state your intention to disclaim the inheritance and the reasons if required.

-

7.Review the document for accuracy and completeness, ensuring all necessary information is provided.

-

8.Add your signature in the designated area, along with the date of signing.

-

9.Submit the completed form as required by the estate executor or legal representative.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.