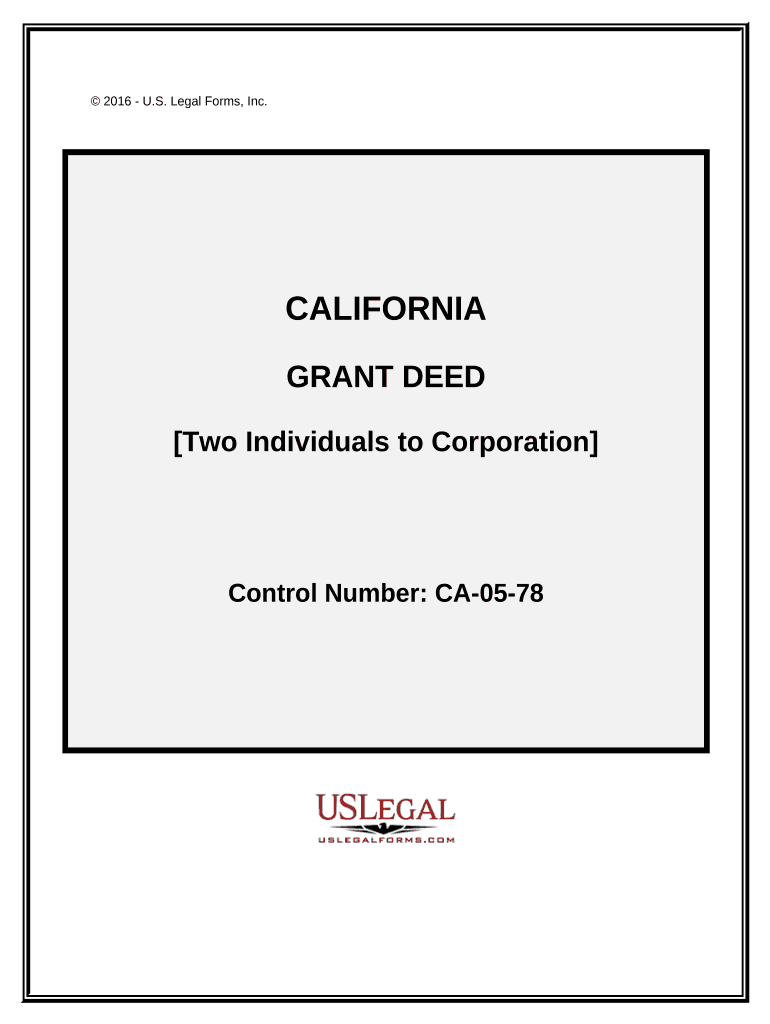

Get the free Grant Deed from Two Individuals to Corporation template

Show details

This Warranty Deed from two Individuals to Corporation form is a Warranty Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey and warrant the described property

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

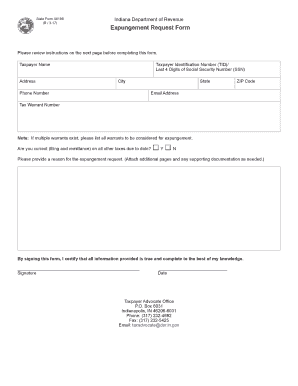

What is grant deed from two

A grant deed from two is a legal document used to transfer property ownership from two parties to another party, ensuring the grantee receives clear title to the property.

pdfFiller scores top ratings on review platforms

Just getting started. Seems very user friendly and quick.

I didn't want to pay for this feature but it is really a great program. I only wish I would be able to be copied and review status of Signed documents as it progresses without paying additional. Or adding the file for Esign to my personal email sent file.

user friendly, easy to create and send, very happy with the responsiveness of customer service via email; however, it would be nice to be able to speak to someone on the phone for quick questions.

new user but so far pleased with service

Can't seem to get to work directly from Google Docs

Great software easy to use and everything I need to get my work done in the office and on the go....

Who needs grant deed from two?

Explore how professionals across industries use pdfFiller.

How to fill out a grant deed from two form form

Filling out a grant deed from two form form is essential for transferring property rights between individuals and corporations effectively. This guide provides a detailed overview of the process, step-by-step instructions, and best practices to ensure your grant deed meets regulatory requirements.

What is a grant deed?

A grant deed is a legal document used to transfer ownership of real property. Its primary purpose is to convey property from one party to another, ensuring that the new owner has full title and rights to the property. Grant deeds are crucial in real estate transactions because they provide a guarantee that the seller owns the property and has the right to sell it.

-

It provides legal proof of the transfer of property ownership.

-

Unlike a quitclaim deed, a grant deed offers warranties regarding the title.

-

It helps protect the buyer by ensuring a clean title in the property transfer process.

How does the grant deed form work?

The 'California Grant Deed Two Individuals to Corporation' form is a specified template designed for specific transactions. In this form, individual owners transfer their property interests to a corporate entity. Furthermore, understanding each part of the form is vital for accuracy and compliance.

-

Each document features a control number for organized tracking and management.

-

Relevant sections include the names of the parties involved, a detailed property description, and signature requirements to validate the deed.

What are the steps to complete the grant deed form?

Filling out the grant deed form involves a straightforward process, particularly with tools like pdfFiller. You can access editable forms and utilize digital tools to ensure your document is accurately filled out and saved.

-

Begin by locating the editable form on pdfFiller's platform.

-

Utilize form fields established with Microsoft Word or Adobe Acrobat to enter your information.

-

Complete the form by saving your modifications for future reference.

What tools can enhance your grant deed workflow?

pdfFiller offers many features to simplify document management, especially for grant deeds. Whether you need to collaborate with a team or send the document for an eSignature, pdfFiller provides tools that streamline these processes.

-

Easily edit the grant deed form directly in the platform to perfect your details.

-

Enable real-time collaboration for teams handling multiple grant deeds.

-

Send documents for eSigning securely, allowing for quicker transactions.

What are the exemptions from transfer tax?

In California, certain grant deeds may be exempt from the documentary transfer tax, providing financial relief during property transfers. These exemptions can vary depending on the type of transaction taking place.

-

Review the various exemptions available under California law related to grant deeds.

-

Examples include transfers between spouses or certain corporate transfers that often qualify.

-

Make sure to consult local regulations for exact scenarios that apply.

What common mistakes should you avoid?

Completing grant deeds can lead to errors that have significant implications if not handled correctly. Avoiding common mistakes is paramount for compliance and ensuring valid transfers.

-

Miswriting property descriptions or failing to have all parties sign are frequent pitfalls.

-

Errors can lead to disputes or issues with future property claims.

-

Double-check all entries and familiarize yourself with state requirements to mitigate risks.

How to finalize the grant deed process?

The final stage of the grant deed process is crucial, as it involves submitting the completed document to appropriate local authorities. Recording the grant deed guarantees public acknowledgment of the property transfer.

-

File the completed deed with the county recorder's office to initiate the official record.

-

Recording protects your rights and interests as the property owner.

-

After submitting the deed, keep track of the public record for future reference.

How do grant deeds compare to other deeds?

Understanding the differences between grant deeds and quitclaim deeds can guide property owners in making informed decisions. Each type of deed has unique advantages and disadvantages that may suit particular scenarios.

-

Grant deeds provide comprehensive protections for buyers, ensuring the seller holds clear title.

-

Quitclaim deeds do not guarantee the property title, making them less secure for buyers.

-

Use grant deeds for sales or transfers where ownership confirmation is essential.

How to fill out the grant deed from two

-

1.Open the PDF filler application and locate the grant deed form.

-

2.Begin by entering the names of the two grantors at the top of the form; make sure both names are legible.

-

3.Insert the grantee's name in the designated field to indicate who will receive the property.

-

4.Fill in the legal description of the property being transferred, which can typically be found in prior deeds or property assessments.

-

5.Add the purchase price in the appropriate section if applicable; ensure accuracy to avoid later disputes.

-

6.Both grantors must sign the document in the signature sections provided, ensuring they are witnessed as required by local laws.

-

7.Finally, review all information for accuracy and completeness before submitting or printing the deed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.