Last updated on Feb 10, 2026

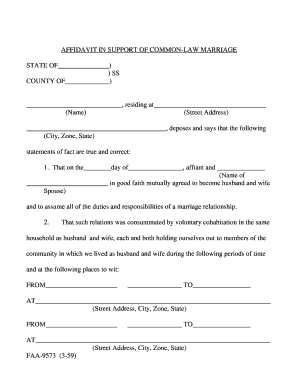

Get the free Non-Foreign Affidavit Under IRC 1445 template

Show details

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is non-foreign affidavit under irc

A non-foreign affidavit under IRC is a legal document asserting that an individual or entity is not a foreign person for tax purposes under the Internal Revenue Code.

pdfFiller scores top ratings on review platforms

As a newcomer to PDFfiller I have only used the Ahnentafel Table. I find it most useful and easy to follow.

What I tried to do worked, and the chat interaction worked as well.

Great product & very good user experience

working great. Just too many steps between done filling and printing.

Easy to use but I know have more to learn on it

Easy method. I have been filling out MER longhand for years. Glad I made the mistake clicking on your sight. Would have copied form and filled out by hand.

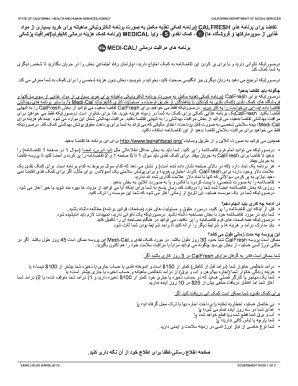

Who needs non-foreign affidavit under irc?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Filling Out the Non-Foreign Affidavit Under IRC Form

Filling out a non-foreign affidavit under IRC Form is essential for property transfers to certify that the seller is not a foreign person. This affidavit is crucial in ensuring a proper tax withholding process during real estate transactions.

What is the non-foreign affidavit under IRC Section 1445?

The Non-Foreign Affidavit under IRC Section 1445 is a document used by property sellers to declare that they are not classified as foreign individuals under U.S. tax law. This affidavit is important as it plays a pivotal role in property transfers, helping to protect buyers from unexpected tax withholding liabilities. Understanding IRC Section 1445's implications allows both buyers and sellers to navigate the complexities of U.S. tax regulations concerning foreign ownership.

What are the key components of the non-foreign affidavit?

-

Accurately completing seller information ensures compliance with tax laws and facilitates a smooth transaction.

-

Providing a precise description of the property is crucial, as it affects tax implications and the validity of the affidavit.

-

Including the U.S. taxpayer ID is essential to confirm the seller's status and secure the exemption from withholding.

How can you complete the non-foreign affidavit step by step?

-

Ensure you have all relevant property documentation and tax identification information at hand.

-

Fill out the property details carefully, noting any unique identifiers.

-

Double-check names and tax IDs to avoid potential compliance issues.

-

Finalizing the affidavit with proper signatures and notarization is required to ensure legitimacy.

What common mistakes should you avoid when submitting your affidavit?

-

Errors in property details can lead to challenges in the transfer process.

-

Missing information can trigger additional scrutiny or delays.

-

Notarization errors can void the affidavit and complicate the seller's legal standing.

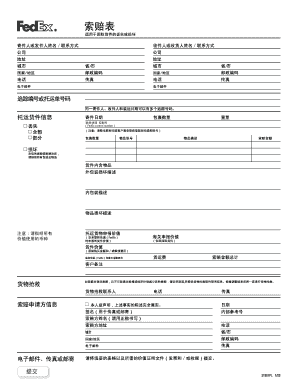

How does pdfFiller simplify the non-foreign affidavit process?

pdfFiller offers a user-friendly interface that helps you effortlessly fill out PDFs, making the non-foreign affidavit process streamlined. Its eSignature capabilities allow for quick signing, which saves time and expedites property transfers. Additionally, collaborative tools enable team review and approval, ensuring no detail is overlooked before submission.

What are the final steps for submitting your completed non-foreign affidavit?

-

Identify the proper agency or office where the affidavit must be submitted to comply with local regulations.

-

Keep a record of submission methods and dates to ensure you receive confirmation of acceptance.

-

Gain clarity on how to leverage the affidavit’s provisions to avoid unnecessary tax withholding.

How can you contact pdfFiller for assistance?

-

Visit pdfFiller's customer support page for various contact options, including chat and email.

-

Access tutorials and written guides to enhance your understanding of the affidavit process.

-

Utilize the FAQ section on pdfFiller’s site to find answers to common questions concerning the affidavit.

How to fill out the non-foreign affidavit under irc

-

1.Access the pdfFiller website and log in to your account.

-

2.Search for the 'Non-Foreign Affidavit under IRC' template in the search bar.

-

3.Open the template and review the fields that need to be filled.

-

4.Begin with the title section and enter your name and any applicable entity information.

-

5.Provide your Tax Identification Number (TIN) and other relevant identification details.

-

6.In the affidavit body, state clearly that you are not a foreign person as defined under the IRC.

-

7.Fill in the address of the property involved in the transaction.

-

8.Include the date and any additional required information or assurances.

-

9.Review the completed document for accuracy and ensure all necessary fields are filled in.

-

10.Save your changes and either print or download the document for submission.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

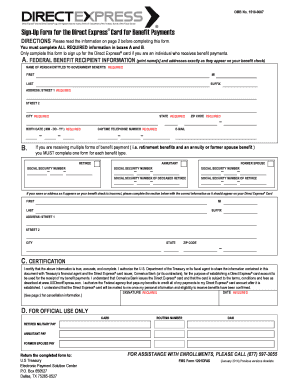

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.