Last updated on Feb 10, 2026

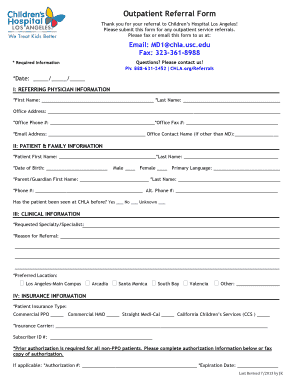

Get the free California Unsecured Installment Payment Promissory Note for Fixed Rate template

Show details

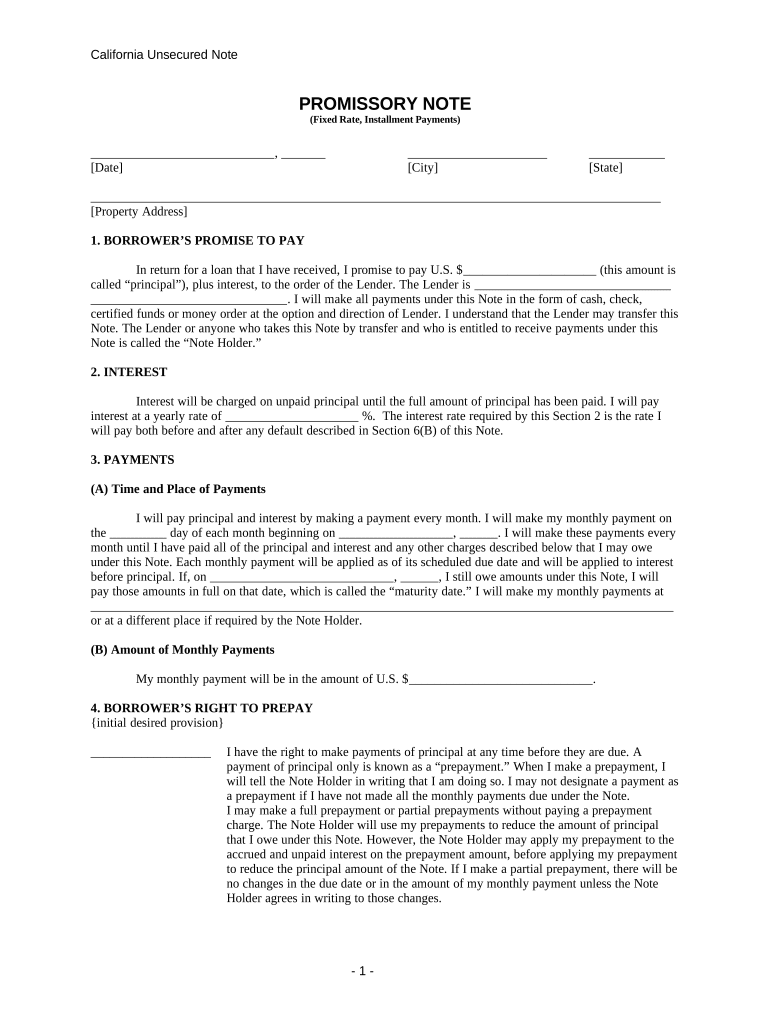

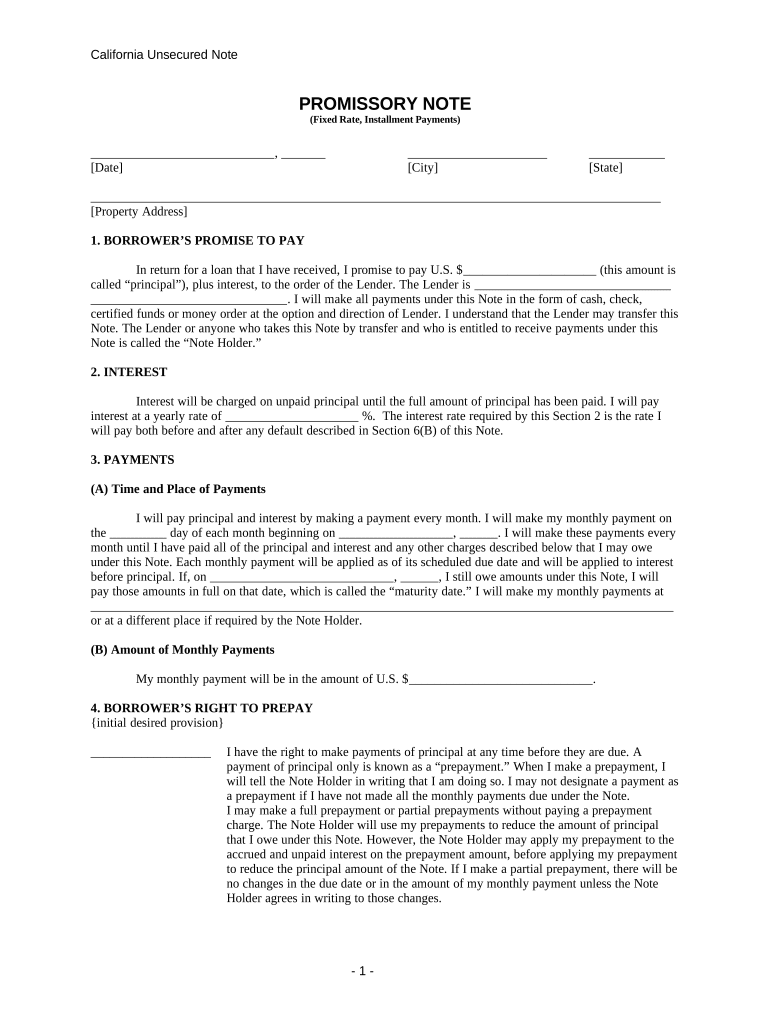

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is california unsecured installment payment

A California unsecured installment payment is a payment plan where a borrower can repay a debt in installments without securing it against collateral.

pdfFiller scores top ratings on review platforms

I find it useful but just need to play with program some to get a grasp of all the features.

easy to use and very convienient

Excellent product

love it

love the pdf filler

Great program

Great program, I just dont use it as much

Easy

Easy to use once you read the directions

Who needs california unsecured installment payment?

Explore how professionals across industries use pdfFiller.

How to fill out a California unsecured installment payment form form

Filling out a California unsecured installment payment form is essential for managing your unsecured loans effectively. This overview will help you navigate the nuances of the form, ensuring accurate completion, which can lead to smoother transactions and compliance.

Understanding the California unsecured installment payment form

An unsecured note is a loan that doesn’t require collateral, meaning the lender cannot claim specific assets if the borrower defaults. This type of financing serves various purposes, from personal loans to business financing, helping borrowers meet immediate financial needs without risking personal property.

-

An unsecured note facilitates borrowing by establishing a legal promise to repay, ensuring both borrower and lender understand their obligations.

-

The form highlights essential loan information such as payment schedules, interest rates, and borrower responsibilities, making it straightforward to comprehend.

-

Accuracy in filling out the form is critical as it affects loan terms and conditions and can prevent potential legal issues down the line.

What are the essential components of the form?

-

This section outlines the borrower's legal commitment to repay the loan, specifying repayment terms and conditions.

-

Details about the lender and their role in the transaction are crucial for establishing accountability.

-

This section breaks down how much is borrowed (principal) and the additional cost to borrow that money (interest).

-

Accepted payment methods must be clearly outlined, ensuring both parties agree on how payments will be made.

How are interest rates determined?

Interest rates on installment payments can vary significantly based on several factors, including the borrower's creditworthiness and market conditions. Understanding these calculations helps borrowers anticipate their financial obligations.

-

Interest on unsecured loans is often calculated based on the remaining principal, with higher rates applicable to riskier borrowers.

-

Failing to pay down the principal can result in higher interest costs over time, impacting total repayment amounts.

-

APR reflects the total cost of borrowing on an annual basis, including interest and applicable fees, providing a clearer picture of loan expenses.

What does the payment schedule entail?

-

Payments are typically structured on a monthly basis, allowing borrowers to plan their finances accordingly.

-

The maturity date signifies when the final payment is due and the loan should be completely paid off, marking the end of the financial obligation.

-

It's essential to understand how payments are allocated between interest and reducing the principal, as this affects overall loan cost.

What are the eligibility criteria for securing an unsecured note?

-

Lenders may require specific personal qualifications, including credit scores and income verification, to assess borrowing risk.

-

Potential borrowers must prepare necessary documentation, such as identification and income statements, to support their application.

How to apply for an unsecured installment payment?

-

Begin by gathering all relevant personal and financial information, then fill out the pdfFiller form systematically, section by section.

-

pdfFiller provides tools and templates that simplify the process, ensuring accurate and efficient form filling.

-

After completion, ensure you submit the form to the designated lender through their preferred channels, which may include email or online portals.

How to manage your unsecured installment payment?

-

Utilize pdfFiller to set reminders for upcoming payments, helping you stay organized and avoid late fees.

-

Regularly monitoring your payment status through pdfFiller ensures you maintain awareness of outstanding balances.

-

If financial circumstances change, communicate with your lender to discuss potentially adjusting your payment agreement.

How do unsecured personal and business options compare?

-

Personal and business loans may have different application requirements and documentation needed, reflecting the unique nature of each type of loan.

-

Payment terms may vary between personal and business loans, with businesses often facing stricter payment schedules.

-

Both individuals and businesses must comply with specific legal and regulatory obligations when entering unsecured loans.

How to fill out the california unsecured installment payment

-

1.Open the PDF template for the California unsecured installment payment.

-

2.Carefully read the instructions provided on the document.

-

3.Begin by entering your personal information at the top of the form, including your full name, address, and contact details.

-

4.Next, specify the amount of debt you are looking to pay off in installments.

-

5.Fill in the terms of the payment, including the interest rate if applicable, and the duration of the payment plan.

-

6.Provide details about your current financial situation, including monthly income and expenses, to support your request.

-

7.Review all information entered for accuracy and completeness before proceeding.

-

8.If required, include any documentation requested to validate your financial claims or obligations.

-

9.Sign and date the document in the designated section to confirm your agreement.

-

10.Finally, save the completed document and submit it as directed by the lender or agency handling your payment plan.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.