Get the free California Installments Fixed Rate Promissory Note Secured by Residential Real Estat...

Show details

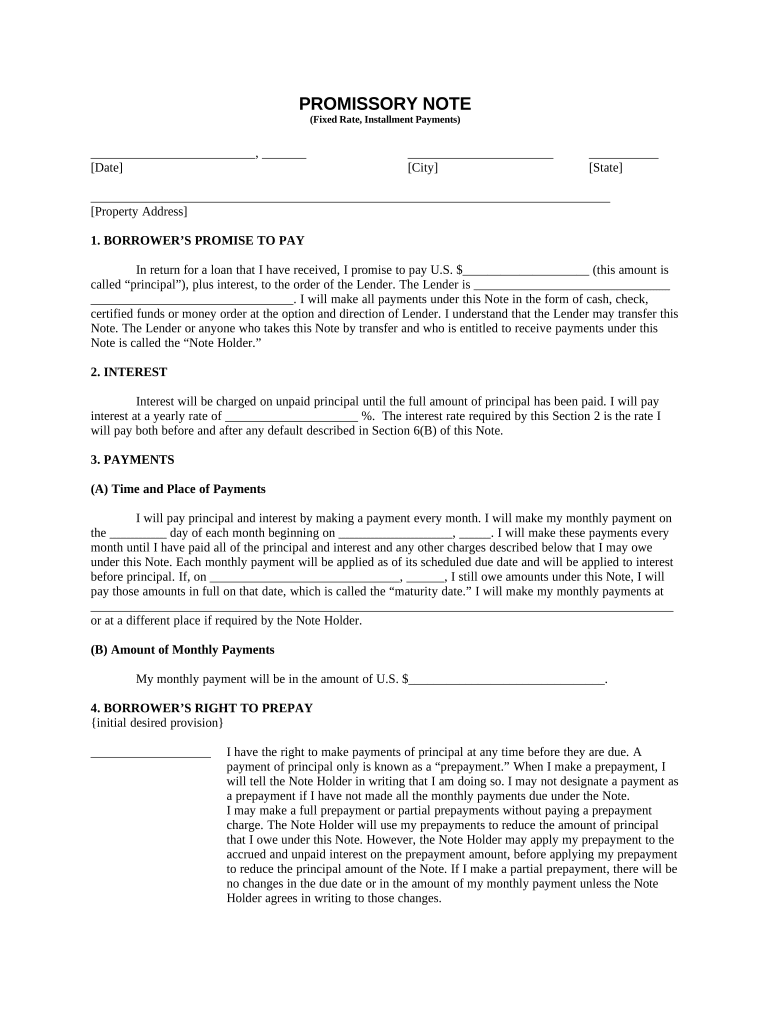

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is california installments fixed rate

California installments fixed rate refers to a loan option in California that allows borrowers to repay their loans in fixed monthly installments over a specified period.

pdfFiller scores top ratings on review platforms

Easy to use

Easy to use. Very quickly.

Great customer service. Noted an erroneous charge to our account and received prompt follow up and resolution of the error.

Easy for On the Go Editing

This works great for creating editable PDFs & exporting them to clients. Can send for signatures and edit details for initial, etc.

I don't dislike it but it could offer more features for the price.

What do you like best?

The site is very easy to use. The layout and design make it very simple to choose the best option for formatting documents. Choices for template or regular document helps to organize which docs you need to reuse. Even if you are not experienced, the options to choose from are so clear, you cannot make a mistake....and if you do, you can fix it very simply.

What do you dislike?

For me and my business purposes there is nothing wrong with this site. It is perfect and has made my business practice so much easier.

Recommendations to others considering the product:

Best program for editing documents, reduces additional work time creating new doc, great advantage with template option. If you are considering a program that will effectively improve your ability to create, organize, and edit important documents pdFiller is the best choice!

What problems are you solving with the product? What benefits have you realized?

I am in the field of Special Education as an administrator. This year with COVID-19, the difficulty of having documents signed, changing information and moving paperwork quickly has been a real challenge. With pdFiller, I have been able to address any paperwork issue that arises in an instant and then get documents back out for a new signature, or an update of information. This has saved me this year and helped me to meet all major and important timelines.

Great Tool very useful and I will…

Great Tool very useful and I will continue to tis tool for all my important documents. Thanks

I was accidentally billed after…

I was accidentally billed after cancelling my subscription. I contacted the customer service and was completely blown away by the fantastic and prompt support i received. My refund was effected very very quickly....never had such excellent and responsive service. This first class customer support is second to none. Highly recommend pdfFiller. Thanks a bunch.Sandra

Who needs california installments fixed rate?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to California Installments Fixed Rate Form

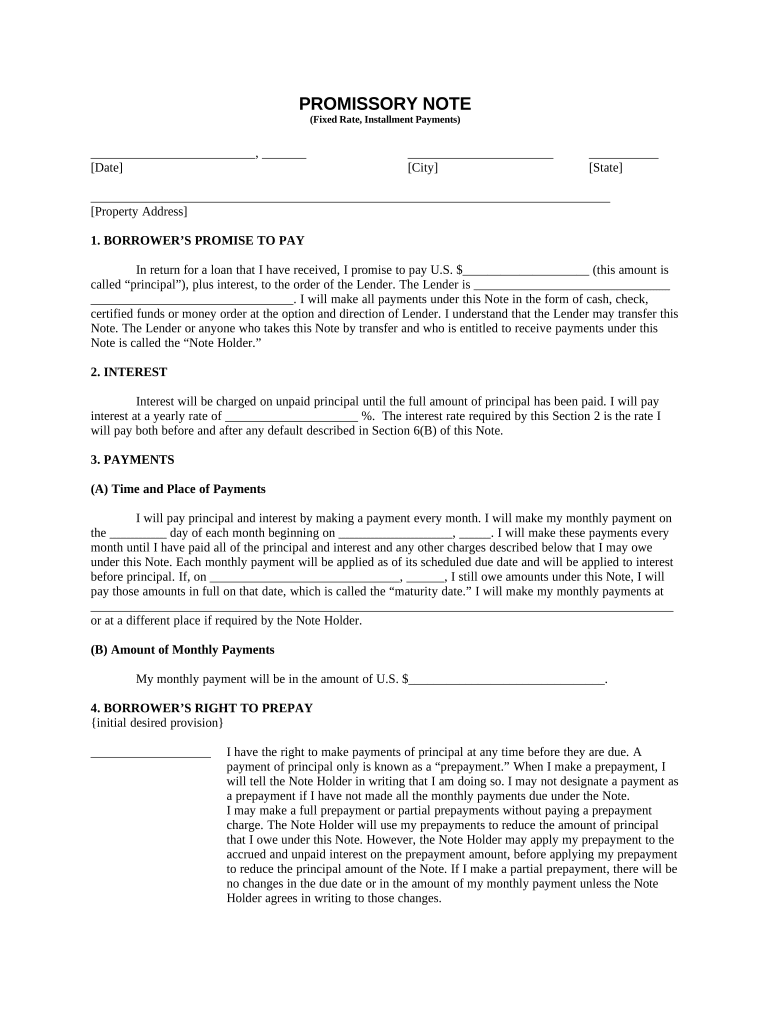

How to fill out a California installments fixed rate form

Filling out a California installments fixed rate form involves providing accurate details such as principal amounts, interest rates, and your payment schedule. Start with a clear understanding of the terms within the promissory note as this ensures compliance and can facilitate smoother transactions.

Understanding the promissory note for fixed rate installments

A promissory note is a financial instrument with a written promise to pay a specified sum of money to a designated party at a determined future date. In California, understanding its significance—essentially a legally binding contract—is crucial before entering into fixed rate installment agreements.

-

A promissory note serves as evidence of a loan and outlines the commitment of the borrower to repay the lent amount under agreed conditions.

-

Fixed rate installments provide certainty in budgeting since the borrower knows exactly how much will be owed each period.

What are the key components of a fixed rate installment promissory note?

A promissory note typically contains essential components such as the principal amount, the interest rate, and the identification of the lender, all of which contribute to understanding the overall agreement.

-

The principal is the original sum borrowed, while the interest is the cost of borrowing that sum, expressed as a percentage.

-

This term refers to the individual or entity entitled to receive payments, and it's important because it defines rights and responsibilities related to the loan.

How do interest rates work in California installments?

Understanding interest rates is vital when entering into fixed rate installment agreements as it directly impacts how much a borrower pays over time. California generally allows lenders to set their rates, although they must comply with state regulations.

-

Interest is usually calculated on the unpaid principal balance, affecting the total amount that must be repaid.

-

Fixed rates remain constant throughout the loan term, providing stability, while variable rates can change based on market conditions.

What are the steps to filling out the form?

Filling out the California installments fixed rate form requires attention to detail and accuracy. Begin with clear entries of all relevant figures, ensuring that each aspect of the payment plan is covered.

-

Clearly state the total loan amount, ensuring there are no typographical errors.

-

Accurately state the interest rate and include a detailed payment schedule to specify how payments will be made.

-

pdfFiller offers electronic editing and signing tools that simplify the completion of forms for efficiency.

Understanding monthly payment structure and schedule

A consistent payment schedule is key to managing a loan effectively. Defining how often payments will occur—weekly, bi-weekly, or monthly—can help individuals maintain a good repayment record.

-

Choose a payment frequency that aligns with your personal financial situation, ensuring you can meet obligations without strain.

-

It is crucial to understand that missed or delayed payments can lead to penalties or negative impacts on credit scores.

What are the compliance requirements with California state regulations?

California has specific regulations governing promissory notes to protect consumers and lenders alike. Failing to comply with these legal guidelines can lead to financial and legal repercussions.

-

Understand the state laws that dictate how promissory notes should be structured and executed.

-

Failure to follow regulations can result in enforceable penalties or difficulties in recovering debts.

How can pdfFiller assist in document management?

With pdfFiller, users can effectively manage their documents, streamline the eSigning process, and facilitate better collaboration. This powerful platform enables users to handle all their forms and templates from one cloud-based solution.

-

Easily edit PDFs and sign documents electronically, which saves time and reduces paperwork.

-

Having all documents stored in one location allows for efficient access and sharing among team members or individuals.

How to fill out the california installments fixed rate

-

1.Open the PDF document for California installments fixed rate.

-

2.Begin by entering your personal information in the designated fields, including your name, address, and contact details.

-

3.Fill in the loan amount you are requesting, ensuring it aligns with your financial needs.

-

4.Specify the fixed interest rate you have negotiated or the rate provided in the document.

-

5.Indicate the loan term, such as 15, 20, or 30 years, based on your financial strategy.

-

6.Complete the sections related to your current financial situation, including income and debt-to-income ratio, if applicable.

-

7.Review all entered information to ensure accuracy and completeness, correcting any mistakes before final submission.

-

8.Sign and date the document in the designated areas, if required.

-

9.Complete any additional required documents and submit your entire application package to the lender.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.