Last updated on Feb 17, 2026

Get the free Satisfaction - Reconveyance of Deed of Trust by Corporation template

Show details

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of California by a Corporation. This form complies with

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

easy to use

Very easy to use.

it's easy to use but runs rather slowly on my desktop

I love this application

great app very buseful worth every penny!!!

very helpful

Helpful

Helpful, clear and lots of visuals to help me understand

Understanding Satisfaction and Reconveyance Forms

What are satisfaction and reconveyance forms?

A satisfaction and reconveyance form is essential in the real estate industry as it signifies that a borrower has fulfilled their loan obligations, leading to the removal of the lender's claim on the property. These forms are crucial for clearing any mortgage liens, allowing property owners to sell or refinance without encumbrances.

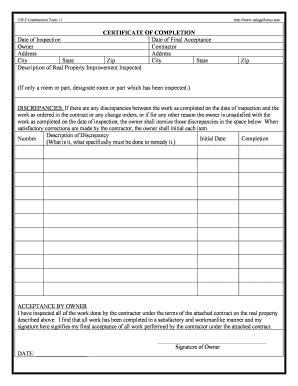

What is the process of reconveyance and its legal implications?

Reconveyance refers to the process of restoring property ownership rights to the borrower after the mortgage is fully paid. Legally, this process requires the lender to file the deed of reconveyance with local authorities to effectively remove their lien from the property's title, ensuring clear ownership for the borrower.

-

Initiation by the lender after loan completion.

-

Submission of the reconveyance form to the local land record office.

-

Confirmation issued to the borrower, providing proof of clear title.

What is the difference between a satisfaction of mortgage and a deed of reconveyance?

A Satisfaction of Mortgage is a document confirming the mortgage debt has been paid off, while a Deed of Reconveyance transfers the title back to the borrower. Understanding this difference is vital for property owners, as it ensures they are following the correct steps to clear their mortgage.

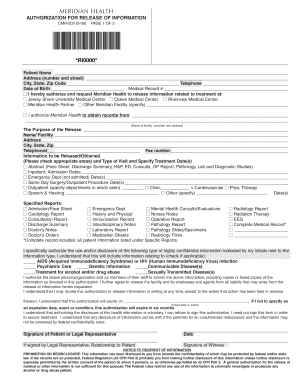

How can you obtain a satisfaction of mortgage form?

Requesting a Satisfaction of Mortgage form is typically straightforward. Borrowers should contact their lender directly and request the required documentation.

-

Reach out to your mortgage lender or servicer.

-

Specify the request for a Satisfaction of Mortgage form.

-

Download the form via pdfFiller if available.

What are the detailed instructions for filling out the satisfaction of mortgage form?

Completing the Satisfaction of Mortgage form requires careful attention to detail. Using platforms like pdfFiller can streamline this process with clickable form fields that ensure accuracy.

-

Ensure all information matches the original loan documents.

-

Consider completing the form electronically to avoid handwriting errors.

-

Review common mistakes, such as incorrect signatures or dates.

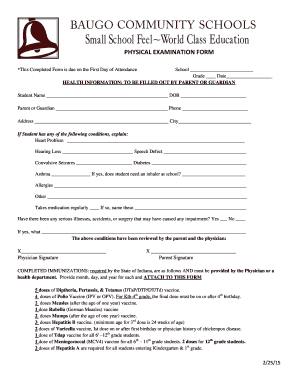

Where can you find examples and templates of satisfaction of mortgage forms?

Finding reliable examples and templates of Satisfaction of Mortgage forms is essential for accurate submissions. Resources like pdfFiller offer interactive templates that can simplify the process.

-

Access sample forms through pdfFiller.

-

Utilize customizable templates to suit personal circumstances.

What happens after submitting a satisfaction of mortgage form?

After submission of the Satisfaction of Mortgage form, lenders typically process this request and issue a confirmation. It is crucial to follow up if confirmation is not received within a standard timeframe.

-

Expect a processing period typically spanning 4-6 weeks.

-

Contact your lender if no confirmation is received.

-

Ensure that the mortgage is cleared in public records by checking with local authorities.

What are the exemptions and notes on transfer taxes related to reconveyance?

Certain transactions may be exempt from documentary transfer taxes, such as those occurring due to a marriage dissolution or when securing a debt. Understanding these exemptions is vital for effective financial management.

-

Transfers between spouses may not incur tax.

-

Inherited properties often have tax exemptions.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.