Get the free Notice of Default for Past Due Payments in connection with Contract for Deed template

Show details

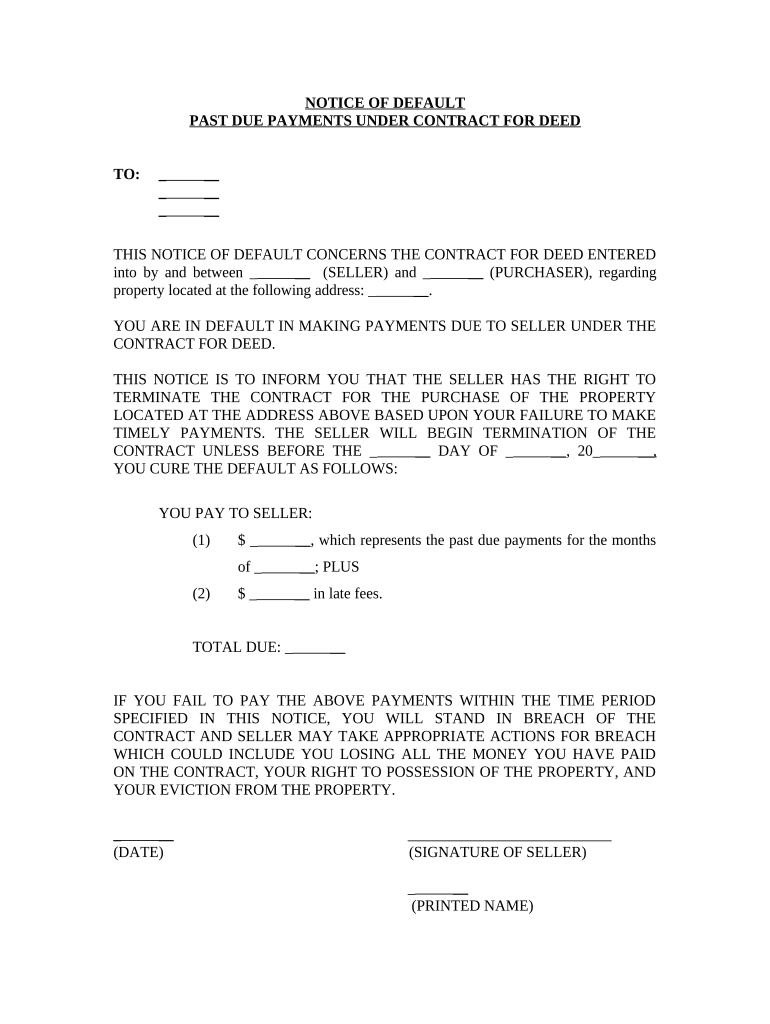

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default for

A notice of default is a formal notification that a borrower has failed to meet the terms set forth in a loan agreement, typically regarding missed payments.

pdfFiller scores top ratings on review platforms

AT FIRST I WAS NERVOUS IN USING THIS PROGRAM AND I WAS NOT INTIMIDATED BY THIS PROGRAM

Realistically I would not have the financial capability nor want to pay for this reoccurring payment unless I had a business of my own.

i am able to complete everything i need with this program Great Jo

Very nice concept for typist with deadlines.

Your website is very user friendly even for non tech savvy people like myself.

i like how the team at PDFfiller make things happen. The recipient box is useful and suddenly the email is ready to be sent to a certain school. Also how you helped me to create a cover letter relating to the Teacher for Science vacancy Very professional. Thank you Brent Walton 2 June 2019

Who needs notice of default for?

Explore how professionals across industries use pdfFiller.

How to fill out a notice of default form

Understanding the Notice of Default

A Notice of Default is a formal declaration by a lender that a borrower has failed to meet the terms of their loan agreement. Understanding its purpose is crucial, as it serves as an early warning about potential foreclosure.

-

It is a legal document informing the borrower of their default status, allowing them an opportunity to rectify the situation before more serious actions are taken.

-

Terms such as 'Contract for Deed'—an arrangement where the buyer makes installment payments to the seller until the full purchase price is paid—and 'default' are critical to understanding your situation.

-

Responding promptly to a Notice of Default is essential to avoid further consequences, including foreclosure proceedings.

Key Components of the Notice of Default Form

The Notice of Default form contains specific information that needs to be filled accurately. This ensures the document is legally valid and enforceable.

-

The form typically includes essential details such as the names of the parties involved and the property address.

-

The language in default notices can be very technical; it’s necessary to understand phrases that specify the default situation.

-

Once a Notice of Default is issued, legal implications unfold, which may include the initiation of foreclosure proceedings if not remedied.

How to fill out the Notice of Default form

Filling out the Notice of Default form requires careful attention to detail to ensure accuracy.

-

Begin by gathering all necessary documentation, including the loan agreement and payment records. Input information accurately.

-

Focus on critical fields, like the 'TO' address, specific 'Defaults', and 'Payments' missed.

-

Ensure you don’t leave any required fields blank, and verify the payment amounts to avoid inaccuracies.

What happens after receiving a Notice of Default

Receiving a Notice of Default can be alarming, but understanding your next steps can help mitigate its consequences.

-

Ignoring this notification can lead to accelerated foreclosure processes, making it easier for lenders to reclaim properties.

-

Typically, a borrower has a limited timeframe to rectify the default, which might range anywhere from weeks to months, depending on state laws.

-

Should the default not be cured, lenders may start legal actions— this could include selling the property at a foreclosure auction.

Important considerations and cautions

Navigating a Notice of Default involves understanding the risks and repercussions associated with it.

-

Buyers may face significant adverse credit impacts, which can affect future borrowing capability.

-

Late fees may accumulate quickly, compounding the total owed, so prompt payment is advised.

-

Borrowers should familiarize themselves with their rights and responsibilities detailed in their Contract for Deed.

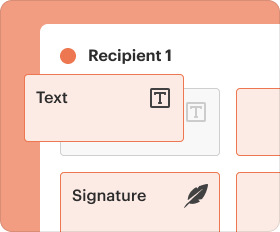

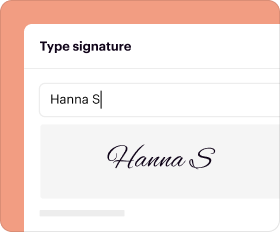

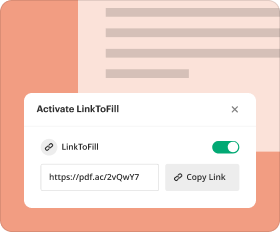

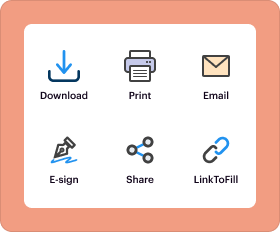

Managing your documents via pdfFiller

Utilizing digital solutions for document management can simplify the handling of a Notice of Default form.

-

With pdfFiller, users can easily edit any required fields and eSign the Notice of Default for immediate compliance.

-

The platform allows seamless cooperation among involved parties, maintaining transparency and efficiency.

-

Managing all your documents on a single, cloud-based platform increases accessibility and organization, streamlining workflows.

Practical examples and scenarios

Real-life examples provide invaluable lessons when dealing with Notices of Default.

-

Consider the case of a homeowner who receives a Notice of Default after missing multiple payments; their options and responses will vary significantly.

-

Some homeowners might successfully negotiate payment plans to avoid foreclosure; understanding different responses illuminates various paths.

-

Reviewing examples of filled-out Notices of Default can clarify how to ensure your form meets all legal requirements.

How to fill out the notice of default for

-

1.Open pdfFiller and upload the notice of default template or create a new document using the editor.

-

2.Begin by entering the date at the top of the document to indicate when the notice is being issued.

-

3.Fill in the name and address of the borrower in the appropriate fields, ensuring accuracy to avoid legal issues.

-

4.Add the lender’s name and contact information, as they are the party issuing the notice.

-

5.Clearly state the loan number associated with the property in default for easy identification.

-

6.Outline the specific reasons for the default, including details such as missed payment dates and amounts owed.

-

7.Include a statement regarding the consequences of failing to remedy the default, such as potential foreclosure.

-

8.Sign the document digitally or print it out for a physical signature to validate the notice.

-

9.Save the completed notice of default and choose whether to download it or send it directly to the necessary parties via pdfFiller.

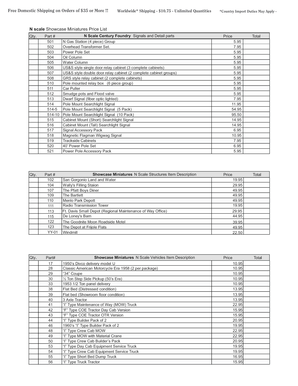

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.