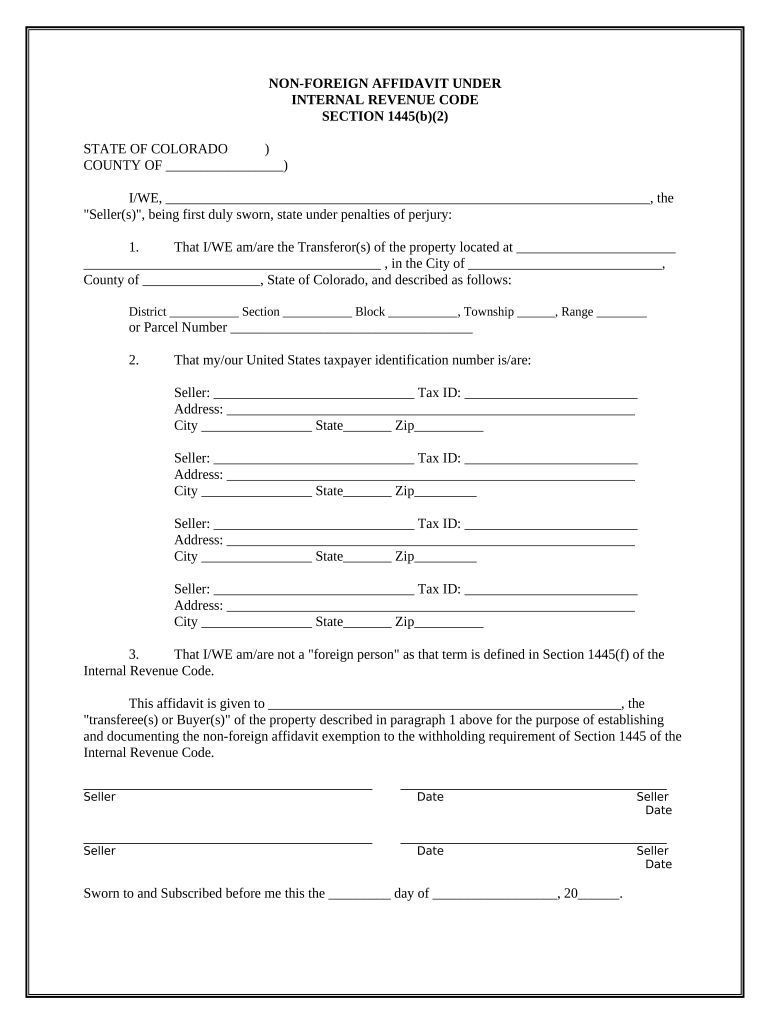

Get the free Non-Foreign Affidavit Under IRC 1445 template

Show details

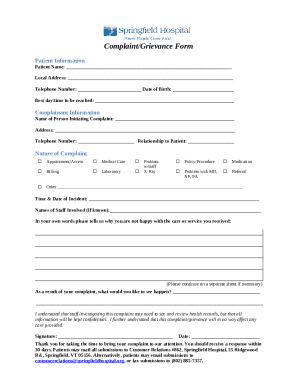

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is non-foreign affidavit under irc

A non-foreign affidavit under IRC is a legal document used to certify that an individual or entity is not a foreign person, typically for tax withholding purposes in real estate transactions.

pdfFiller scores top ratings on review platforms

i love this app im able to get any form…

i love this app im able to get any form i need thank u

thanks!

thanks! really happy with what I can do in it.

So far so good

So far so good

its very useful

its very useful

excellent services

excellent services, fast, easy and satisfying. Thank you!

This program worked very well for us.

This program worked very well for us.

Who needs non-foreign affidavit under irc?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Non-Foreign Affidavit Under IRC Form

Filling out a non-foreign affidavit under IRC Form can be crucial for real estate transactions involving U.S. taxpayers. This guide explores the functions, processes, and necessary information in detail, helping you to navigate the legal requirements seamlessly.

What is a non-foreign affidavit?

A non-foreign affidavit is a legal document that certifies that the seller of a property is not classified as a foreign person under the Internal Revenue Code Section 1445. This affidavit is significant in transactions to avoid withholding tax on the sale proceeds, ensuring compliance with U.S. tax law.

-

The affidavit verifies the seller's status as a U.S. person, which is necessary for tax purposes.

-

Section 1445 requires buyers to withhold tax on payments made to foreign sellers, making this affidavit crucial.

-

Understanding roles like Transferor (seller), transferee (buyer), and what defines a foreign person is vital.

How does the legal framework underpin the non-foreign affidavit?

The Internal Revenue Code Section 1445 outlines the obligations for buyers in real estate transactions, particularly concerning foreign sellers. Being classified as a foreign person has significant tax implications, impacting whether withholding taxes apply or not.

-

The section mandates withholding tax on foreign transferors, elevating the importance of the non-foreign affidavit.

-

If classified as a foreign person, sellers face withheld taxes on the sale, affecting the sale's viability.

-

U.S. taxpayers must ensure compliance to avoid penalties and ensure proper transaction flow.

What information is necessary for filling out the affidavit?

Completing the non-foreign affidavit requires specific details from the sellers, including personal and property information. It’s essential for supporting documents and tax identification consistency.

-

Full name, address, and Social Security Number (SSN) or Taxpayer Identification Number (TIN) are mandatory.

-

Location, description, and identification of the property must be clearly outlined.

-

Providing a TIN is not only essential for identification but also for IRS records.

How to complete the non-foreign affidavit?

Filling out the affidavit correctly is crucial to avoid legal troubles. Each section needs to be completed meticulously to reflect accurate information.

-

Ensure that all personal details are accurate and up-to-date to prevent delays.

-

Provide clear identification details of the property, establishing ownership and transfer clarity.

-

The seller must affirm their non-foreign status and ensure appropriate notarization of the document.

What is the notarization process for the affidavit?

The notarization of the non-foreign affidavit is an essential step to validate the document. A notary public is responsible for witnessing the signing and authenticating identities.

-

They ensure the identity of the signer, preventing fraud and verifying the transaction.

-

Present a valid ID, sign in front of a notary, and receive a notarized affidavit.

-

Fees vary by state; ensure to check local regulations and bring required documents.

What common mistakes should you avoid when filing the affidavit?

Avoiding common pitfalls when filing your non-foreign affidavit can save you from potential delays or legal issues. Awareness of these issues is crucial for successful filing.

-

Double-check all entries to ensure no fields are left blank or filled incorrectly.

-

This can lead to erroneous filings; familiarize yourself with the definitions and implications.

-

Failure to notarize properly can invalidate the affidavit, necessitating resubmission.

How can pdfFiller assist with your non-foreign affidavit needs?

pdfFiller streamlines the process of creating and editing the non-foreign affidavit through its user-friendly interface. The platform empowers users to collaborate and manage documents efficiently in a cloud-based solution.

-

Easily find and edit the Non-Foreign Affidavit template directly on pdfFiller.

-

Quickly obtain approvals by employing e-signature capabilities for timely submissions.

-

Work with teams, make necessary edits, and share documents efficiently within the platform.

How to fill out the non-foreign affidavit under irc

-

1.Access pdfFiller and select the non-foreign affidavit form.

-

2.Fill in your name, address, and other identifying information as requested in the form.

-

3.Ensure to include the seller's tax identification number (TIN) to avoid withholding tax.

-

4.Review the form for accuracy, making sure all fields are filled out correctly, especially the statement regarding foreign status.

-

5.Date and sign the affidavit in the designated area to certify the information is true and accurate.

-

6.Save the completed document in your pdfFiller account, then download or print it as needed for submission.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.