Last updated on Feb 20, 2026

Get the free pdffiller

Show details

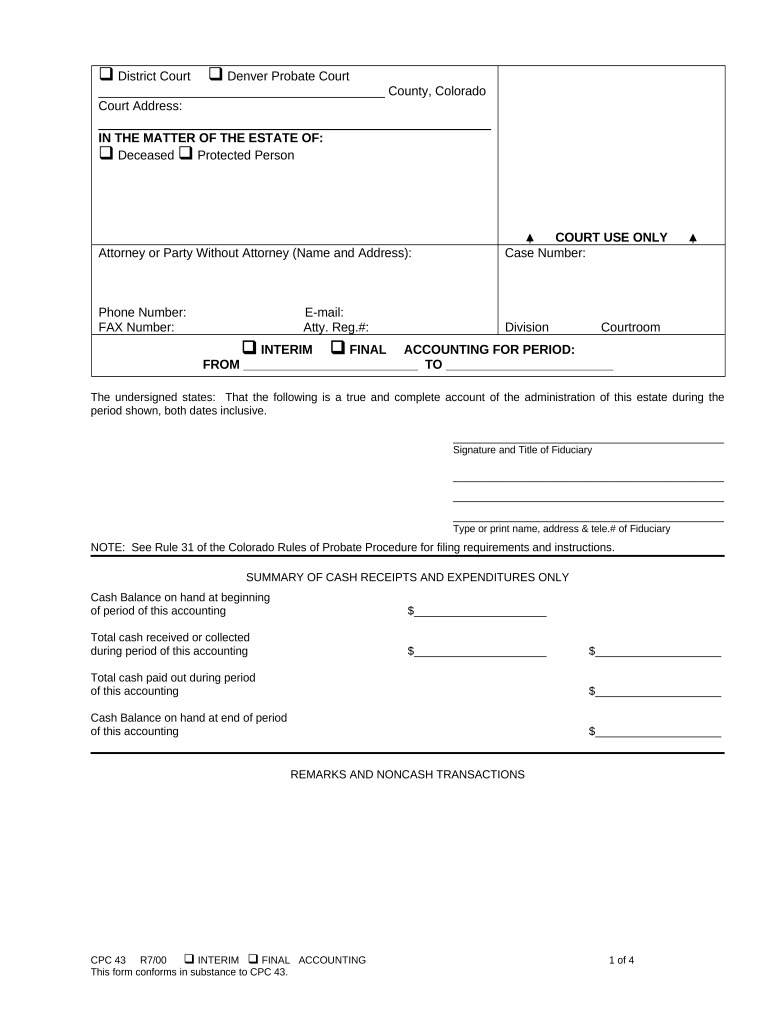

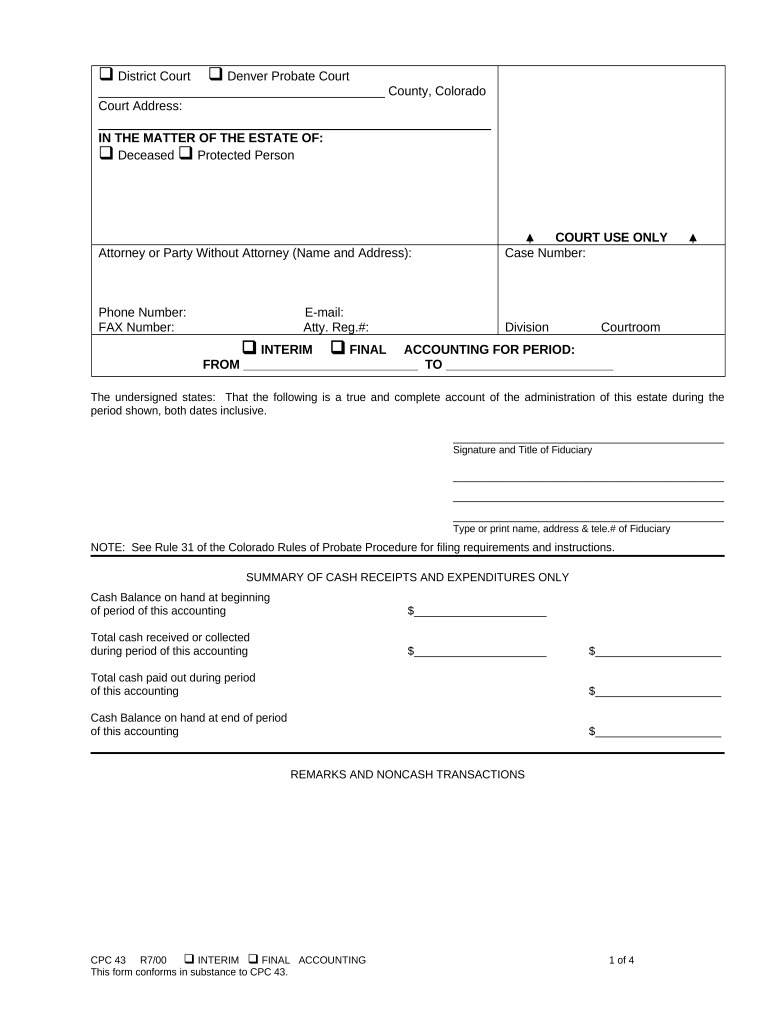

(Interim) (Final) Accounting: This is an official form from the Colorado Probate Court, which complies with all applicable laws and statutes. USLF amends and updates the Colorado Probate Court forms

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is interim - final accounting

Interim - final accounting is a financial report that summarizes all transactions and balances over a specific period, often used for audits or financial reviews before the conclusion of a project.

pdfFiller scores top ratings on review platforms

I'm amazed at how well it does with filling and editing. There are sooooo many features that I am still learning. Great product.

I really like working with this program I am do my trial version buy I will be purchasing this one its reliable.

Just getting started, but so far so good!

I am not tech savy but I was able to do what I needed.

Works great. If the price was < $20, I'd pay for it after the trial period.

Generally fine, though is hard to operate on my tablet

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Completing the Interim/Final Accounting Form

How does the interim/final accounting form work?

The interim/final accounting form is a crucial document in estate management, serving as a financial statement that outlines the cash transactions and assets of the estate. It holds significance for fiduciaries, who are responsible for managing the estate and ensuring compliance with legal obligations. Understanding how to fill out this form effectively ensures transparency and accurate record-keeping.

What is the purpose of the interim/final accounting form?

-

The form provides an overview of financial activities within the estate, highlighting the fiduciary’s management.

-

It acts as a transparency tool for beneficiaries, showing them how the estate’s finances have been handled.

-

Filing this form is often a legal requirement to ensure compliance with local probate laws.

What key sections are included in the form?

-

This section identifies the district or probate court relevant to the estate, ensuring proper jurisdiction.

-

Essential details about the deceased or protected person must be filled, providing context to the financial data.

-

If legal representation is involved, this section should include the attorney’s credentials and contact details.

How do you fill out the accounting period?

-

Specify the timeframe for the financial data presented, which typically covers the period of fiduciary management.

-

Detail the total income received and the total expenses paid, ensuring an accurate cash flow summary.

What to know about managing noncash transactions?

-

Include all noncash transactions such as property transfers, as they impact the overall estate value.

-

Ensure assets remaining at the end of the accounting period are accurately reported, contributing to a clear final statement.

What to include in the signature and fiduciary information section?

-

The fiduciary's signature is essential to validate the document and signify its authenticity.

-

Provide necessary contact information, which includes the attorney’s registration number and email to facilitate communication.

Why is compliance and filing so important?

-

Understand Colorado Rules of Probate Procedure, especially Rule 31, for filing guidelines.

-

Verify all items—such as signatures, necessary documents, and formatting—before submission to avoid delays.

How can pdfFiller help with form management?

-

With pdfFiller’s cloud-based platform, users can edit, sign, and share the interim/final accounting form anywhere.

-

Teams can work together in real time to complete accounting forms, enhancing productivity and accuracy.

What regional specificities should you be aware of?

-

Different states may have varying regulations affecting how you fill out the interim/final accounting form.

-

Stay vigilant of frequent mistakes, such as missing signatures or incorrect filing dates, which can hinder the process.

How to fill out the pdffiller template

-

1.Open the PDF file for the interim - final accounting.

-

2.Start by entering the project name and relevant identification numbers at the top of the form.

-

3.Fill in the period of the accounting at the designated field, including start and end dates.

-

4.List all income sources under the income section, ensuring to provide dates, amounts, and descriptions for each entry.

-

5.Proceed to the expenses section, detailing all expenditures, categorized appropriately and including amounts and dates.

-

6.Check the subtotals of income and expenses, and then calculate the final balance by subtracting total expenses from total income.

-

7.Review all entries for accuracy, ensuring no details are overlooked.

-

8.Sign and date the document at the bottom to validate the accounting.

-

9.Save the completed PDF and submit it to the relevant authority or department.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.