Last updated on Feb 20, 2026

Get the free colorado amount exempt form

Show details

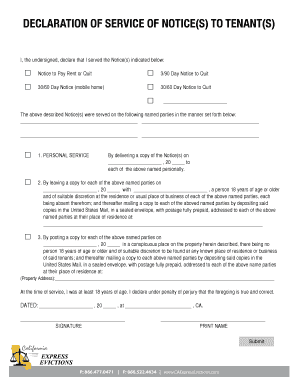

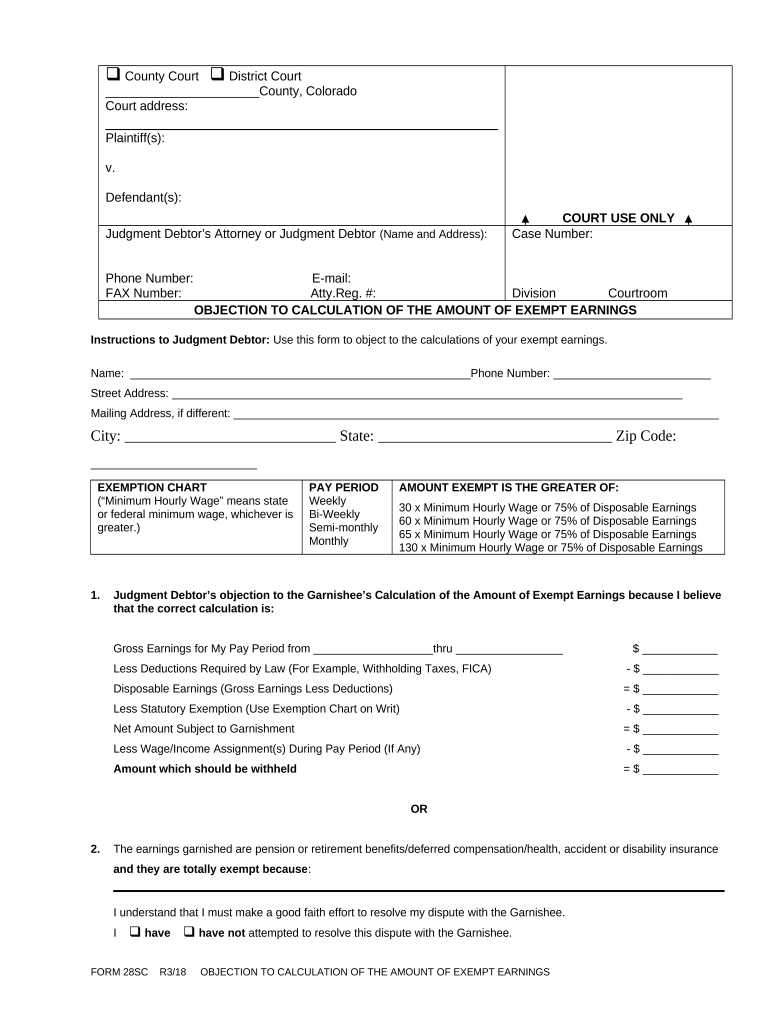

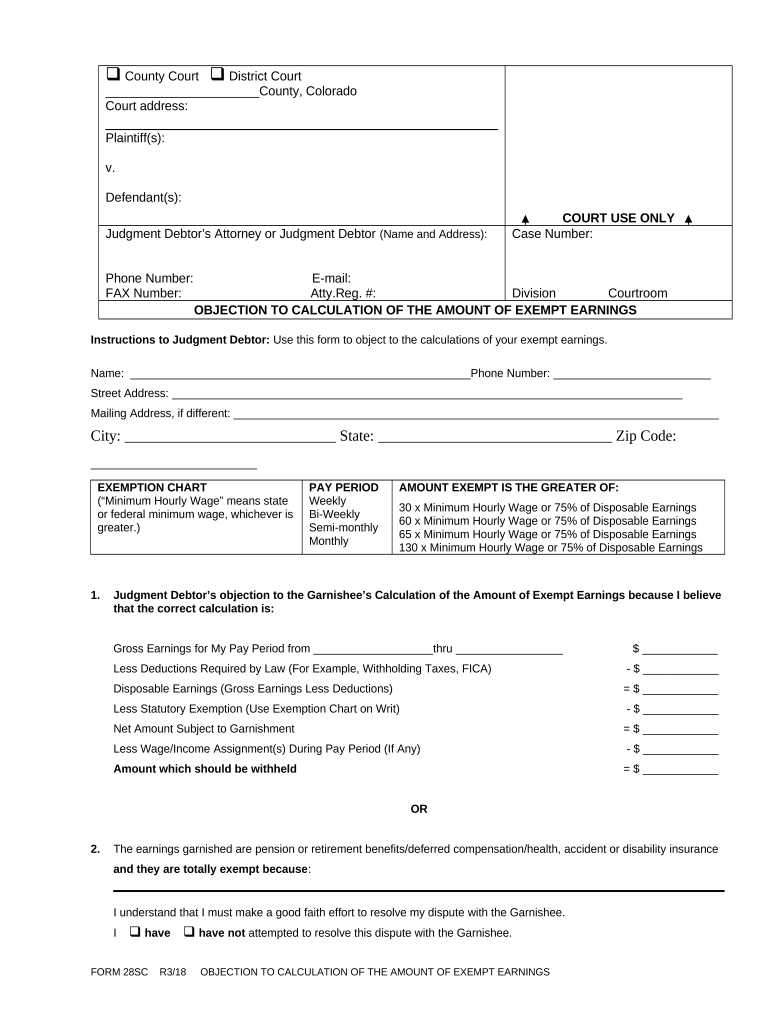

Objection to Calculation of the Amount of Exempt Earnings: This is an official form from the Colorado County Court, which complies with all applicable laws and statutes. USLF amends and updates the

pdfFiller is not affiliated with any government organization

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is objection to calculation of

An 'objection to calculation of' is a formal document disputing the accuracy or legality of a financial calculation, often in legal or administrative contexts.

pdfFiller scores top ratings on review platforms

THE BEST!!!!

Easy and usefull

Easy and usefull! Amazing.

happy full..

Incredible tool

Incredible tool, big posibilities!

This software is SUPER AWESOME!!!!!!!

It it the best pdf editor that i have…

It it the best pdf editor that i have ever use

Who needs colorado amount exempt template?

Explore how professionals across industries use pdfFiller.

How to file an objection to calculation of form form

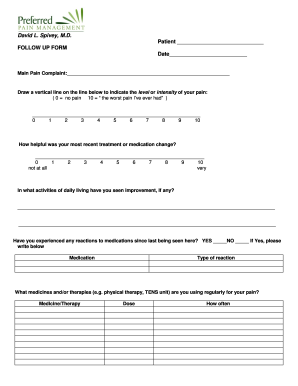

What are exempt earnings?

Exempt earnings refer to portions of income that cannot be garnished due to legal protections. Understanding your exempt earnings is crucial, as they can significantly impact your financial situation, particularly in instances of wage garnishment or legal financial obligations.

-

Exempt earnings are income amounts protected by law from being withheld or seized by creditors.

-

Knowing your exempt earnings can help you plan your budget and ensure that your essential needs are met despite potential garnishments.

-

Mistakes in calculating exempt earnings can lead to financial strain and unnecessary legal complications if too much of your earnings is withheld.

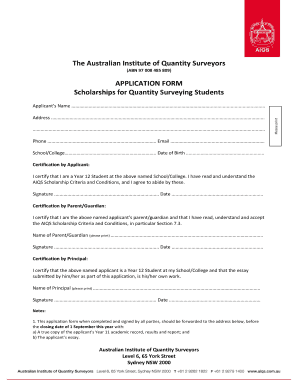

Who is eligible to file an objection?

Typically, individuals impacted by wage garnishments can file objections to the calculation of exempt earnings. Understanding the eligibility requirements can empower you in asserting your rights against incorrect or unfair assessments.

-

Individuals whose earnings are being garnished and believe that the calculation of exempt earnings is incorrect are eligible to file an objection.

-

Objections are often filed when individuals suspect over-calculation of their disposable income or misinterpretation of exemptions.

-

Pension and retirement benefits may have specific legal protections, which should be understood before submitting an objection.

How can you fill out the objection form?

Filling out the objection form meticulously is crucial to ensure accurate and favorable outcomes. Here is a step-by-step guide to assist you in navigating the paperwork.

-

Begin by downloading the objection form from the relevant legal website or local court.

-

Make sure to provide the correct address of the district court handling your case.

-

Include all pertinent information detailing both the plaintiff and defendant involved in the case.

-

Accurately input the judgment debtor's name, address, phone number, and email for effective communication.

-

Specify the case number and courtroom details to help officials identify your case promptly.

How do you calculate your exempt earnings?

Understanding how to calculate your exempt earnings accurately is essential to protect your financial interests, particularly during wage garnishment proceedings. Correct calculations can prevent over-collection and help maintain your standard of living.

-

Utilize the exemption chart provided by local or federal guidelines to determine the minimum amount exempt from garnishment.

-

Be aware of whether state or federal minimum wage laws apply to your situation, as this impacts exempt earnings.

-

Disposable earnings are calculated by subtracting legally mandated deductions such as taxes from your total income.

-

Common deductions include federal and state taxes, social security, and other statutory contributions.

-

Illustrate calculations for weekly or bi-weekly pay periods to provide understandable formats for users.

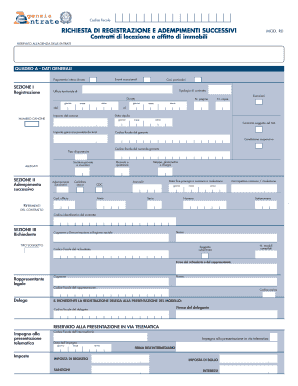

What is the filing process for your objection?

Submitting your objection form correctly and on time is paramount. Awareness of filing specifics can ensure your objection is considered without unnecessary delays.

-

Submit the completed objection form to the court specified in your documentation, either in person or via mail.

-

Filing timelines depend on local rules, so it's vital to act swiftly to avoid missed opportunities to contest the garnishment.

-

Double-check your form for accuracy, keep copies, and ensure you meet all submission deadlines.

What are good faith efforts in disputes?

Good faith efforts are essential when entering disputes regarding exempt earnings. Demonstrating your attempts to resolve issues amicably can bolster your position in court.

-

The law often mandates that individuals show attempts to negotiate with the garnishee before filing formal objections.

-

Keep thorough records of all communications, including dates and content of conversations about the dispute.

-

Possible methods include direct negotiation, mediation, or seeking assistance from legal advisors.

What are common pitfalls and mistakes?

Many individuals encounter typical errors when filing objections, which can jeopardize their results. Understanding these pitfalls can help you navigate the process more effectively.

-

Common mistakes include incomplete information, missing signatures, or incorrect calculation of exempt earnings.

-

Errors can lead to denied objections or accelerations of garnishment, creating further financial issues.

-

Always review your submissions carefully, maybe seek professional help, and use available resources to confirm accuracy.

How to fill out the colorado amount exempt template

-

1.Access pdfFiller and upload the 'objection to calculation of' form.

-

2.Review the form's sections and gather necessary documentation to support your objection.

-

3.Begin by filling out your personal information at the top section of the form, including your name, address, and contact information.

-

4.Clearly state the disputed calculation details in the designated area, providing a concise explanation of why you object.

-

5.Attach any required evidence that supports your claim, such as invoices or previous statements, and ensure they are properly referenced in your objection.

-

6.Double-check all filled-in information for accuracy before finalizing the document.

-

7.Once complete, review the entire document for clarity and completeness, then proceed to sign and date it.

-

8.Save the document on your device and consider printing a copy for your records before submitting it to the relevant authority.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.