Last updated on Feb 20, 2026

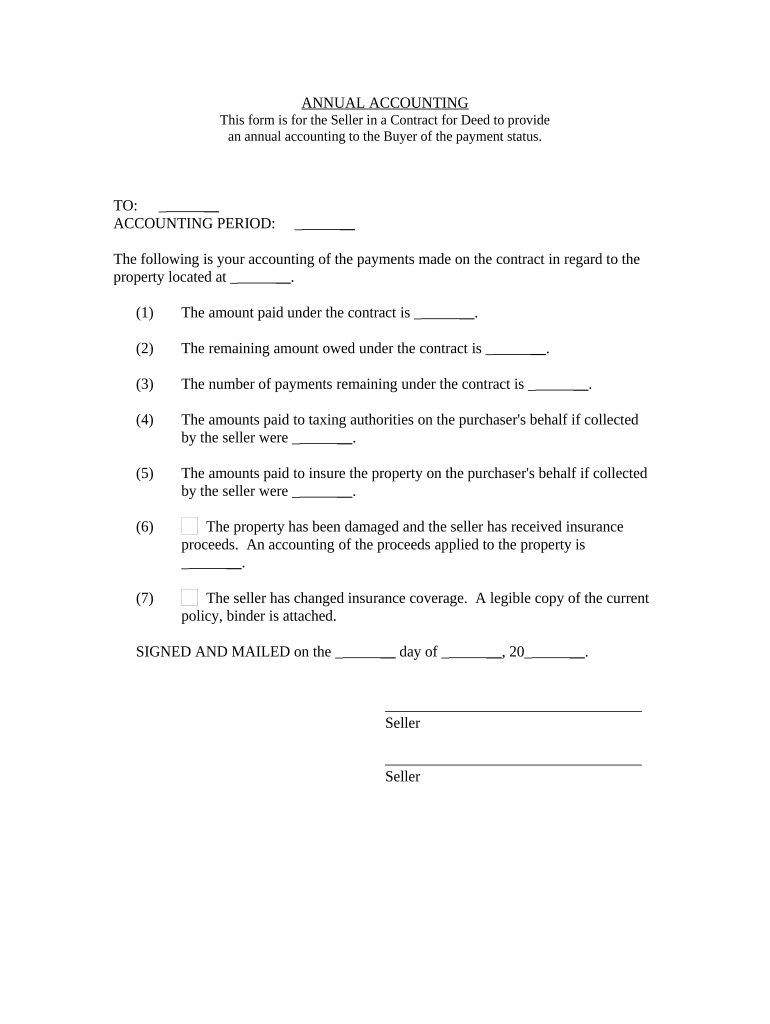

Get the free Contract for Deed Seller's Annual Accounting Statement template

Show details

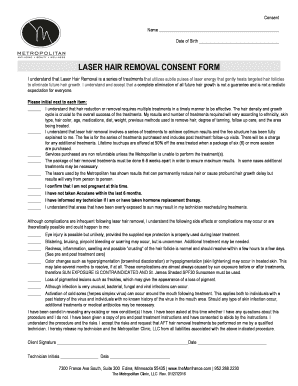

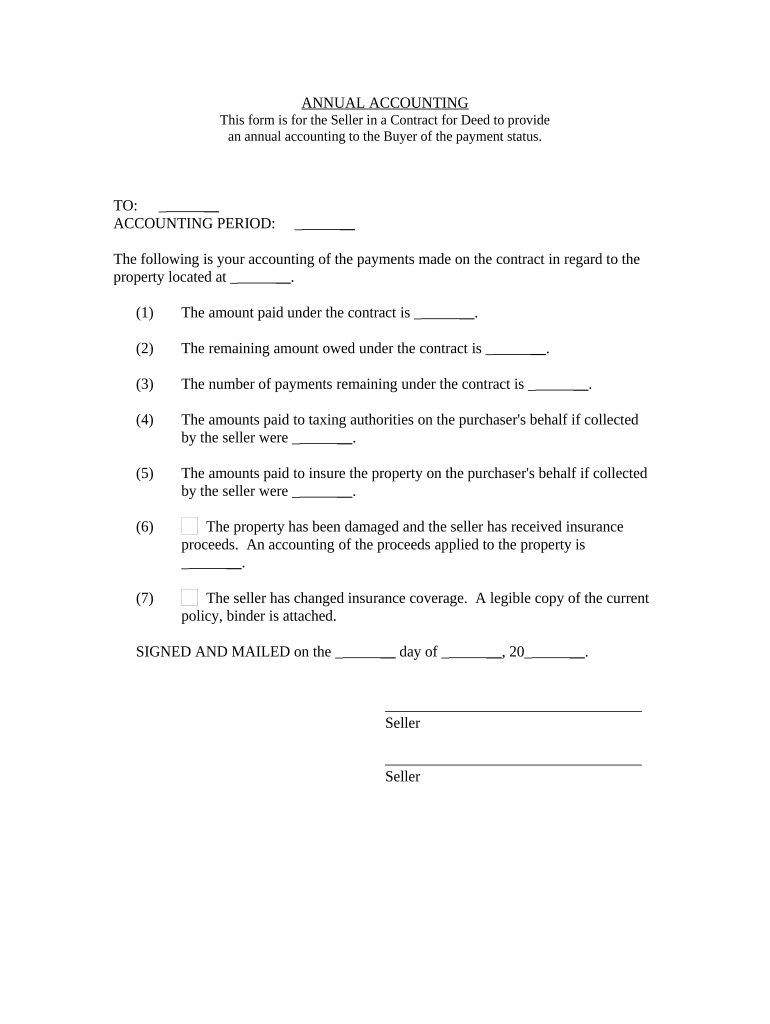

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is contract for deed sellers

A contract for deed sellers is an agreement where the seller finances the purchase of property and retains the deed until the buyer has paid the purchase price in full.

pdfFiller scores top ratings on review platforms

It works good but is clumsy to figure out some things should be easier like saving an altered document to your computer. Currently I have to pretend to print it then in the printer tell it to save as a PDF to my computer instead.

The log in process is a little clunky. I have not been able to copy paste a field in the template creator. I have 30 fields or so that will each have the same sized field, I should be able to duplicate the specific field a number of times and paste. No?

overall it is fairly easy to use and it is clear, but it is not straight forward if you want to continue on with the next form, ie when finishing one form 1099 and you wish to do anothe

I wish I would have known about this site years ago. It makes signing and sharing documents so much more time convenient.

so far everything is great! very easy to use

Great program and service for anyone with a small business!

Who needs contract for deed sellers?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Contract for Deed Sellers Form on pdfFiller

A contract for deed sellers form is vital for property transactions, allowing sellers to offer financing directly to buyers. This guide will help you understand the intricacies of this form, how to fill it out, and manage your obligations efficiently with pdfFiller.

What is a contract for deed?

A contract for deed, also known as a land contract, is a method of seller financing where the buyer makes payments directly to the seller until the full purchase price is paid.

-

This financing option allows buyers to purchase property without traditional mortgages, making it beneficial for those with credit issues.

-

The seller maintains ownership until the buyer fulfills their payment obligations, highlighting the need for clear agreements.

-

Unlike conventional loans, contracts for deed may have fewer regulations and faster approval processes, but come with their risks.

What are the essential elements of the annual accounting form?

An annual accounting form is crucial for tracking the financial aspects of the contract.

-

Accurate records must include payment history, outstanding balances, and related terms.

-

Establishing the timeframe helps both parties stay informed on financial obligations.

-

A well-maintained account minimizes disputes and clarifies each party's responsibilities.

How do you fill out the contract for deed sellers form section by section?

Filling out the contract methodically ensures clarity and compliance with expectations.

-

Clearly state the buyer's full legal name to ensure proper identification.

-

Define the period for the contract, typically annually or monthly, to outline payment schedules.

-

This section helps both parties see the financial flow and obligations clearly.

-

Ensure tax responsibilities and insurance coverage are documented to avoid misunderstandings.

-

Detail how insurance proceeds will be handled in case of damages.

-

Attach proof of current insurance to assure both parties of protection.

What key considerations should be taken when selling via contract for deed?

Selling a property through a contract for deed brings various considerations to mind.

-

Always check local regulations as they may impose specific requirements on such transactions.

-

While sellers retain ownership until the sale completes, buyers may face difficulties if payments are missed.

-

Clear communication and equitable terms are essential in preventing misunderstandings.

How can pdfFiller assist in managing your contract for deed?

pdfFiller provides unique tools to simplify your contract management process.

-

Its user-friendly platform allows for easy editing of forms, ensuring accuracy.

-

Utilize e-signature functions for a seamless signing process that maintains legal validity.

-

Shared access ensures both the buyer and seller can manage and review the same documents.

What checklist should be followed for completing the contract for deed process?

A thorough checklist aids in ensuring nothing is overlooked during the contract process.

-

Check off each document as it is finalized to avoid missing anything crucial.

-

Confirm that all information is accurate and all parties agree on terms.

-

Adhering to legal standards and maintaining records prevents future disputes.

How to fill out the contract for deed sellers

-

1.Open the pdfFiller platform and upload the contract for deed document.

-

2.Begin by filling in the seller's full legal name and address in the designated fields.

-

3.Next, enter the buyer's full legal name and address accurately.

-

4.Specify the property details, including the address and any legal descriptions needed.

-

5.Indicate the purchase price and any down payment amount clearly.

-

6.Complete the payment terms, including the interest rate, monthly payment amount, and duration of the contract.

-

7.Include any clauses regarding default or late payments as required.

-

8.Review all filled information for accuracy and compliance with local laws.

-

9.Save the document, and if required, send it for electronic signatures to all parties involved.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.