Last updated on Feb 20, 2026

Get the free Warranty Deed from Individual to a Trust template

Show details

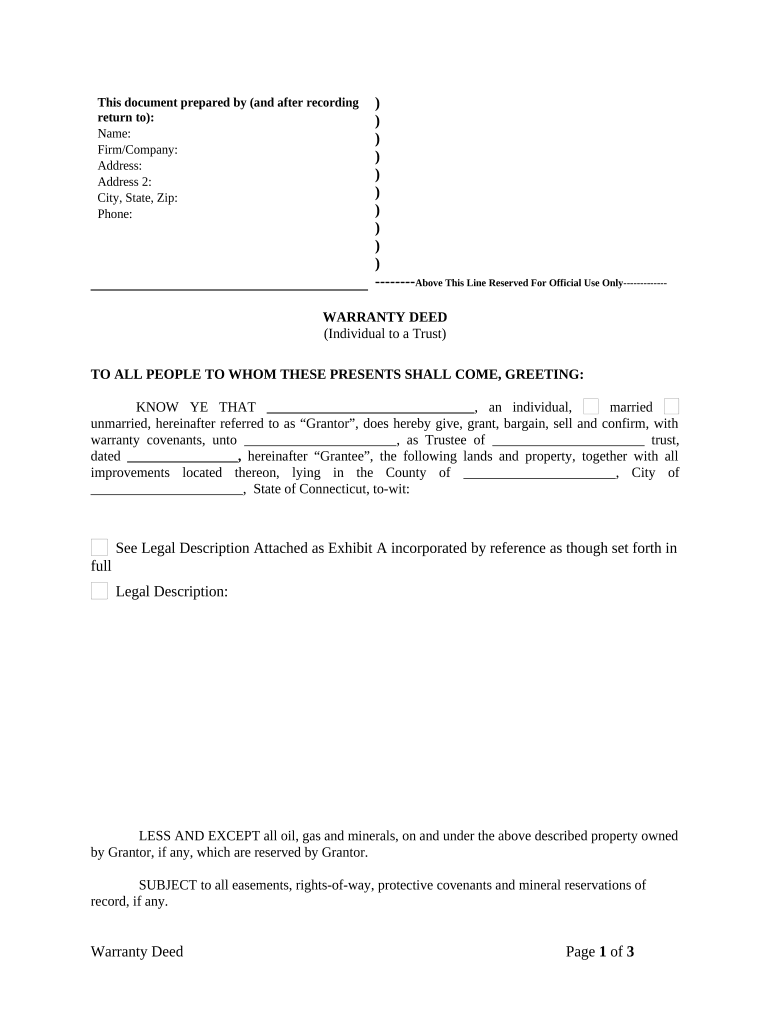

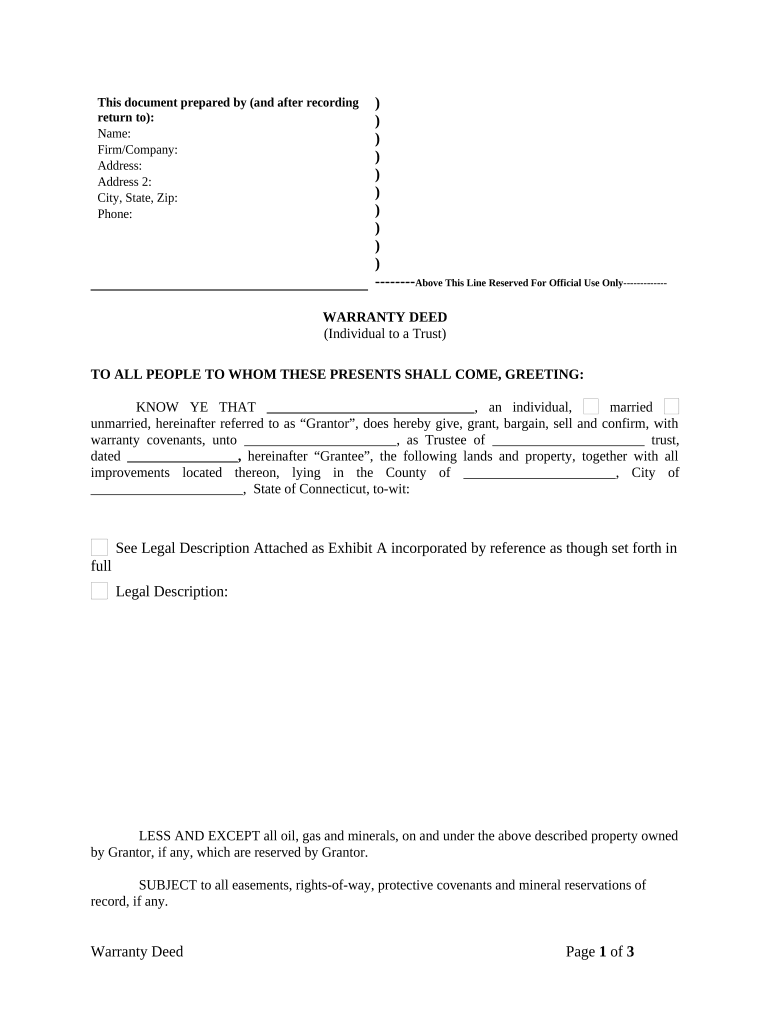

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is warranty deed from individual

A warranty deed from an individual is a legal document that guarantees that the individual (grantor) has the legal right to transfer ownership of a property and provides assurances against future claims.

pdfFiller scores top ratings on review platforms

It was very easy to use and printing options were great.

Works very well and ideal for completing many types of forms especially from the Federal government. Works great at making your own forms.

YOU HAVE SO MUCH TO OFFER. I AM NOT VERY GOOD WITH THIS SORT OF THING SO I WOULD LOVE HELP OR THE WEBINAR

use if for grant writing to fill out the forms

I am doing my own 1099's for my business!

Nice experience but somewhat difficult to navigate from one form to the next.

Who needs warranty deed from individual?

Explore how professionals across industries use pdfFiller.

Guide to Completing a Warranty Deed from Individual Form

How does a warranty deed work?

A warranty deed from individual form serves as a legal document used to transfer ownership of property from one individual (the Grantor) to another (the Grantee), ensuring that the property being transferred is free of any claims, liens, or encumbrances. The primary purpose of this deed is to guarantee clear title, meaning the Grantor assures that they legally own the property and have the right to sell it. This type of document is vital in real estate transactions as it provides security for the Grantee, protecting them against future disputes regarding the title.

-

It is a document that guarantees good title to the property, ensuring that the Grantor has the right to transfer ownership.

-

Having a warranty deed is crucial for legal protection, as it offers the Grantee a form of recourse if there are issues with the title post-sale.

-

Unlike a warranty deed, a quitclaim deed transfers whatever interest the Grantor has but does not guarantee clear title or ownership.

What are the key components of a warranty deed?

A well-crafted warranty deed will include essential components that ensure clarity and legality of the transaction. Key elements are crucial to protecting both the Grantor and Grantee and require precise information to avoid potential legal disputes.

-

The names of the parties involved in the transaction must be distinctly identified, usually with full legal names.

-

A detailed and accurate description of the property being transferred is necessary, including the address and legal description to avoid ambiguity.

-

The warranty deed must contain specific legal terms and covenants that outline the obligations of the Grantor concerning the title.

-

Providing the legal addresses and contact information for both parties allows for efficient communication and legal notices.

How do you fill out a warranty deed form?

Completing a warranty deed form can seem daunting, but following step-by-step instructions can simplify the process. It’s crucial to fill out each section accurately and to understand standard pitfalls that can lead to complications during the property transfer.

-

Begin by filling out the names of the Grantor and Grantee, followed by a detailed property description, and then complete all required legal language.

-

Ensure not to skip any sections, as well as double-check the legal description to avoid errors.

-

Explore interactive tools on pdfFiller to guide you through the form completion process, including template illustrations.

What legal compliance should you consider?

Legal compliance varies by state, and it’s essential to understand specific requirements for completing a warranty deed, especially in states like Connecticut. Additionally, there are potential easements and rights-of-way that must be considered to ensure the property can be legally transferred.

-

Connecticut may have specific regulations governing how a warranty deed must be executed and witnessed.

-

Identify any easements that may affect the property title and document their implications in the deed.

-

Ensure that the title carried by the Grantor is free of legal issues before proceeding with the transfer.

How to edit and sign the warranty deed?

Once the warranty deed is filled out, it’s critical to ensure accuracy and legality through proper editing and secure signing. pdfFiller provides tools to facilitate both of these processes effectively.

-

Leverage editing tools within pdfFiller to make necessary adjustments before finalizing the document.

-

Utilize eSigning capabilities to sign the document digitally, ensuring that the process adheres to legal standards.

-

After signing, easily share the document with involved parties for record-keeping and further action.

How can you manage your warranty deed document?

Post-creation, managing your warranty deed effectively is vital. Proper storage, retrieval, and version tracking of the document can prevent potential legal issues in the future.

-

Consider secure online storage solutions through pdfFiller for easy access and safety.

-

pdfFiller allows for easy retrieval and re-editing of your warranty deed as needed.

-

Maintain versions of the document to document any changes made over time.

How to fill out the warranty deed from individual

-

1.Open pdfFiller and upload the warranty deed template.

-

2.Fill in the grantor's name and address at the top of the document.

-

3.Enter the grantee's name and address in the designated section.

-

4.Clearly describe the property being transferred, including address and parcel number.

-

5.Add a clause that guarantees the grantor's ownership and the right to sell the property.

-

6.Affix the date of the property transfer in the specified space.

-

7.Include signature lines for the grantor and two witnesses if required.

-

8.If applicable, notarize the document by signing in front of a notary public and attaching the notary seal.

-

9.Review the entire document for accuracy before saving and downloading its final version.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.