Last updated on Feb 20, 2026

Get the free 497300958

Show details

A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

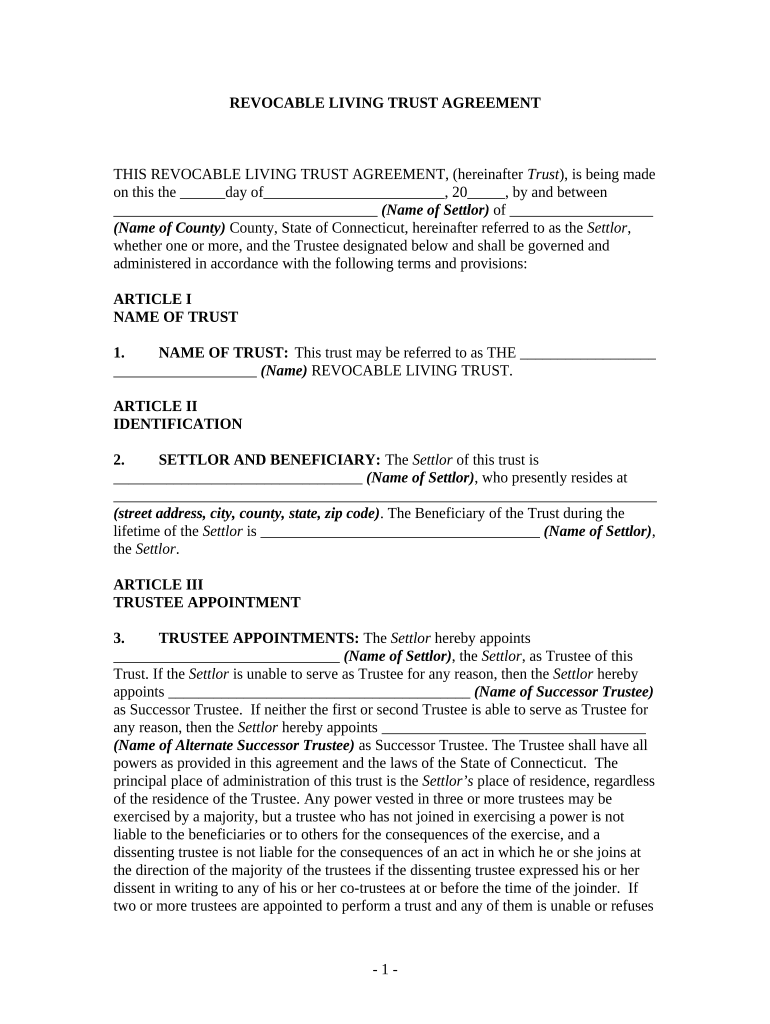

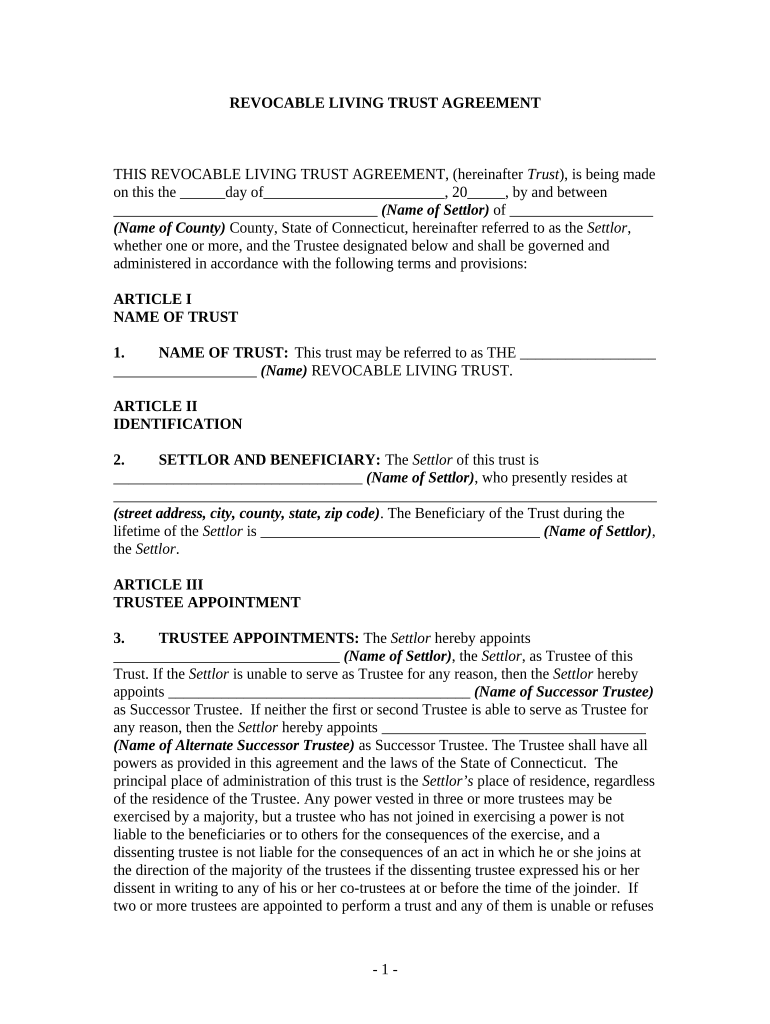

What is revocable living trust agreement

A revocable living trust agreement is a legal document that creates a trust for managing an individual's assets during their lifetime and after death, allowing for flexibility and asset protection.

pdfFiller scores top ratings on review platforms

Very good outside of being able to make payments through the system, like updating payment methods.

Easy. User friendly. Makes my life with paperwork so much more manageable!

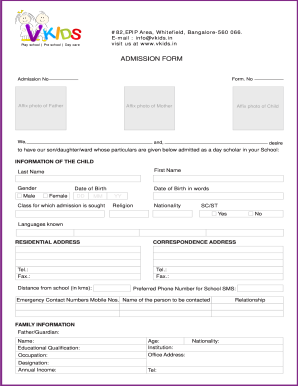

This online PDFFiller makes my family's life a LOT EASIER when filling out kids school enrollments, Child Information Records and much more.

It makes my life easier without a doubt!

gILBIE WAS VERY HELPFUL AND QUICK TO PROVIDE THE FORM THAT I NEEDED.

Product is really good, but customer service is great. I had an issues with printing after spending a couple of hours editing a documents and quickly became frustrated. I contacted customer service, they responded within a few hours with a solid solution that worked.

Who needs 497300958 template?

Explore how professionals across industries use pdfFiller.

How to fill out a revocable living trust agreement form for your estate planning

Understanding the revocable living trust agreement

A revocable living trust is a legal document that allows you to manage and distribute your assets during your lifetime and after your death without going through probate. This agreement includes key components such as the identification of the settlor, trustee, and the beneficiaries, which are essential for its functionality.

-

This trust can be altered or revoked by the settlor at any time before their death.

-

Essential elements include the names of the parties, the property involved, and instructions for asset distribution.

-

It simplifies estate management and helps avoid probate, thus saving time and costs.

What are the key advantages of a revocable living trust?

Creating a revocable living trust has several advantages that can enhance your estate planning. The flexibility it provides allows you to make amendments as circumstances change.

-

You can modify or revoke the trust as your financial situation or relationship dynamics change.

-

Assets held in a revocable living trust are not subject to probate, leading to timely distribution.

-

Since the trust does not go through probate, its details remain private, unlike a will.

-

This allows complete control over the trust throughout your lifetime.

What are the possible disadvantages of a revocable living trust?

While there are many benefits, it is also important to be aware of the potential disadvantages of a revocable living trust. Understanding these can help you make a well-informed decision.

-

Establishing a trust can involve legal fees and ongoing administrative costs.

-

Because the trust is revocable, it offers less protection from creditors compared to irrevocable trusts.

-

Assets in a revocable trust are considered part of your taxable estate, which could lead to estate taxes.

When should you consider a revocable living trust?

Deciding when to create a revocable living trust can depend on several factors, including your personal financial situation and family dynamics. Identifying the right time can facilitate smoother estate management.

-

If you have complex assets or dependents, a trust may simplify management.

-

Events like marriage, divorce, or the birth of a child can impact your estate planning needs.

-

A revocable living trust can complement other estate planning tools, like wills and insurance policies.

How to establish a revocable living trust: Step-by-step

Establishing a revocable living trust involves several key steps. Following this order can ensure that your trust is valid and meets all legal requirements.

-

Assess your assets and what you want to achieve with the trust.

-

Choose individuals or organizations you trust to manage the trust effectively.

-

Work with legal professionals to create a document that clearly outlines your intentions.

-

Ensure that all required parties sign the document in accordance with state laws.

-

Transfer your assets into the trust to ensure they are governed by its terms.

What are the components of the revocable living trust agreement form?

The revocable living trust agreement form contains several important fields necessary for establishing a trust. Understanding these can help avoid common mistakes during completion.

-

Each field must be filled accurately to ensure the document is legally enforceable.

-

Follow guidelines to minimize errors and ensure compliance with legal standards.

-

Be aware of any specific requirements dictated by state law to avoid complications.

-

Any mistakes or ambiguities can lead to misinterpretation of the trust's intentions.

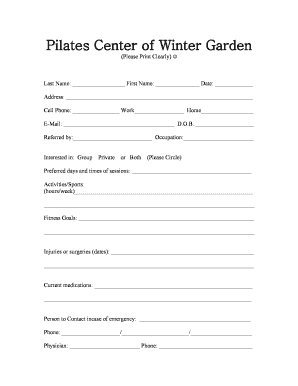

What does a sample revocable living trust agreement look like?

Understanding a sample agreement can provide insight into how to structure your own revocable living trust. Reviewing templates can highlight what is essential in your document.

-

Templates usually include standard provisions and sections you might expect.

-

Focus on the portions that are commonly misunderstood, such as trustee responsibilities.

-

Familiarizing yourself with frequent errors can help you draft more accurately.

Who plays key roles in a revocable living trust?

The effectiveness of a revocable living trust relies heavily on the roles played by the settlor, trustee, and beneficiaries. Each party has specific responsibilities and implications.

-

The settlor is the creator of the trust; the trustee manages it, while beneficiaries are the recipients of the trust's assets.

-

Responsibilities vary from management obligations to distributions upon the settlor’s passing.

-

Understanding these roles can help family members and advisors in planning and utilization of the trust.

What should you know about state-specific trust laws?

Trust laws vary by state, which makes it crucial to understand local regulations. This knowledge can prevent costly mistakes.

-

Connecticut has specific requirements that must be met to ensure your trust is valid.

-

Compliance with state laws can affect everything from asset distribution to tax liabilities.

-

Consulting with local legal experts can provide updated insights on compliance.

How does a revocable living trust compare to other trusts?

Comparing revocable living trusts with irrevocable trusts and other estate planning instruments is essential for proper estate planning. Each type has unique advantages and disadvantages.

-

Irrevocable trusts offer more protection from creditors but at the cost of flexibility.

-

When choosing between them, consider your need for control and the associated tax implications.

-

Evaluate your financial situation, family structure, and long-term goals.

How to fill out the 497300958 template

-

1.Begin by downloading a blank revocable living trust agreement template from pdfFiller.

-

2.Open the template on pdfFiller and read through the instructions provided to understand how to fill it out.

-

3.Enter your full legal name as the grantor and include your address in the designated fields.

-

4.List the assets you wish to place into the trust, detailing each asset clearly.

-

5.Assign a trustee, which can be yourself or another trusted individual, and include their contact information.

-

6.Designate beneficiaries who will receive the trust assets after your death and state any specific conditions or amounts.

-

7.Review the document to ensure all information is accurate and complete, making any necessary changes.

-

8.Sign the document electronically and, if required, have it notarized to make it legally binding.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.