Last updated on Feb 20, 2026

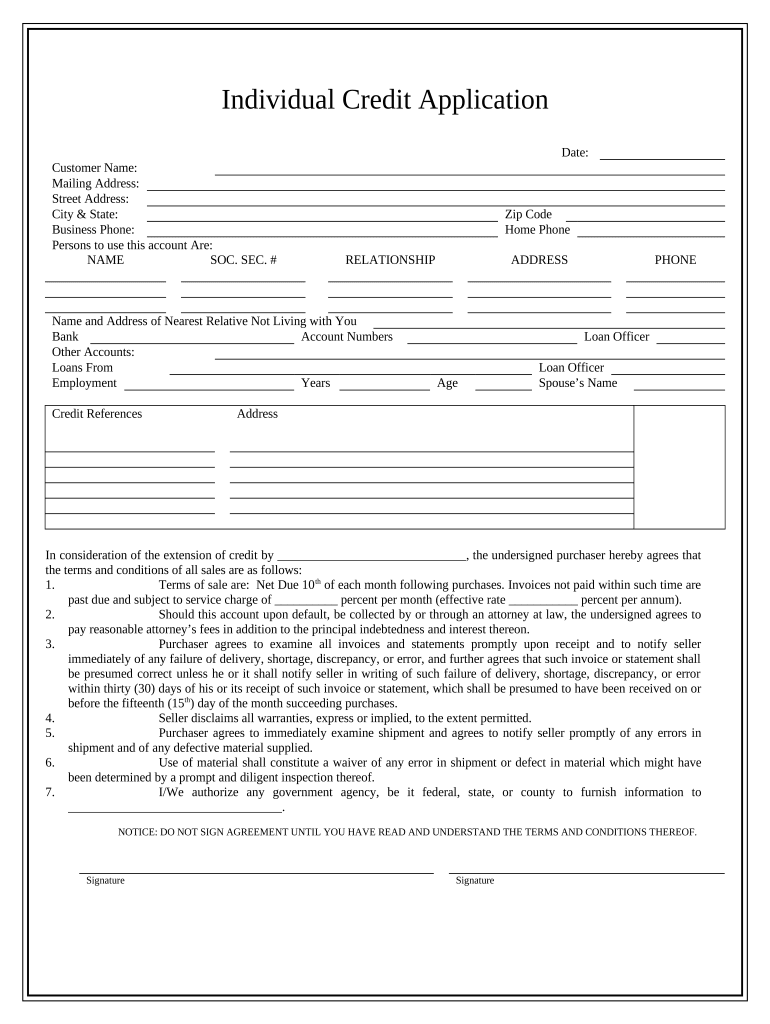

Get the free Individual Credit Application template

Show details

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a form used by lenders to assess a person's creditworthiness when applying for a loan or credit.

pdfFiller scores top ratings on review platforms

Easy to navigate

Easy to navigate, fill in info, save and edit.

VERY EASY TO NAVIGATE

dfgyhdfh

I need more experience to be able to navigate to CREATE new documents.

xxxxxxxxxxxxxxxxxxxxxxxxxxxxx

Easy to Use

It is easy to use and affordable.

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

How to fill out an individual credit application form

Filling out an individual credit application form requires careful attention to detail to ensure accurate information is provided. This guide will walk you through each step to make the process straightforward and efficient.

Understanding the individual credit application form

An individual credit application form is a document that individuals complete to apply for credit, such as loans or credit cards. The form is essential for financial institutions to assess creditworthiness. Accurate information is crucial, as it determines loan approval and terms.

-

A formal request to borrow money from a financial institution.

-

Inaccuracies can lead to denial, unfavorable terms, or legal issues.

-

Used primarily for loans, credit cards, and other forms of credit.

What are the essential components of the individual credit application form?

The individual credit application form includes several key fields necessary for evaluating a credit request. Providing complete and accurate details here is vital for the processing of applications.

-

Ensure all contact details are current and correct.

-

These are critical for identity verification and credit history access.

-

Financial status helps lenders assess repayment capability.

How to fill out the individual credit application form?

Filling out the form correctly is essential. Each section should be approached carefully to avoid mistakes.

-

Follow provided instructions for each field, ensuring completeness.

-

Verify data to minimize errors and improve approval chances.

-

Select relevant and trustworthy references to support your application.

How can pdfFiller help in editing and managing your credit application?

Using pdfFiller, you can easily edit your credit application form and collaborate with others. This tool simplifies the process of making changes and adds essential functionalities such as electronic signing.

-

Make quick changes to your application without hassle.

-

Securely sign your document digitally, speeding up the submission process.

-

Share the form for input from trusted parties before finalizing.

What common mistakes should you avoid when submitting the individual credit application form?

Many applicants make avoidable mistakes on their credit application forms, which can negatively affect their chances of approval. Awareness and diligence are key to mitigating these errors.

-

Common issues include typos in personal information or omission of required details.

-

'Reviewing your application thoroughly can uncover errors before they affect your application.'

-

Small mistakes can lead to delays, denials, or higher interest rates.

What are the legal considerations in credit applications?

Understanding the legal landscape surrounding credit applications is crucial for both borrowers and lenders. Compliance with these laws ensures adherence to fair lending practices and protects consumers.

-

Familiarize yourself with laws that govern credit transactions.

-

Ensure that lenders provide necessary information during the application process.

-

Make sure your application adheres to state and federal regulations.

What happens after submitting the individual credit application?

Once a credit application is submitted, applicants may experience a waiting period before receiving feedback. Knowing what to expect can ease anxiety and guide next steps.

-

Lenders typically review applications and perform background checks.

-

Stay updated; applicants should reach out if they haven't heard back within specified timelines.

-

Seek advice or clarification from a financial advisor if needed.

Where can individuals find resources for credit applications?

Various resources are available for individuals navigating the credit application landscape. Utilizing these can enhance your credit knowledge and application success.

-

Online resources provide various forms to meet your specific needs.

-

Learn tips and strategies to improve your creditworthiness.

-

Reach out to certified financial advisors for personalized guidance.

How to fill out the individual credit application template

-

1.Open the pdfFiller website and log in to your account or create one if you don’t have it yet.

-

2.Search for the 'individual credit application' template in the document library.

-

3.Select the application form and click 'Fill' to start editing.

-

4.Enter your personal information such as name, address, and contact details in the designated fields.

-

5.Provide your financial details including income, employment status, and existing debts as requested in the form.

-

6.Review all the information for accuracy and completeness before finalizing the application.

-

7.If required, add any supporting documents such as proof of income or identification by uploading them directly in pdfFiller.

-

8.Once all information is filled out and verified, click ‘Submit’ to send your application electronically or download it for mailing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.