Get the free Assumption Agreement of Mortgage and Release of Original Mortgagors template

Show details

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is assumption agreement of mortgage

An assumption agreement of mortgage is a legal document that allows a buyer to take over the responsibilities of an existing mortgage from the seller.

pdfFiller scores top ratings on review platforms

easy to use

I have enjoyed being able to import documents.

easy and great features

Great way to communicate with clients and staff members alike

easy to use

good so far

Who needs assumption agreement of mortgage?

Explore how professionals across industries use pdfFiller.

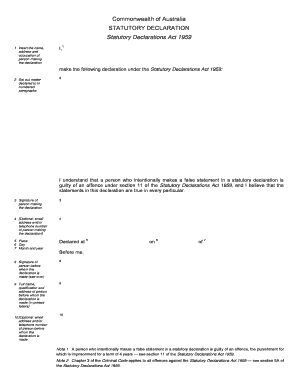

A comprehensive guide to the assumption agreement of mortgage form

How to fill out an assumption agreement of mortgage form

Filling out an assumption agreement of mortgage form involves careful consideration of various factors to ensure a smooth transition between parties involved. This guide will provide detailed steps on how to accurately complete and manage this critical real estate document.

Understanding the assumption agreement of mortgage

An assumption agreement allows a new buyer to take over the existing mortgage from the seller. This process can simplify the transaction by maintaining the original terms of the mortgage.

-

An agreement that allows a buyer to assume responsibility for an existing mortgage on a property.

-

Include the terms of the mortgage, borrower details, and property information.

-

Helps facilitate smoother transfers between buyers and sellers, often with more favorable terms.

What steps are involved in preparing your assumption agreement?

Preparation is crucial before completing the form. Gathering all necessary documentation and identifying involved parties ensures the agreement aligns with legal requirements.

-

Collect property deeds, mortgage statements, and any relevant communication records.

-

Clearly define who the buyer and seller are in the agreement to avoid confusion.

-

Discuss interest rates and payment schedules to ensure both parties are informed.

What are the steps for filling out the form?

Using pdfFiller, you can easily fill out the assumption agreement of mortgage form. Leveraging its features will streamline the process and help avoid mistakes.

-

Visit pdfFiller to download or access the assumption agreement of mortgage form.

-

Ensure you know how to operate the forms toolbar to access fields properly.

-

Begin by entering borrower details and property information accurately.

How can you edit and customize your form using pdfFiller?

pdfFiller provides robust tools for editing and customizing your assumption agreement. Using the platform effectively can enhance the functionality of your document.

-

Make text edits, add signatures, and adjust the document as necessary.

-

Be sure to save your changes and manage versions effectively.

-

Use sharing and commenting features to facilitate real-time collaboration.

What do you need to do for signing and finalizing the mortgage assumption?

Finalizing the assumption agreement through eSigning is a vital step that provides legal validity to the document.

-

Electronic signatures are legally recognized, providing a modern solution to document signing.

-

Follow the prompts on pdfFiller to complete the eSigning process smoothly.

-

Ensure you upload and store the finalized document securely for future reference.

What common pitfalls should be avoided?

Completing the form accurately is essential to avoid legal complications. Here are several common issues to be mindful of.

-

Double-check for any missing details that may jeopardize your agreement.

-

Understanding state-specific laws, like those in Connecticut, can save you from pitfalls.

-

A lawyer can provide insights and ensure your agreement meets all legal standards.

Exploring related resources and support

Utilizing additional resources enhances your understanding of the mortgage assumption process. pdfFiller offers tools to guide users effectively.

-

Explore a library of mortgage-related templates that can further assist in your documentation needs.

-

If you need help, reaching out to customer support can provide tailored guidance.

-

Access additional legal resources for a deeper understanding of mortgage assumptions.

How to fill out the assumption agreement of mortgage

-

1.Begin by downloading the assumption agreement of mortgage template from pdfFiller.

-

2.Open the document in the pdfFiller application.

-

3.Input the current mortgage holder's name and contact details in the designated fields.

-

4.Fill in the buyer's information, ensuring correct spelling of names and addresses.

-

5.Provide property details including the address and legal description to specify the mortgage.

-

6.Enter the loan amount, interest rate, and remaining terms of the mortgage.

-

7.Check the assumptions clause to confirm if the lender allows the mortgage assumption.

-

8.Include signatures from both the seller and the buyer in the appropriate sections.

-

9.Review all filled information for accuracy before saving.

-

10.Finally, submit the completed document for lender approval and record keeping.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.