Last updated on Feb 17, 2026

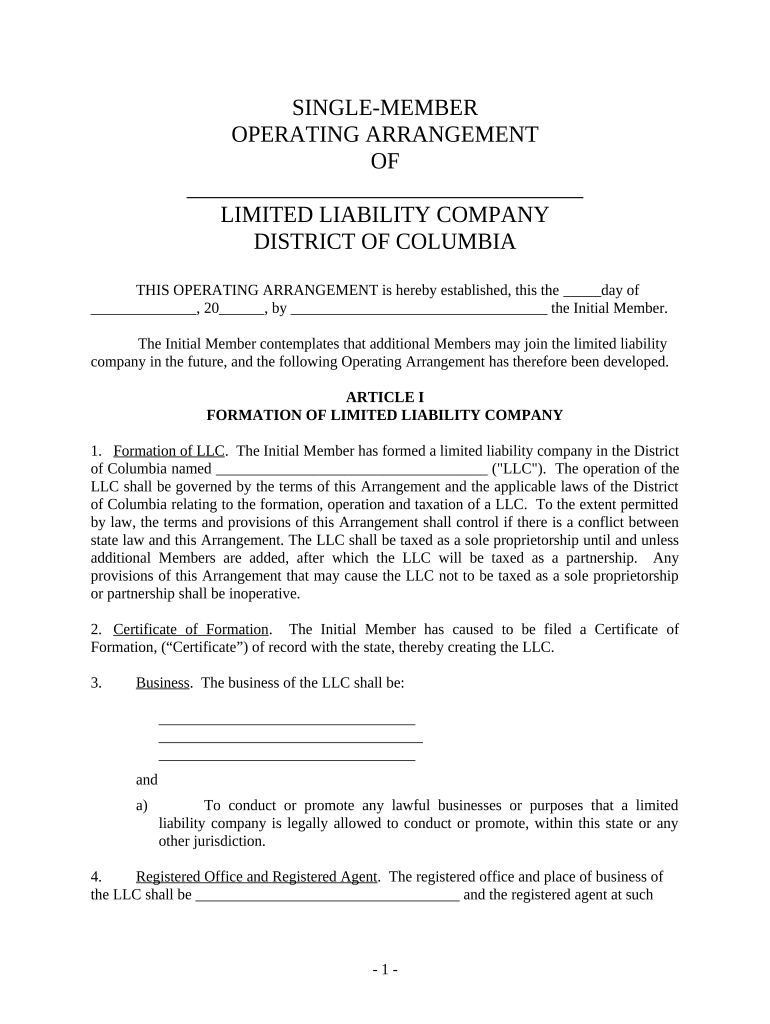

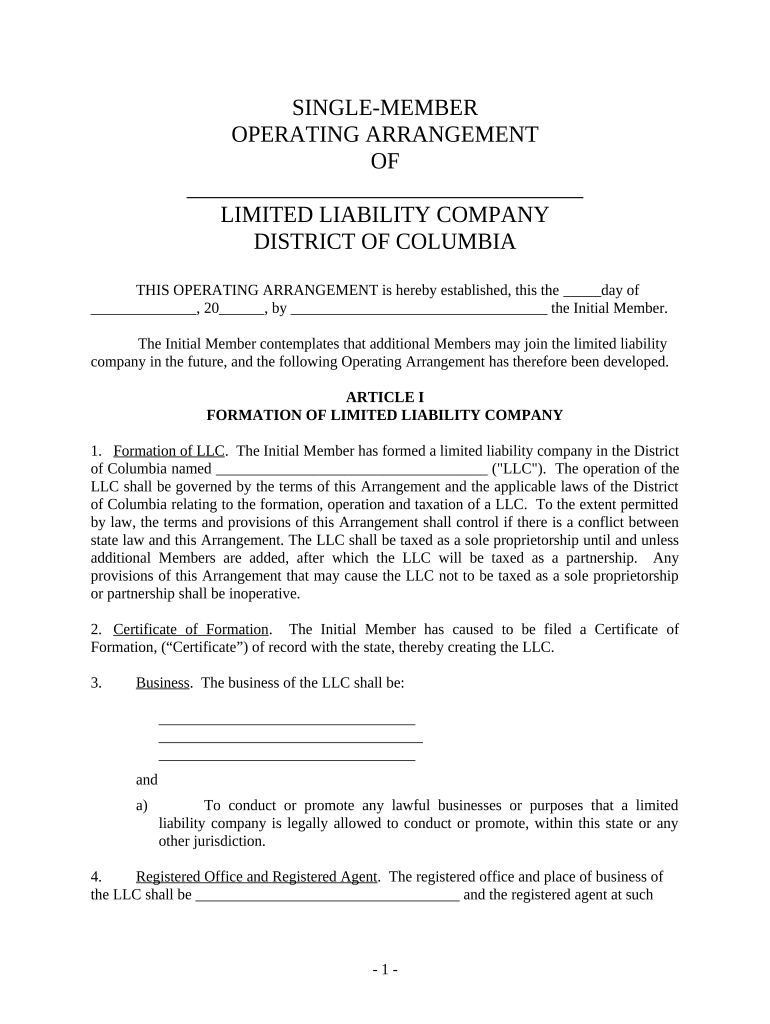

Get the free Single Member Limited Liability Company LLC Operating Agreement template

Show details

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is single member limited liability

A single member limited liability company (SMLLC) is a business structure that allows a single owner to maintain limited liability protection while conducting business activities.

pdfFiller scores top ratings on review platforms

Love the form and love the software!! It was exactly what I needed for my project.

I love PSFfiller, it helps me with all my documents that are emailed to me.

Wish it could be saved in our computer clients directory too as before when it could be saved as a PDF document.

Very good experience. Fairly easy to use and beats printing filling out and rescanning.

I'm finding the sit is somewhat difficult to use.

This is the best editing tool I've ever seen.

Who needs single member limited liability?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Completing a Single Member Limited Liability Company Form on pdfFiller

This guide serves as your comprehensive resource for filling out the single member limited liability form form effectively. By understanding the procedural requirements and utilizing the right tools, you can complete your formation with confidence.

What is a single member ?

A single member limited liability company (LLC) is a business structure owned by one individual. Its primary benefit is the protection it provides against personal liability, meaning that personal assets are safeguarded from business debts and lawsuits. However, it’s essential to consider factors such as potential self-employment taxes that may arise.

-

A single member LLC combines the simplicity of sole proprietorship with the liability protection of a corporation.

-

These include limited personal liability, pass-through taxation, and flexible management structures.

-

You must remain aware of self-employment taxes and potential challenges in raising capital.

How do prepare for my Single Member formation?

-

Compile your name, business address, and an outline of your business goals, as this information is crucial for completion.

-

Each state has specific rules regarding LLC formation; familiarize yourself with D.C. regulations.

-

A Registered Agent receives legal documents on behalf of your LLC and must have a physical address in the District of Columbia.

What are the steps to complete the formation process?

-

Begin by obtaining the Certificate of Formation from the D.C. Department of Consumer and Regulatory Affairs.

-

Key fields include your business name, which must be unique, and the applicable formation date.

-

Incorrect information could lead to issues with tax filings or obtaining essential permits.

What is included in the operating arrangement?

-

This section outlines the founding principles and purpose of your LLC.

-

The document should reflect both your internal governance and comply with local laws.

-

Understand how different tax designations can impact your financial obligations.

How do register my Single Member ?

-

Submit your finalized Certificate of Formation to the D.C. Department of Consumer and Regulatory Affairs.

-

After approval, you will receive a stamped copy of your Certificate confirming your LLC's formation.

-

Be aware of effective date rules; your LLC might not officially exist until you receive final approval.

What are the management requirements after forming my ?

-

Ensure that you file any necessary annual reports to maintain good standing.

-

Follow specific procedural steps to update this information, including submitting the proper forms.

-

Routine bookkeeping can help mitigate errors during tax season and keep your LLC compliant.

How can pdfFiller assist with document management?

-

pdfFiller allows for easy digital signatures to streamline your document process.

-

Invite team members to collaborate on forms, ensuring input from all necessary parties.

-

Make changes on the fly with pdfFiller’s intuitive editing tools, ensuring your documents are always current.

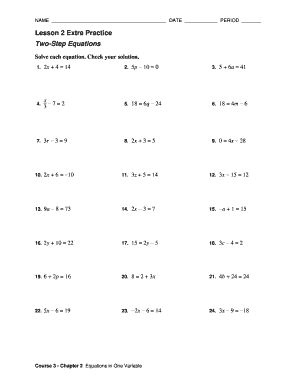

How to fill out the single member limited liability

-

1.Visit pdfFiller and log in or create an account.

-

2.Search for the 'single member limited liability' form in the template library.

-

3.Select the form to start filling it out.

-

4.Enter your name in the designated field as the owner of the SMLLC.

-

5.Provide your business name, ensuring it complies with state regulations.

-

6.Fill in the business address, including city, state, and zip code.

-

7.Detail the ownership structure by confirming it’s a single-member entity.

-

8.Include any necessary business registration information as required by your state.

-

9.Review all the entered information for accuracy before submission.

-

10.Save the completed form in pdf format or submit it directly through pdfFiller.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.