Last updated on Feb 20, 2026

Get the free Individual Credit Application template

Show details

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a formal request submitted by a person seeking to obtain credit or a loan from a financial institution.

pdfFiller scores top ratings on review platforms

i love it

It's fine so far, I double checked for accuracy off of the tax tables and it calculated correctly which is a positive for me and very helpful and a huge timesaver to know it is accurate and reliable

so far this is a good program I just need to learn more about it.

Great

VERY HELPFUL AND EASY

I really needed this. It saved me some work

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

Detailed Guide to the Individual Credit Application Form on pdfFiller

How do begin filling out the individual credit application form?

To fill out an individual credit application form, start by gathering all required personal information such as your name, address, and employment history. Utilize pdfFiller’s tools to easily input this information.

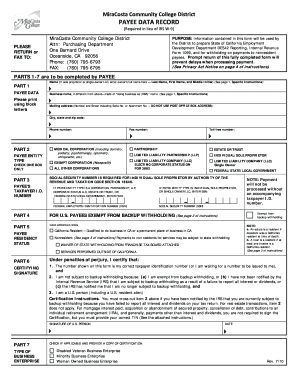

Understanding the individual credit application form structure

The structure of the individual credit application form includes several key sections, each designed to collect necessary information for the credit evaluation process. These essential fields reflect your financial state, character, and capacity to repay.

-

Includes customer name, mailing address, and contact details crucial for identity verification.

-

Requires you to disclose existing financial obligations and accounts, vital for assessing your creditworthiness.

-

Gathers information on your employment status and credit references, which significantly influence credit approvals.

Understanding the purpose of each section can help you provide accurate information and enhance your chances of credit approval.

Navigating the personal information section

Filling out the personal information section is crucial as it verifies your identity and contact points. Mandatory fields such as Customer Name and Mailing Address must be completed accurately.

-

Customer Name, Mailing Address, and Contact Information are mandatory to establish your identity and financial presence.

-

'Persons to use this account' and 'Nearest Relative' sections help lenders assess your support network.

-

Ensure all information is accurate and up-to-date to prevent delays in processing.

What details do provide under account usage?

When disclosing account usage details, you'll need to provide information related to any existing bank accounts, loans, or other financial commitments. This transparency is vital for your credit assessment.

-

List your primary and secondary banking accounts for a better overview of your financial landscape.

-

Include details of credit cards and loans, as they reflect your overall financial obligations.

-

Incomplete disclosure can lead to denials, so ensure you report all financial commitments accurately.

How does employment history affect my credit application?

Your employment history provides lenders with insights into your income stability and reliability. The details of your employment, including tenure and references, are critical for credit decisions.

-

A stable employment record can enhance your creditworthiness, signaling reliability to lenders.

-

Providing strong credit references contributes positively to your application.

-

Gather reliable references that speak positively about your financial habits.

Understanding terms and conditions of sales

Being well-acquainted with the terms and conditions of your credit agreement is necessary to avoid any misunderstandings regarding payment obligations.

-

Main clauses often include payment timelines and service charges that you need to adhere to.

-

Late payment penalties can add significant costs over time, so it’s crucial to know what you’re agreeing to.

-

Seek legal advice on loan agreements to ensure your interests are protected.

How to utilize pdfFiller features for your application

pdfFiller offers several interactive tools that can simplify the filling and management of your credit application form. From editing to e-signing, these features cater to various user needs.

-

Easily edit documents and sign them online without any hassle.

-

Utilize collaboration features for teams to work together seamlessly on applications.

-

Manage your completed forms in an organized manner for future reference.

Ensuring compliance with local regulations and standards

Adhering to local regulations regarding credit applications is essential to avoid potential legal issues. This ensures that all submitted information is accurate and compliant.

-

Understand the specific compliance requirements in your region to mitigate any risks.

-

Follow best practices for ensuring legal information in your applications is up to date.

-

pdfFiller helps ensure that your documents meet all necessary compliance standards while securing your data.

How to fill out the individual credit application template

-

1.Access the individual credit application form on pdfFiller.

-

2.Begin by entering your personal information in the designated fields.

-

3.Input your Social Security number for identification purposes.

-

4.Provide details about your employment status, including employer name and income.

-

5.Fill in your financial information, such as existing debts and assets.

-

6.Review the terms and conditions associated with the credit application.

-

7.Double-check all sections for accuracy and completeness to avoid delays.

-

8.Use the e-signature feature to sign the application electronically.

-

9.Submit the application through the platform once everything is confirmed to be correct.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.