Last updated on Feb 17, 2026

Get the free Closing Statement template

Show details

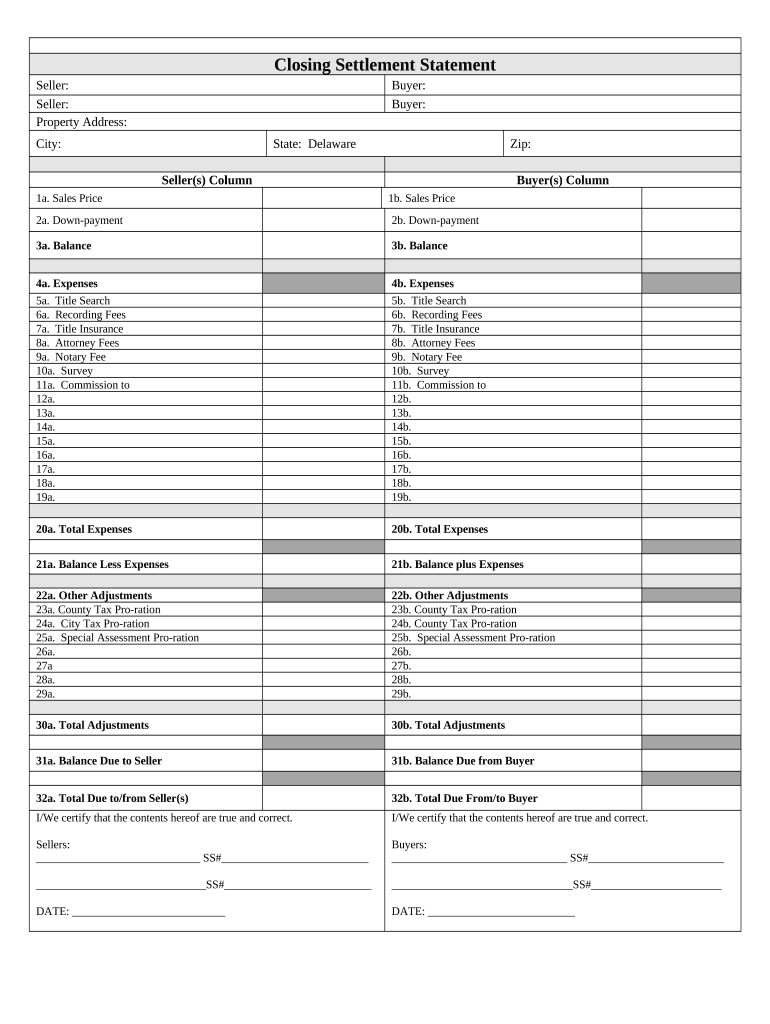

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is closing statement

A closing statement is a financial document that summarizes the final terms and costs involved in a real estate transaction, detailing both buyer and seller obligations.

pdfFiller scores top ratings on review platforms

it's ok

spanish feedback: me encanta la manera tan facil en que podemos conectar con aquellos clientes que tienen dificultad para todo cuando se necesita una firma, puedes usar emails, textos y mas, te da solucioin a tu trabajo y eso es LO GENIAL QUE AHI PARA TODO TIPO DE CLIENTE UNA SOLUCION

I love is so helpful

I find it somewhat frustrating at times.

Brilliant

Good

Who needs closing statement template?

Explore how professionals across industries use pdfFiller.

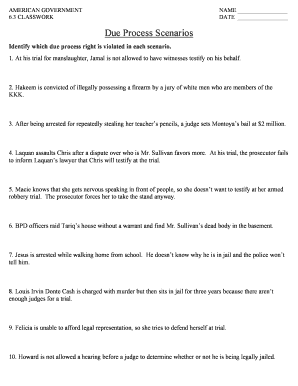

Comprehensive Guide to Closing Statement Form

What is a Closing Statement Form?

A closing statement form is a critical document used in real estate transactions to detail the financial aspects of the sale. It includes information about the sales price, closing costs, and the allocation of expenses between the buyer and the seller. Understanding this form helps both parties navigate the complexities of financial commitments during the closing process.

-

The purpose of the closing statement form is to provide a detailed summary of all financial transactions that occurred during the closing of a real estate property.

-

Key components of the form include sections for the seller, buyer, and a detailed breakdown of costs, ensuring transparency and clarity.

-

This document is crucial as it protects the interests of both parties and serves as a reference for future transactions.

How is the Closing Settlement Statement structured?

The Closing Settlement Statement is typically divided into sections for both the seller and buyer. Each section outlines specific financial components, making it easier for individuals to assess their obligations and entitlements. A meticulous breakdown of these sections helps avoid confusion during the transaction.

-

The seller's column outlines the seller's responsibilities, including sales price, common expenses, and total expenses, ensuring the seller understands their financial commitments.

-

The buyer's column focuses on expenses from the buyer's perspective, outlining sales price correlations and anticipated costs, helping buyers prepare for their financial obligations.

What are the steps for filling out the Closing Statement Form?

Filling out the closing statement form involves following a structured approach to ensure accuracy. Each section must be filled out with precision, reflecting the actual figures from the transaction. Mistakes can lead to significant financial discrepancies that may complicate the transaction.

-

Start by entering the sale price, then detail expenses for both the seller and buyer sections, ensuring all figures align with the contract.

-

Be wary of omitting expenses or misallocating costs, as this can lead to disputes and delays.

-

Utilizing pdfFiller can simplify the documentation process by providing templates and tools to manage forms efficiently.

What should know about signing and submitting the Closing Statement Form?

Understanding e-signature requirements is essential for ensuring the validity of the closing statement form. The finalized document must be submitted promptly to avoid delays in the closing process. Familiarity with the submission procedures aids in smooth transactions.

-

Ensure that all parties understand the e-signature process, as electronic signatures must meet specific legal standards.

-

Know where to submit the completed form, which may be different based on local regulations.

-

Pay attention to timeframes for submission to ensure all aspects of the closing process are completed timely.

What are common issues with Closing Statements?

It is not uncommon for misunderstandings to arise regarding the closing statement. Being prepared for these issues can alleviate stress and streamline the resolution process. Knowing how to navigate disputes and unexpected costs can improve your experience significantly.

-

If you disagree with any charges, document your concerns and communicate directly with the relevant parties involved in the closing.

-

Keep records of all communications and agreements to help manage unexpected costs effectively.

-

Consult professionals when in doubt to navigate complexities and protect your interests.

How can pdfFiller enhance the Closing Statement process?

pdfFiller is a powerful tool that streamlines document management for closing statements. Its features enable users to edit, sign, and securely share documents while integrating seamlessly with other platforms to enhance overall workflow.

-

Easily edit forms directly within pdfFiller to reflect the most accurate and current information.

-

Store all completed forms securely, with easy access anytime, ensuring that your documents are always on hand.

-

pdfFiller can be integrated with various tools to streamline your form management process, making transitions smoother.

In summary: how to benefit from using pdfFiller

Using pdfFiller enhances your experience while dealing with the closing statement form. A digital approach not only simplifies the management of closing documents but also creates opportunities for efficiency and clarity in real estate transactions.

-

Digitizing your closing documents leads to better organization, reduces paper usage, and eliminates risks of misplacement.

-

Embrace modern solutions like pdfFiller to streamline your closing document processes for greater accuracy and satisfaction.

How to fill out the closing statement template

-

1.Start by gathering all necessary documentation related to the real estate transaction, including the purchase agreement, loan details, and closing costs.

-

2.Log in to your pdfFiller account and open the closing statement template from the document library.

-

3.Fill in the buyer's and seller's information, including names, addresses, and contact details at the top of the form.

-

4.Enter the purchase price of the property and details of any deposits or credits in the designated sections.

-

5.Detail all closing costs, including title insurance, appraisal fees, and any applicable taxes, in the closing cost section.

-

6.If applicable, include the loan information such as terms, interest rates, and loan type in the financing section.

-

7.Review the calculations for total due at closing and ensure all figures align with the transaction details.

-

8.Save or export the completed document as a PDF once all fields are filled out and verified for accuracy.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.