Get the free Living Trust for individual, Who is Single, Divorced or Widow or Widower with Childr...

Show details

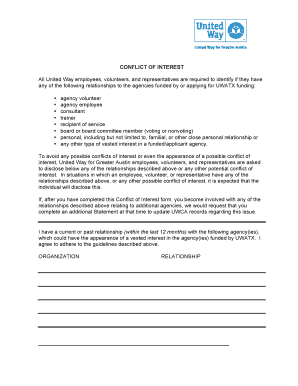

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is living trust for individual

A living trust for an individual is a legal document that allows a person to place their assets into a trust during their lifetime, controlling the distribution of those assets upon their death without going through probate.

pdfFiller scores top ratings on review platforms

What do you like best?

I like PDFfiller pretty well as it is extremely functional.

What do you dislike?

Some free products do almost exactly the same job.

Recommendations to others considering the product:

Consider all of your options to truly find the best product for you in this area.

What problems are you solving with the product? What benefits have you realized?

This helps with my pdf files and is pretty similar to Acrobat pro. I prefer Acrobat pro to PDFfiller, but this is still very good software

I like PDFfiller pretty well as it is extremely functional.

What do you dislike?

Some free products do almost exactly the same job.

Recommendations to others considering the product:

Consider all of your options to truly find the best product for you in this area.

What problems are you solving with the product? What benefits have you realized?

This helps with my pdf files and is pretty similar to Acrobat pro. I prefer Acrobat pro to PDFfiller, but this is still very good software

What do you like best?

Huge time saver because we spend a great deal of time filling out forms, and we fill out the same forms with the same info year after year, and pdffiller keeps it for us and all we have to do is change the date.

What do you dislike?

Nothing really. It's an odd process, fill in your forms, hit this button, then hit that button, and then go find the finished product in your downloads. I would prefer to specify where it goes and rename it before it goes there.

Recommendations to others considering the product:

If you are an insurance agent that uses Acord forms, this is for you.

What problems are you solving with the product? What benefits have you realized?

This definitely saves me money because it save my staff huge amounts of time. Everything is now done digitally, so we need our forms in a digital format that we can save from year to year and change information in the forms at will.

Huge time saver because we spend a great deal of time filling out forms, and we fill out the same forms with the same info year after year, and pdffiller keeps it for us and all we have to do is change the date.

What do you dislike?

Nothing really. It's an odd process, fill in your forms, hit this button, then hit that button, and then go find the finished product in your downloads. I would prefer to specify where it goes and rename it before it goes there.

Recommendations to others considering the product:

If you are an insurance agent that uses Acord forms, this is for you.

What problems are you solving with the product? What benefits have you realized?

This definitely saves me money because it save my staff huge amounts of time. Everything is now done digitally, so we need our forms in a digital format that we can save from year to year and change information in the forms at will.

What do you like best?

I think, best side of this product is variety of tools for updating, signing and sharing my papers.

What do you dislike?

First time it seemed complicated. Not sure, but probably it will be good if you will have a manual, guide book or whatever to help me understand all possibilities.

What problems are you solving with the product? What benefits have you realized?

As a freelance worker, I must use papers for completing contracts, bills and etc.

I think, best side of this product is variety of tools for updating, signing and sharing my papers.

What do you dislike?

First time it seemed complicated. Not sure, but probably it will be good if you will have a manual, guide book or whatever to help me understand all possibilities.

What problems are you solving with the product? What benefits have you realized?

As a freelance worker, I must use papers for completing contracts, bills and etc.

What do you like best?

I found out that I can not use papers in my work. I can take and use online forms, fill our them with PDFfiller and just forget about it.

What do you dislike?

I need much more tools than only PDF editing and sending. I also use RTF, Docx. Or sometimes I edit them in HTML. So, I need do use other tools too.

What problems are you solving with the product? What benefits have you realized?

My team saves insane big amount of time for working with papers. So, our productivity dramatically increased.

I found out that I can not use papers in my work. I can take and use online forms, fill our them with PDFfiller and just forget about it.

What do you dislike?

I need much more tools than only PDF editing and sending. I also use RTF, Docx. Or sometimes I edit them in HTML. So, I need do use other tools too.

What problems are you solving with the product? What benefits have you realized?

My team saves insane big amount of time for working with papers. So, our productivity dramatically increased.

What do you like best?

Forms library and signature sending tool

What do you dislike?

Random glitches and sudden document export errors

What problems are you solving with the product? What benefits have you realized?

Sending documents for signature and editing IRS forms

Forms library and signature sending tool

What do you dislike?

Random glitches and sudden document export errors

What problems are you solving with the product? What benefits have you realized?

Sending documents for signature and editing IRS forms

What do you like best?

I like being able to edit forms and send out for client signature

What do you dislike?

The fact that the software does not offer a reasonable and affordable way for my assistant to access account and complete routine tasks

Recommendations to others considering the product:

It is a great solution for any company needing to get PDF forms completed and get signatures on agreements

What problems are you solving with the product? What benefits have you realized?

I use pdffiller to get completions and signatures on client agreements

I like being able to edit forms and send out for client signature

What do you dislike?

The fact that the software does not offer a reasonable and affordable way for my assistant to access account and complete routine tasks

Recommendations to others considering the product:

It is a great solution for any company needing to get PDF forms completed and get signatures on agreements

What problems are you solving with the product? What benefits have you realized?

I use pdffiller to get completions and signatures on client agreements

Who needs living trust for individual?

Explore how professionals across industries use pdfFiller.

How to create a living trust for individuals: A comprehensive guide

What is a revocable living trust?

A revocable living trust is a legal document that allows an individual, known as the trustor, to manage their assets during their lifetime while designating beneficiaries to receive those assets upon their death. This type of trust can be altered or revoked by the trustor at any time, providing flexibility. Revocable living trusts are designed to simplify the estate planning process.

-

A trust that can be changed or revoked during the trustor's lifetime, allowing for ongoing management of assets.

-

Used primarily to avoid probate, manage assets effectively during incapacity, and ensure privacy.

-

Important terms include trustor (creator of the trust), trustee (manages the trust), and beneficiaries (receivers of the trust's assets).

What are the advantages of a revocable living trust?

Creating a revocable living trust can offer several significant advantages. Most notably, it allows for the avoidance of probate— the legal process of distributing assets after death. This not only saves time but can also reduce legal costs. Additionally, the management of assets during incapacity becomes much easier, providing peace of mind for individuals concerned about their financial affairs.

-

Assets held in a living trust bypass probate court, leading to quicker distributions to beneficiaries.

-

If the trustor becomes incapacitated, the trustee can step in to manage the assets without court intervention.

-

Living trusts are not public documents; therefore, their contents remain confidential, unlike wills.

What are the disadvantages of a revocable living trust?

While there are many benefits to establishing a revocable living trust, several drawbacks must also be taken into account. The upfront costs and complexity of setting up the trust can be considerable, and ongoing management is required to maintain its validity. Furthermore, revocable living trusts do not provide any tax benefits, which may be a deciding factor for some individuals.

-

Creating a living trust may require professional help, leading to increased initial costs.

-

The trust must be actively managed to reflect changes in the trustor's wishes or assets.

-

Unlike other estate planning tools, revocable living trusts do not reduce estate taxes.

When should you use a revocable living trust?

A revocable living trust is ideal for individuals with significant assets or specific estate planning needs. Conditions such as having minor children, facing potential incapacity, or wanting to maintain privacy are key indicators that this type of trust might be beneficial. Moreover, evaluating the entirety of assets and beneficiaries is crucial in determining the appropriateness of establishing a living trust.

-

Consider using a living trust if you own real estate or have substantial assets to manage.

-

Assess your overall estate plan and the roles of your specified beneficiaries to determine the fit.

-

A thorough inventory of your assets and an understanding of who will benefit can guide your decision.

How to set up a revocable living trust?

Setting up a revocable living trust involves a straightforward process that helps ensure your assets are protected and managed according to your wishes. Initially, understanding the essential information required for the trust document is vital. Using platforms like pdfFiller can facilitate effective document management by allowing you to easily fill, edit, sign, and store your living trust documentation securely.

-

Start by naming your trust, identifying beneficiaries, and determining your trustee.

-

You’ll need to provide detailed information about your assets and chosen beneficiaries.

-

This tool simplifies the document creation process, allowing seamless collaboration and management.

What are the key components of the revocable living trust document?

The revocable living trust document contains several key components that must be meticulously outlined to ensure clarity and effectiveness. The trust must include the name of the trust, identification of the trustor and beneficiaries, and the appointment of a trustee and successor trustee who will manage the trust in the event of the trustor's incapacity or death.

-

It should reflect the trustor’s name to identify the trust clearly.

-

Precise identification helps eliminate ambiguities during asset distribution.

-

Choosing a reliable trustee is essential for proper management and execution of the trust.

Who is involved in a revocable living trust?

The parties involved in a revocable living trust play vital roles in its functionality. The trustor, or creator, sets up the trust, while the trustee is responsible for managing the assets in accordance with the trustor’s wishes. Beneficiaries hold rights to the trust's assets based on the trustor's directives, and understanding these roles enhances the trust’s efficiency.

-

The trustor establishes the trust terms and contributes assets.

-

Trustees manage the trust and ensure the trustor's wishes are executed effectively.

-

Beneficiaries have rights to distributions as outlined in the trust agreement.

What are state-specific trust laws?

Understanding state-specific trust laws is crucial to ensuring your revocable living trust complies with legal requirements. Different states, like Delaware, may have varying regulations regarding trusts, which can impact their formation and execution. Accessing local resources and expert guidance can help navigate these nuances.

-

Delaware is known for its favorable trust laws that can provide privacy and asset protection.

-

Adhering to local laws prevents legal challenges and ensures the trust remains valid.

-

Online legal resources can provide updated information tailored to your state's laws.

What is the difference between a living trust and a revocable trust?

Often confused, the terms 'living trust' and 'revocable trust' are not interchangeable. While both allow the trustor flexibility during their lifetime, a living trust typically refers to the broader category, whereas a revocable trust specifically denotes the trust's ability to be altered or revoked. Understanding these distinctions can significantly impact your estate planning.

-

The main distinction is in the ability to change the terms of the trust.

-

Choosing the right trust type depends on individual needs and future considerations.

-

Assessing your estate planning goals will guide appropriate trust selection.

How to fill out the living trust for individual

-

1.Access the pdfFiller website and log in or create an account.

-

2.Search for 'living trust for individual' template in the search bar.

-

3.Select the template from the results to open it in the editor.

-

4.Begin filling in your personal information, including your full name and address.

-

5.List all assets you wish to place in the trust, such as real estate, bank accounts, and investments.

-

6.Designate a trustee, who will manage the trust during your lifetime and distribute assets after your death.

-

7.Specify the beneficiaries who will inherit the assets held in the trust and the terms of distribution.

-

8.Review the filled form for accuracy and completeness.

-

9.Save your document and consider printing it to sign in the presence of a notary if required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.