Get the free Satisfaction, Release or Cancellation of Mortgage by Corporation template

Show details

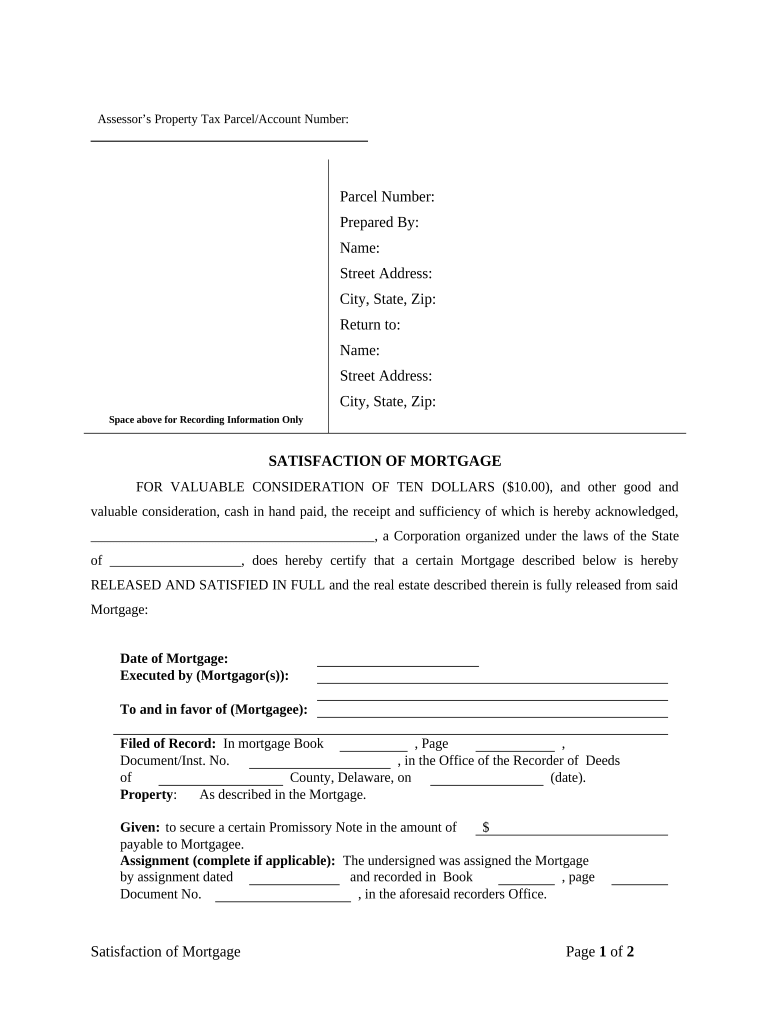

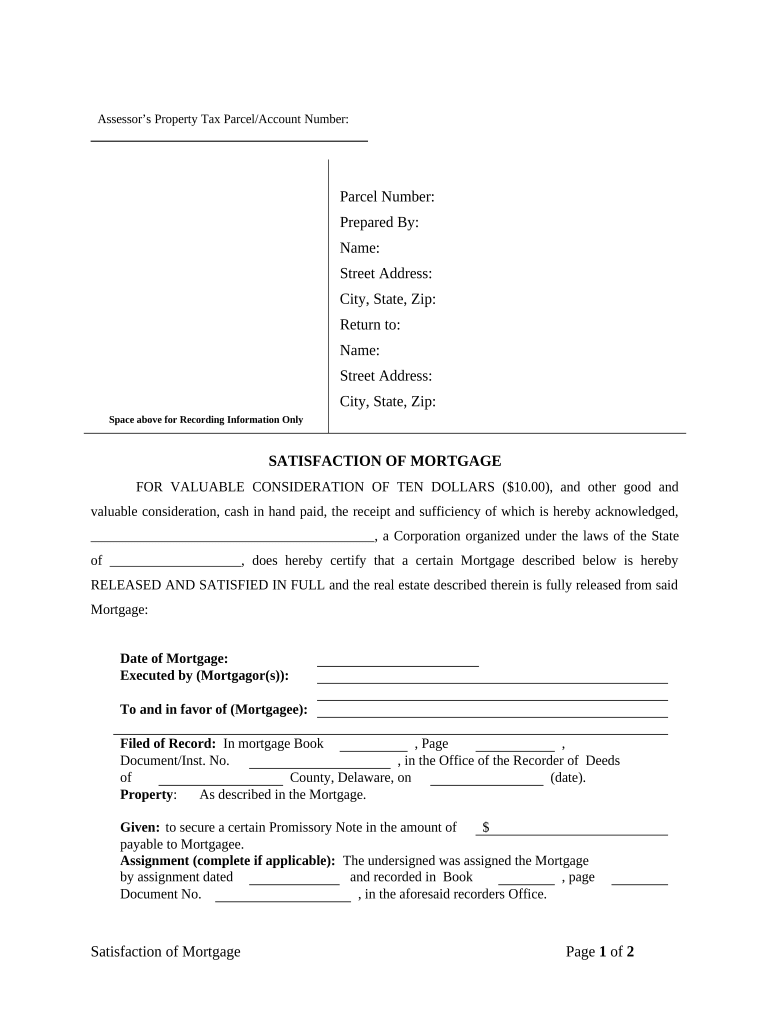

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Delaware by a Corporation. This form complies with

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is satisfaction release or cancellation

A satisfaction release or cancellation is a legal document that officially declares a debt or obligation has been fulfilled and releases the debtor from further liability.

pdfFiller scores top ratings on review platforms

Awesome

I was nt been able to do some serious editing on some of my additional job duties until i this program. It has def helped.

Great company thank has super easy…

Great company thank has super easy fillable PDF's that walk you step by step of the way.

Brilliant Brilliant App

This is my first time using pdfFiller

This is my first time using pdfFiller. It is an amazing software and make it much easier to anyone to complete required forms.

Easy to use

Easy to use. Definitely what I needed to correct 2020 W2 forms.

5* Customer Service

I am very impressed with the customer service. When I was charged for a years subscription after my free trial, which I queried immediately, I received a full refund within the hour with no quibble.

Who needs satisfaction release or cancellation?

Explore how professionals across industries use pdfFiller.

How to fill out a satisfaction release or cancellation form

Understanding satisfaction release or cancellation forms

A satisfaction release or cancellation form is a legal document confirming that a borrower has fulfilled all obligations under a mortgage agreement. Filing a Satisfaction of Mortgage is essential for the borrower to clear the property's title, ensuring that it is free from the mortgage lien. The mortgage satisfaction process typically involves preparing and submitting this form to the appropriate local authorities.

-

The Satisfaction of Mortgage form provides legal acknowledgment that the loan associated with the property is fully paid.

-

It is important because it protects the borrower’s ownership rights by removing the mortgage lien from the property title.

-

The process usually requires submission to the county recorder’s office for official recognition.

Components of a satisfaction of mortgage form

Key components of a Satisfaction of Mortgage form ensure that all necessary details are included for validity. Missing or incorrect information can delay the process or render the document ineffective.

-

This number identifies the specific property in question within local tax records.

-

Essential details like the parcel number, names of parties, address, and contact information must be accurately filled.

-

The form must include a statement acknowledging that consideration (payment) was made for the release.

-

Clearly identify mortgagor and mortgagee to avoid legal confusion.

-

Include details about the mortgage like its original date, filing number, and relevant document numbers.

-

All necessary parties must sign the document, including a notarization for authentication.

Step-by-step guide to completing the satisfaction of mortgage form

Filling out the Satisfaction of Mortgage form requires careful attention to detail. Accurate information leads to faster processing and avoids potential legal issues.

-

Gather all required details regarding the mortgage and property.

-

Make sure to fill out every section to ensure compliance with local regulations.

-

Double-check all entries to prevent mistakes that could delay processing.

-

Ensure that all parties sign the document and have it notarized at the same time.

-

Submit the completed form to the appropriate local office to officially record the mortgage satisfaction.

Practical example: completing a satisfaction of mortgage form

Using a practical example can clarify the process of completing the form. Sample scenarios may illustrate common challenges and how to navigate them.

-

Illustrate how to complete sections of the form based on real-life examples.

-

A sample document can provide clarity and act as a template for new borrowers.

-

Different counties may have specific requirements; thus, it is crucial to consult local guidelines.

Tools and resources provided by pdfFiller

pdfFiller empowers users by offering online tools that simplify the mortgage satisfaction process. Its cloud-based platform allows for seamless document editing, signing, and management.

-

pdfFiller provides various features including editing, signing, and collaboration options to streamline document handling.

-

Users can take advantage of interactive tools for a more engaging experience when filling out forms.

-

The Satisfaction of Mortgage form template can easily be found and customized on pdfFiller's website.

-

pdfFiller ensures that users can manage their documents efficiently from anywhere with an internet connection.

How to fill out the satisfaction release or cancellation

-

1.Obtain the satisfaction release or cancellation form from a reliable source or pdfFiller's template library.

-

2.Fill in the debtor's and creditor's names as they appeared in the original agreement.

-

3.Include the date when the debt was satisfied and any relevant account or reference numbers.

-

4.If applicable, describe the terms of the debt that was fulfilled and any relevant details about the payment or fulfillment.

-

5.Sign and date the document where indicated by the debtor; sometimes, the creditor will also need to sign as verification.

-

6.Review the completed form for accuracy and completeness before finalizing it.

-

7.Save the document electronically and consider printing copies for both parties' records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.