Get the free Single Member Limited Liability Company LLC Operating Agreement template

Show details

This Operating Agreement is for a Limited Liability Company with only one Member. This form may be perfect for an LLC started by one person. You make changes to fit your needs and add description

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is single member limited liability

A single member limited liability is a business structure allowing one individual to own and operate a limited liability company (LLC), protecting personal assets from business liabilities.

pdfFiller scores top ratings on review platforms

No problems with what I'm trying to…

No problems with what I'm trying to accomplish.

Easy to use

Easy to use. Very intuiative, the prompts were very helpful

Super easy to use

Super easy to use, amazing price, best I've found for e-signatures.

Good Good Good

Good Good Good

Truly Great!

Truly Great!. Thank you..

It would be optimal if you could select multiple cells at the same time (for alteration) , when editing excel files

I was able to edit my pdf files

Who needs single member limited liability?

Explore how professionals across industries use pdfFiller.

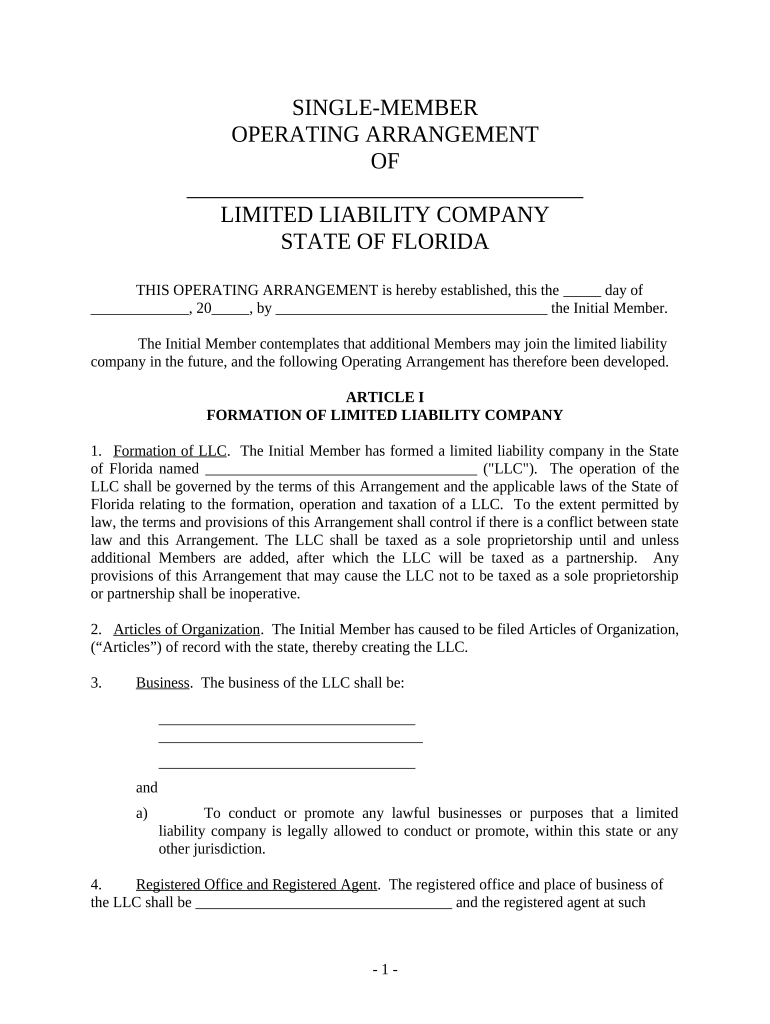

The Comprehensive Guide to the Single Member Limited Liability Form at pdfFiller

Filling out a single member limited liability form can streamline your business registration process. This guide will walk you through understanding its components, navigating the filing process, and utilizing tools available via pdfFiller to create your documents efficiently.

What is a single member limited liability company?

A single member limited liability company (LLC) is a distinct legal entity formed by an individual, providing a separation between personal and business liabilities. This structure offers several benefits, including personal asset protection from business debts, and is easier to manage with fewer regulatory burdens compared to multi-member LLCs.

-

A single member LLC is defined by its sole owner, distinguishing it from corporations and partnerships. Its key characteristics include personal liability protection and potential tax benefits.

-

Notable advantages include asset protection, simplified tax processes, and operational flexibility. Business owners can also enjoy the pass-through taxation model, avoiding double taxation.

-

While multi-member LLCs have additional owners, single member LLCs simplify operations and governance. Only one member is required for decision-making, which can lead to quicker business responses.

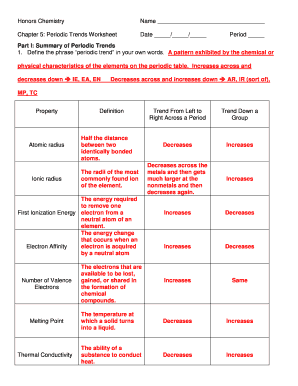

What are the essential components of a single member operating arrangement?

The operating agreement is crucial for establishing the roles, responsibilities, and business procedures specific to your single member LLC. This document includes important elements that govern the functioning of your company.

-

The Articles of Organization must be filed to legally create the LLC. This document includes the LLC's name, address, and details about the registered agent.

-

Clearly stating the business purpose is important for compliance and tax purposes, as it outlines legally permissible business activities.

-

A registered agent is essential to receive legal documents and communications on behalf of the LLC. Choosing a location for the registered office is also a legal requirement.

How do you navigate the filing process in Florida?

Navigating the filing process to establish a single member LLC in Florida involves several steps. Understanding the requirements and following an organized process can significantly ease this task.

-

First, prepare your Articles of Organization with necessary details. Next, submit these to the Florida Division of Corporations either online or via mail.

-

You will need to provide a completed application along with payment for filing fees, which vary based on the entity type and submission method.

-

Typically, processing takes about 2-4 weeks, but expedited services are available for quicker approval.

What are the tax implications of a single member ?

Single member LLC taxation primarily treats the entity as a sole proprietorship, which simplifies tax reporting. However, understanding when it may transition to partnership taxation as you add members is critical for compliance.

-

As a sole proprietorship, the LLC's income is reported on the owner’s personal tax return, allowing for easier financial management.

-

If the LLC gains additional members, it may need to file for partnership taxation, which requires different reporting and compliance standards.

-

Understanding Florida's tax frameworks, including any specific fees or requirements, will ensure compliance and avoid unnecessary penalties.

How can you customize your operating arrangement with pdfFiller?

pdfFiller provides accessible tools to create and modify your single member operating arrangement efficiently. Leveraging these features streamlines the document creation process.

-

pdfFiller offers a single member operating arrangement template that you can fill out online. This template ensures you meet all state requirements.

-

Utilize pdfFiller's editing tools to make necessary changes easily, including adding personalized terms or removing unnecessary sections.

-

Once your document is completed, pdfFiller allows for electronic signatures, ensuring a secure and quick way to finalize and share your operating agreement.

How do you maintain your single member ?

Ongoing compliance and recordkeeping are essential for maintaining your single member LLC. Establishing best practices from the start can safeguard your business.

-

Keep detailed records of all business transactions, including income and expenses. Proper documentation supports tax filings and legal compliance.

-

Evaluate your business needs regularly; substantial growth or new goals may warrant considering additional members to enhance capital and expertise.

-

Should you need to make changes to your operating agreement, pdfFiller allows you to easily update your document while staying compliant with Florida laws.

How to fill out the single member limited liability

-

1.Download the single member limited liability form from pdfFiller.

-

2.Open the file in pdfFiller and review the provided sections.

-

3.Begin with your personal information: enter your full name and address in the designated fields.

-

4.Next, specify the purpose of the LLC in the appropriate section to describe its business activities.

-

5.Fill out the details regarding the business name you wish to register and ensure that it complies with state regulations.

-

6.Include the duration of the LLC; if it’s intended to be indefinite, you can indicate that clearly.

-

7.Identify the registered agent who will receive legal documents on behalf of the LLC using their name and address.

-

8.Review the sections regarding ownership percentage to confirm your sole ownership.

-

9.Ensure all sections are filled out accurately, then proceed to save your work periodically.

-

10.Feel free to utilize the tools for digital signatures if required, ensuring all signatures are appropriately placed before submission.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.