Last updated on Feb 20, 2026

Get the free Florida Renunciation And Disclaimer of Property received by Intestate Succession tem...

Show details

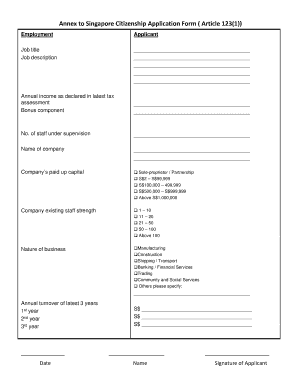

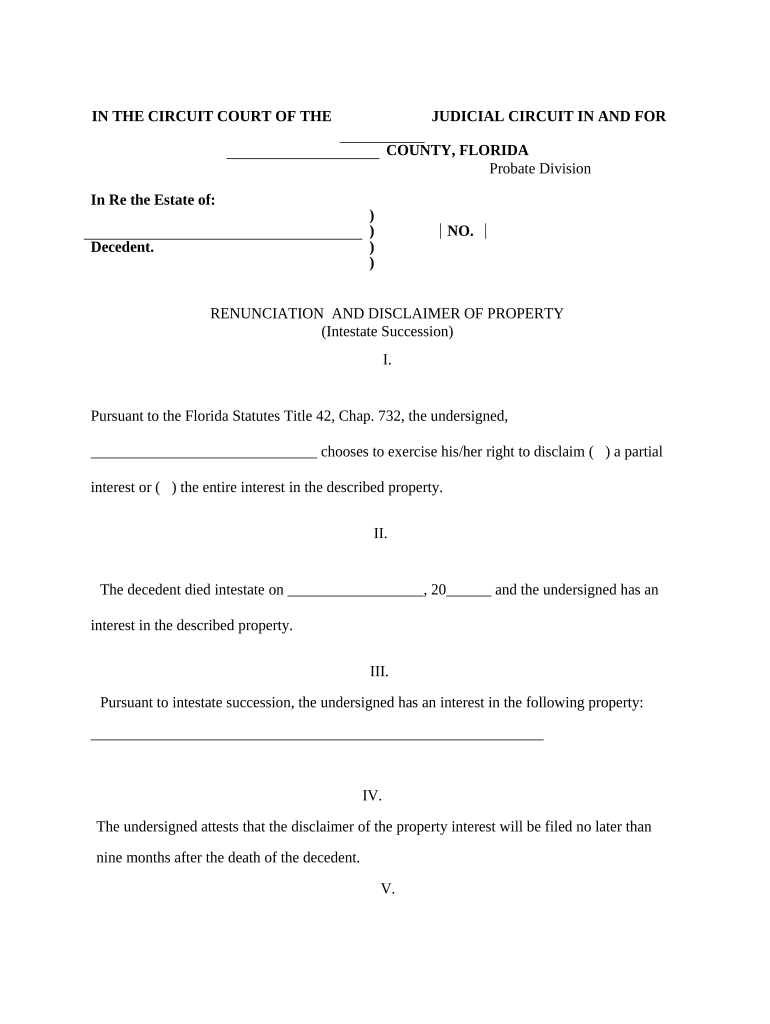

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is florida renunciation and disclaimer

The Florida renunciation and disclaimer is a legal document that allows an individual to refuse or disclaim a gift or inheritance they are entitled to under Florida law.

pdfFiller scores top ratings on review platforms

I loved it but need to know more about how to use it I dont know how to blank out the form once I have filled it out, saved it, and put it in the folder. I want to use it again but it has the old information on it help email me my phone is broken and i will not have it back until tomorrow

It's makes working with PDF so easy. It does exactly what I need it to do with out the complications for using adobe pro. I am in real estate and this helps so much.

I was able to complete difficult SSA forms without having to hand write everything.

Just starting with this program,made several errors, but being user friendly the program let me correct without loosing my unsaved work!

My experience has been great. Works just like it says

THIS PROGRAM IS VERY USER FRIENDLY. THE ONLY THING THAT I DONT UNDERSTAND IS THAT WHEN YOU RESAVE THE DOCUMENT IT DOES NOT UPDATE THE TIME OF YOUR MOST RECENT CHANGE.

Who needs florida renunciation and disclaimer?

Explore how professionals across industries use pdfFiller.

The Ultimate Guide to Florida Renunciation and Disclaimer Form

How does renunciation and disclaimer affect estate planning?

Renunciation refers to the act of refusing an inheritance, while a disclaimer is a formal refusal of a particular property or asset from an estate. Both actions play a crucial role in estate planning, as they allow individuals to navigate the complexities of property rights after a decedent's passing. Understanding these terms is vital for beneficiaries who are uncertain about accepting their inherited assets, especially if it poses financial burdens.

What are the key reasons for filing a renunciation or disclaimer?

There are several scenarios where filing a Florida renunciation or disclaimer form is appropriate. For instance, individuals may want to renounce property that carries tax liabilities or unwanted responsibilities. Moreover, because Florida law requires filing within nine months after the decedent's death, timing becomes essential.

-

Individuals may choose to disclaim property to avoid future taxes or debts associated with it.

-

Renunciation can sometimes help maintain harmony by avoiding arguments over the distribution of property.

-

Some may prefer to disallow property that adds personal financial strain.

How to accurately complete the Florida renunciation and disclaimer form?

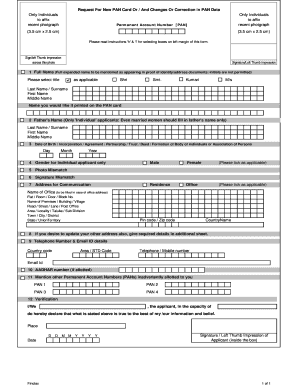

Filling out the Florida renunciation and disclaimer form requires attention to detail. The form includes sections such as 'I. Pursuant to the Florida Statutes' and 'II. The decedent died intestate,' where individuals must enter critical information about the decedent and their inheritance.

-

Enter the full name and date of death of the individual whose estate is being considered.

-

List any properties or assets that you are renouncing or disclaiming for clarity.

-

Ensure that the form is signed in front of a notary public to maintain its legal validity.

What are the legal implications of renouncing or disclaiming an inheritance?

Once a renunciation or disclaimer form is filed, it relates back to the date of the decedent's death. This means the renounced property will be treated as if you never inherited it, and the property will then be distributed according to Florida state law. Additionally, there may be tax implications that you should understand, especially regarding the Internal Revenue Code.

How to deliver and acknowledge the renunciation or disclaimer form?

Delivering your renunciation form needs to adhere to specific guidelines. The form should be directed towards the decedent's personal representative or executor. Acceptable methods of delivery include in-person handoff, registered mail, or through certified mail, ensuring you retain proof of delivery.

-

A notary public will confirm your signature, adding legal protection.

-

Use methods that provide tracking or confirmation to avoid disputes.

How can pdfFiller assist with your renunciation and disclaimer documentation?

pdfFiller provides an excellent platform for users to edit, eSign, and manage their PDF documents. With its user-friendly, cloud-based solution, individuals can collaboratively create and store their Florida Renunciation and Disclaimer Forms. This functionality allows for seamless management and access to important legal documents, ensuring compliance with state regulations.

What factors should you consider before filing your renunciation or disclaimer?

Renouncing an inheritance is not a decision to be taken lightly. Consider the emotional and financial consequences involved. Consulting with a legal professional can help clarify any personal implications. Take time to reflect on your family dynamics and the potential impact of your decisions on others.

-

Consider how renouncing may affect your relationships with family members.

-

Understand any potential loss in financial security that may stem from renouncing.

-

A professional can provide insights tailored to your specific circumstances.

How to fill out the florida renunciation and disclaimer

-

1.Obtain the Florida renunciation and disclaimer form from pdfFiller.

-

2.Open the form in pdfFiller and review the document for any required information.

-

3.Fill in your personal details, including your name, address, and the relationship to the decedent.

-

4.Specify the details of the gift or inheritance you are renouncing, including a description and the value if applicable.

-

5.Include the date of death of the decedent to provide context for the disclaimer.

-

6.Sign the document where indicated, ensuring you verify that your signature matches your printed name.

-

7.If necessary, have the document notarized to ensure its legal standing, depending on the requirements of your situation.

-

8.Once completed, save the document and print a copy for your records, or submit it electronically as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.