Get the free Non-Foreign Affidavit Under IRC 1445 template

Show details

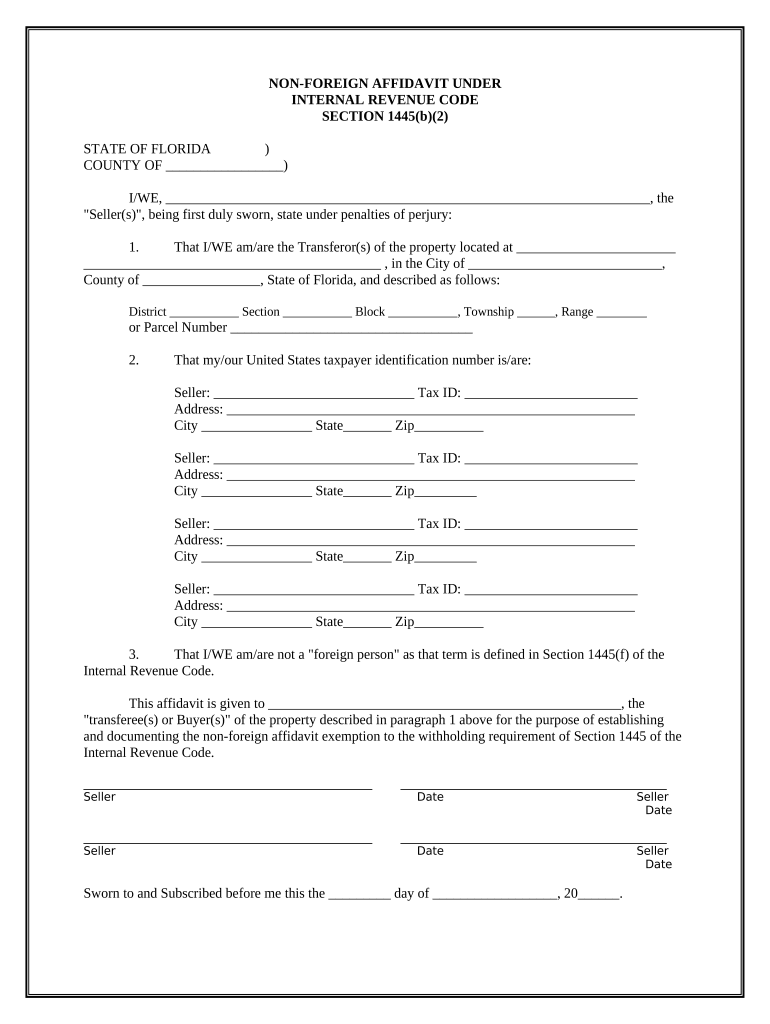

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

pdfFiller scores top ratings on review platforms

ONCE I UNDERSTAND HOW TO USE, ITS QUITE SIMPLE. JUST WOULD LIKE PICTURE EDITOR AVAILABLE AT TIME OF INSERT

Was looking for a way to convert pdf files to writeable files. Works great once you get used to it,

quick easy and speaks in layman terms....

Great application! I use it for everything

its amazing saves me soooo much time, money,and extra help!!!

I AM VERY PLEASE WITH YOUR SERVICE. I WAS WITH A COMPANY THAT I could never get the forms need and was paying a very high cost for them.

How to fill out a non-foreign affidavit under IRC Form Form

What is a non-foreign affidavit under IRC 1445?

A non-foreign affidavit is a legal document utilized in real estate transactions to certify that the seller is not a foreign person, as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is critical because it helps buyers avoid withholding taxes that would otherwise apply if the seller were a foreign entity. In essence, it acts as a protection mechanism for the buyer during property transfers.

-

This affidavit verifies the seller's status as a U.S. resident, thus exempting the transaction from foreign withholding.

-

It ensures compliance with IRS regulations and facilitates a smoother property transfer process.

-

Section 1445 mandates that buyers must withhold taxes on U.S. real property sales if the seller is foreign.

What does the structure of the non-foreign affidavit include?

The non-foreign affidavit is structured into several comprehensive sections that require specific information regarding the property and selling party. Completing these sections accurately is vital for compliance and to avoid delays in the transaction.

-

This section collects details about the seller, including their name, address, and taxpayer identification number.

-

Sellers need to provide their Social Security Number (SSN) or Employer Identification Number (EIN) to validate their non-foreign status.

-

A declaration that the seller is not a foreign individual, supported by the information provided in the previous sections.

-

This is crucial for the affidavit's legal validity; sellers must have their signatures notarized.

How do you fill out the non-foreign affidavit?

Filling out the non-foreign affidavit requires careful attention to detail to ensure accuracy and compliance. Following these step-by-step instructions can mitigate common errors and streamline the process.

-

Before starting, make sure to collect all relevant information including the property address, sale price, and seller details.

-

Pay attention to common mistakes such as incorrect identification numbers or incomplete information, which can lead to compliance issues.

-

Always double-check the completed affidavit for accuracy before submitting, as errors can complicate the transaction.

How can pdfFiller assist with non-foreign affidavit management?

pdfFiller offers powerful tools designed to simplify the management of non-foreign affidavits. Its user-friendly interface allows for easy editing, signing, and collaboration.

-

With pdfFiller, you can easily upload your affidavit and make necessary edits without hassle.

-

The platform supports eSignatures, allowing you to secure necessary approvals promptly.

-

Users can easily share documents with team members, facilitating smooth collaboration on property transactions.

What common mistakes should be avoided when submitting the non-foreign affidavit?

Errors in filing the non-foreign affidavit can lead to penalties or delays. Being aware of these common mistakes enables you to complete the process more effectively.

-

Failing to ensure the accuracy of identification numbers can result in serious delays or additional scrutiny.

-

Ensure that property details match public records to avoid any complications during the transaction.

-

This can render the affidavit invalid, obstructing the transaction process.

What resources are available for legal compliance in Florida?

In Florida, it’s essential to adhere to state-specific requirements when submitting non-foreign affidavits. Utilizing available resources can ease the compliance burden.

-

Familiarize yourself with local tax regulations to ensure compliance during all real estate transactions.

-

Have a list of contacts for local tax authorities to resolve any queries quickly.

-

Access online resources to review additional documentation necessary for a complete submission.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.