Last updated on Feb 17, 2026

Get the free Florida Small Business Accounting Package template

Show details

This Small Business Accounting Package contains many of the business forms needed to operate and maintain a small business, including a variety of accounting forms. These forms may be adapted to suit

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is florida small business accounting

Florida small business accounting refers to the financial record-keeping and reporting practices specifically tailored for small businesses operating in Florida.

pdfFiller scores top ratings on review platforms

The ease of this program makes my work more efficient.

I am happy with PDF filler. It has been such a great help with my court docs. I am constantly having to complete docs and with PDF filler all the information is saved and I only have to edit and save for next court hearing. PDF filler has saved me so much time and headaches. Thank you!

Works great and not nearly as expensive as ADOBE

So far it is been a good experience you send a PDF filler Stephanie could have a little bit too exciting but I'm just starting to get yes of it

Sometimes it jumps and brakes the sequence of filling. Also sometimes character size is not the same

I am a first time user. I've experienced some difficulty but the Support Team is right on it and I expect it to be resolved soon.

Your support is outstanding!

Who needs florida small business accounting?

Explore how professionals across industries use pdfFiller.

Florida Small Business Accounting Forms Guide

In Florida, the relevance of the proper accounting forms cannot be overstated; they are essential tools for small businesses aiming to maintain financial clarity and regulatory compliance.

Understanding the significance of accounting forms can help business owners streamline operations and avoid costly mistakes.

Why are accounting forms important for Florida small businesses?

-

Accounting forms serve as standardized documentation for tracking financial transactions, which is essential for transparency and record-keeping.

-

Florida small businesses often face unique compliance challenges, such as local tax regulations and different reporting standards that necessitate reliable accounting.

-

Utilizing accounting forms helps streamline financial management and ensures timely documentation, which is vital for ongoing operations.

What essential forms are included in the Florida small business accounting package?

-

This package offers a comprehensive set of accounting forms specifically designed for Florida small businesses.

-

Forms included are the Profit and Loss Statement, Balance Sheet, and Aging Accounts Payable form, which are pivotal for accurate financial assessments.

-

These forms can improve bookkeeping efficiency and help businesses maintain an organized financial record.

What essential accounting forms should Florida small businesses be aware of?

-

This statement is crucial for providing business owners with insights into revenue and expenses, thus helping make informed decisions.

-

This form aids in tracking outstanding payments, ensuring timely payment to suppliers and maintaining healthy cash flow.

-

The balance sheet highlights a company’s financial position, showcasing assets, liabilities, and equity, which is vital for assessing financial health.

-

This form helps monitor incoming payments, allowing for better forecasting and management of cash flow, which is essential for sustained operations.

What common mistakes should be avoided when filling out accounting forms?

-

Common errors include data entry mistakes, utilizing outdated forms, and overlooking specific Florida regulations.

-

Ensuring accuracy involves double-checking entries, familiarizing oneself with the form requirements, and keeping abreast of compliance updates.

-

Businesses should understand the local regulatory context to avoid mistakes that could lead to penalties.

What are the smart tips for managing Florida accounting forms efficiently?

-

pdfFiller provides tools for easy form completion and streamlined storage, saving time and reducing errors.

-

The platform allows teams to collaborate in real-time, which minimizes misunderstandings and improves communication.

-

Utilizing pdfFiller’s cloud services ensures that form access and editing can happen from anywhere, facilitating remote work.

When are the deadlines and important dates for Florida accounting forms?

-

Understanding submission deadlines for accounting forms is crucial to avoid costly penalties and maintain compliance with state regulations.

-

Developing a tracking system for deadlines will reduce stress and ensure timely submissions.

-

pdfFiller can help set reminders for important dates, ensuring small businesses stay organized and compliant.

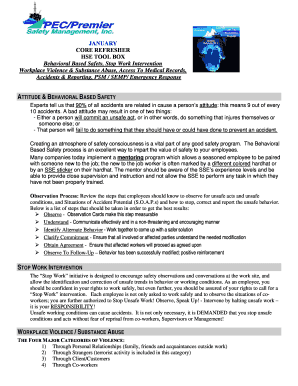

What compliance and legal considerations are important for Florida small businesses?

-

Florida has unique regulations affecting accounting practices; understanding these is crucial for compliance.

-

Maintaining precise records is vital for meeting state and federal requirements, especially regarding tax obligations.

-

Using the recommended accounting forms helps ensure that businesses meet legal requirements efficiently.

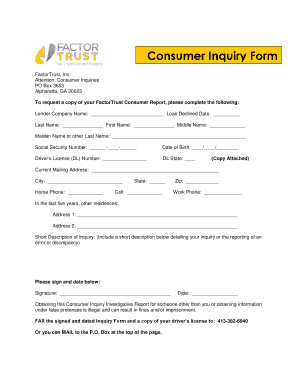

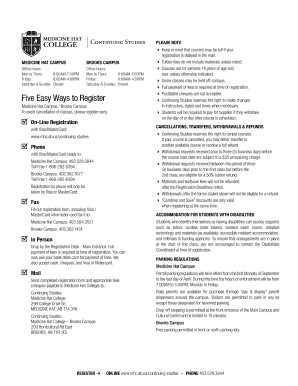

How to fill out the florida small business accounting

-

1.Open the pdfFiller application and log in to your account or create a new one if necessary.

-

2.Search for the 'Florida Small Business Accounting' template within the platform's library.

-

3.Once you locate the template, click on it to open in the editing interface.

-

4.Begin filling out the required fields, such as your business name, address, and tax identification number.

-

5.Enter your financial data accurately, including income, expenses, and profit margins.

-

6.Ensure all entries are clear and precise, checking for any applicable tax regulations in Florida.

-

7.After completing all sections, review the document for accuracy and completeness.

-

8.Once satisfied, save your changes and choose the option to download or print the filled document.

-

9.If needed, share the completed document with your accountant or relevant stakeholders directly from pdfFiller.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.