Last updated on Feb 17, 2026

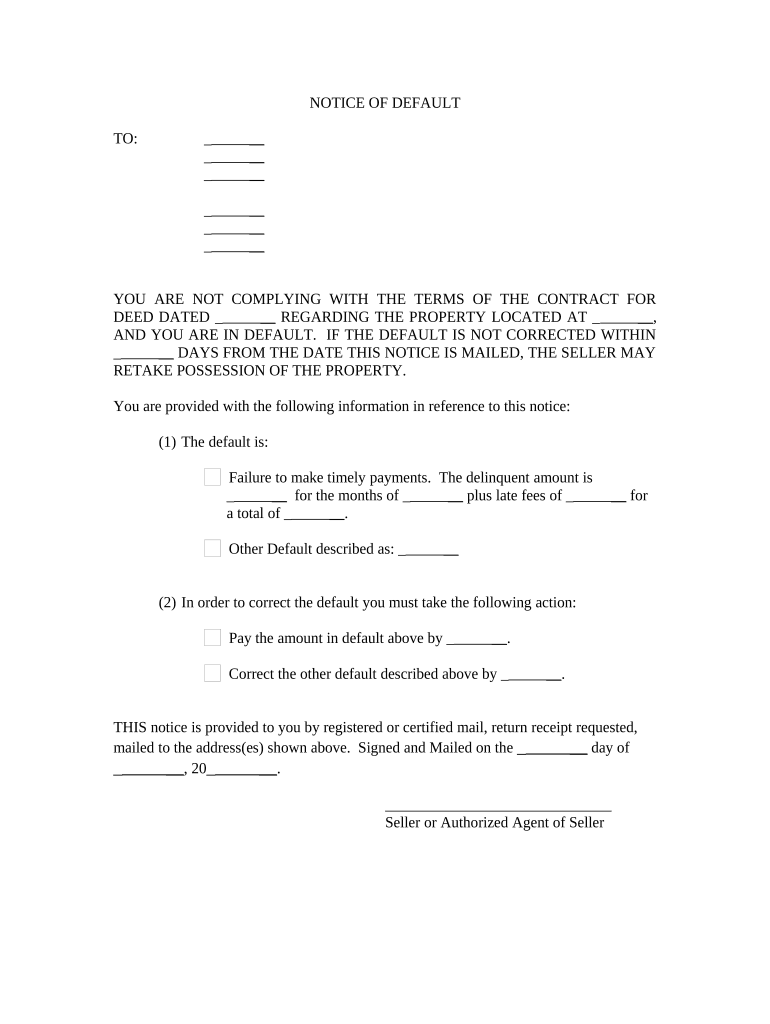

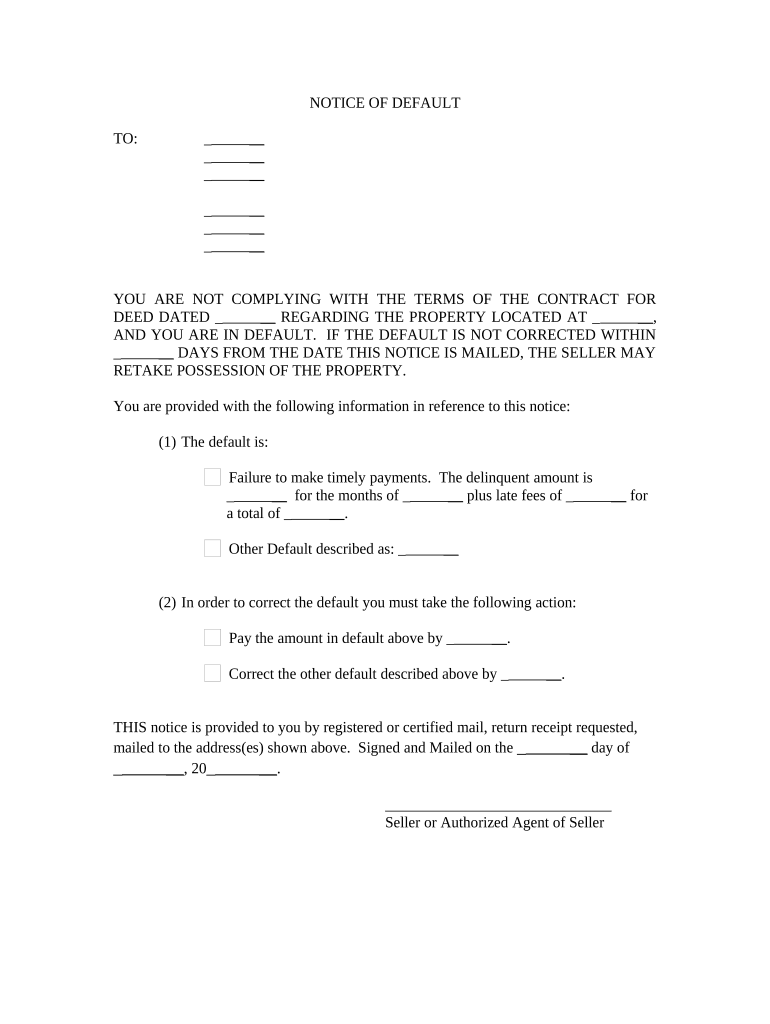

Get the free General Notice of Default for Contract for Deed template

Show details

This is a general notice of default that can be used by the Seller to notify the Purchaser of being in default. This form allows the Seller to notify the Purchaser of the reason why the contract for

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is general notice of default

A general notice of default is a formal notification to a borrower indicating that they have defaulted on their loan obligations.

pdfFiller scores top ratings on review platforms

It makes things so much easier, faster, and more professional. I am very pleased with my user experience thus far!!!

Confusing on how to get the AAO form I already filled out -so I can email it to the docto

Makes filling out documents sooooo easy!! Thank you!

PDFfiller helped me a bunch! Found my files and saved me lots of work. They deserve a big hug!

It's the easiest pdf editor that I have ever used. I have 27 years experience in the IT Industry & I'll be recommending this one to my commercial customers

Very good tool, the sign feature has saved me fortunes on ink!

Who needs general notice of default?

Explore how professionals across industries use pdfFiller.

Detailed Guide for General Notice of Default Form

How to understand a notice of default?

A Notice of Default is a formal notification indicating that a borrower has failed to meet the obligations outlined in a loan agreement. Recognizing the legal significance of this document is crucial, as it can initiate foreclosure proceedings if the default is not addressed in a timely manner. Common scenarios leading to a Notice of Default include missed mortgage payments, failure to pay property taxes, or other breaches of the loan agreement.

-

This is a legal document informing the borrower of their breach of contract, highlighting the seriousness of the situation.

-

Timely action can prevent escalation to more severe measures, such as foreclosure.

-

Missed payments and other contractual breaches can trigger default notifications.

What essential information goes into a notice of default?

Filling out a General Notice of Default Form requires careful attention to detail. Identifying the parties involved, specifying the contract for deed, and including comprehensive property information are fundamental to ensuring clarity and legal compliance.

-

Include all relevant parties such as borrower, lender, and any other interested parties.

-

Specify terms and conditions of the contract that are relevant to the default.

-

Provide clear details about the property, such as address and legal description, to avoid any ambiguity.

How do different default scenarios affect the notice process?

Understanding the nature of the default is crucial for determining the appropriate course of action. Timely payment failures mainly concern delinquent amounts, but other defaults may relate to terms of the agreement. Also, different types of defaults can have distinct implications on notice and lien rights.

-

These are the most common defaults, often involving late or missed payments, which can escalate quickly.

-

Defaults can also occur due to violations of terms such as not maintaining property insurance.

-

Different defaults could lead to varying rights and obligations under the notice and lien procedures.

How to effectively fill out the notice of default form?

Completing the General Notice of Default Form accurately is essential for clarity and compliance. A step-by-step approach can facilitate this process, ensuring all key fields are explained and understood. Using tools like pdfFiller can not only simplify editing but also provide a secure method for eSigning.

-

Follow clear instructions for each section of the form to reduce errors.

-

Ensure all information is provided clearly to prevent misunderstandings or legal issues.

-

Leverage this platform for seamless editing and signing of documents.

What are the best methods for delivering the notice correctly?

Proper delivery of the Notice of Default is critical to ensure it is legally recognized. Using registered or certified mail provides proof of delivery, which is essential if disputes arise. It's also important to know the steps to take if the recipient fails to respond within the established timeframe.

-

Choose reliable methods like registered or certified mail to confirm receipt.

-

Keep records of all communications and delivery confirmations.

-

Have a clear plan for legal recourse if no response is received by the deadline.

What are the consequences of ignoring a notice of default?

Ignoring a Notice of Default can lead to severe consequences. It is essential to understand the rights that remain after receiving such a notice, as well as the potential actions the lender may take. Sellers can retake possession of the property and seek legal recourse, so exploring the legal options available to the recipient is critical.

-

Post-notice, certain rights and options for recourse remain available.

-

Sellers can take possession or initiate foreclosure if the issue isn't resolved.

-

Know the remedies and defenses that could be employed against the default claims.

How to mitigate defaults and address issues?

There are several proactive actions to take when facing a Notice of Default. Timely corrective actions and effective communication with lenders can often resolve issues before they escalate. Exploring options for contract modification or refinancing may also provide viable paths to mitigating defaults.

-

Define specific financial settlements and timelines to rectify the issue.

-

Engage openly with lenders to negotiate and clarify situations.

-

Consider merging existing debts or renegotiating terms for better management.

How can pdfFiller assist in document management?

pdfFiller offers a comprehensive document management solution for dealing with Notices of Default. You can upload and manage forms efficiently, utilizing collaborative features for team editing and ensuring secure storage of documents. eSigning is also facilitated through a secure cloud platform, streamlining your workflows.

-

Create a well-organized structure for accessing forms quickly when needed.

-

Work with team members effectively to ensure accuracy in document preparation.

-

Store and sign documents securely in the cloud to protect sensitive information.

How to fill out the general notice of default

-

1.Open the pdfFiller platform and log into your account.

-

2.Select the option to create a new document and choose 'General Notice of Default' from the templates available.

-

3.In the designated fields, enter the borrower's full name and address accurately as required.

-

4.Provide the lender’s information, including name, address, and contact details.

-

5.Specify the loan details, including the loan account number and the amount owed that is in default.

-

6.Detail the nature of the default, outlining the specific terms of the loan that have not been met.

-

7.Include any relevant dates, like the due date for the missed payments.

-

8.Review the document for accuracy to ensure all information is correct.

-

9.Once completed, save the document and choose to either print or send it directly to the borrower using pdfFiller’s options.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.