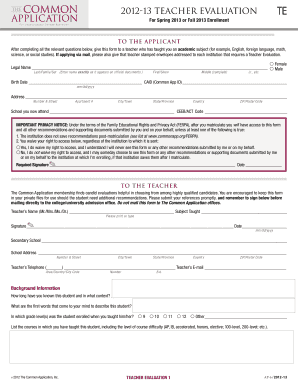

Get the free Non-Foreign Affidavit Under IRC 1445 template

Show details

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is non-foreign affidavit under irc

A non-foreign affidavit under IRC is a legal document confirming that a property seller is not a foreign person for tax purposes, as required by the Internal Revenue Code.

pdfFiller scores top ratings on review platforms

Saved my life when i need tax forms. But I also run a nonprofit arts education organization and need help.

Easy to use. Very handy for my business.

So far, the experience is satisfactory. I appreciate that the pages load quickly.

NICE, BUT I NEED A WEBINAR TO LEARN MORE

This program has been easy-to use and straightforward.

Easy to use. Straight forward to save and print.

Who needs non-foreign affidavit under irc?

Explore how professionals across industries use pdfFiller.

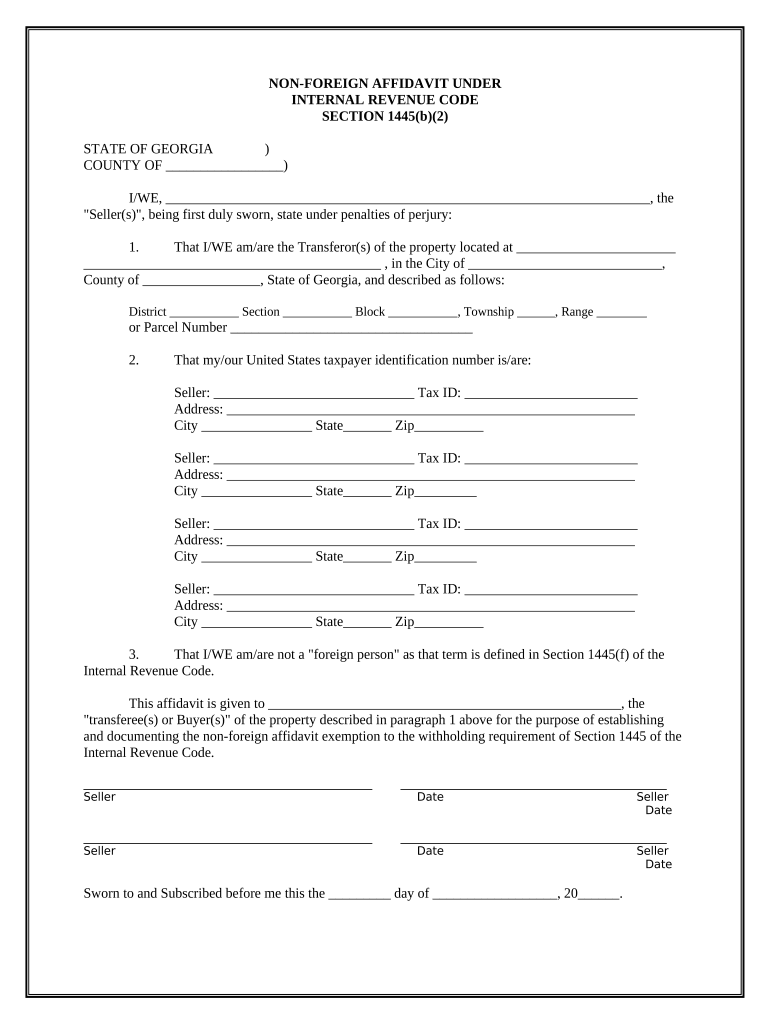

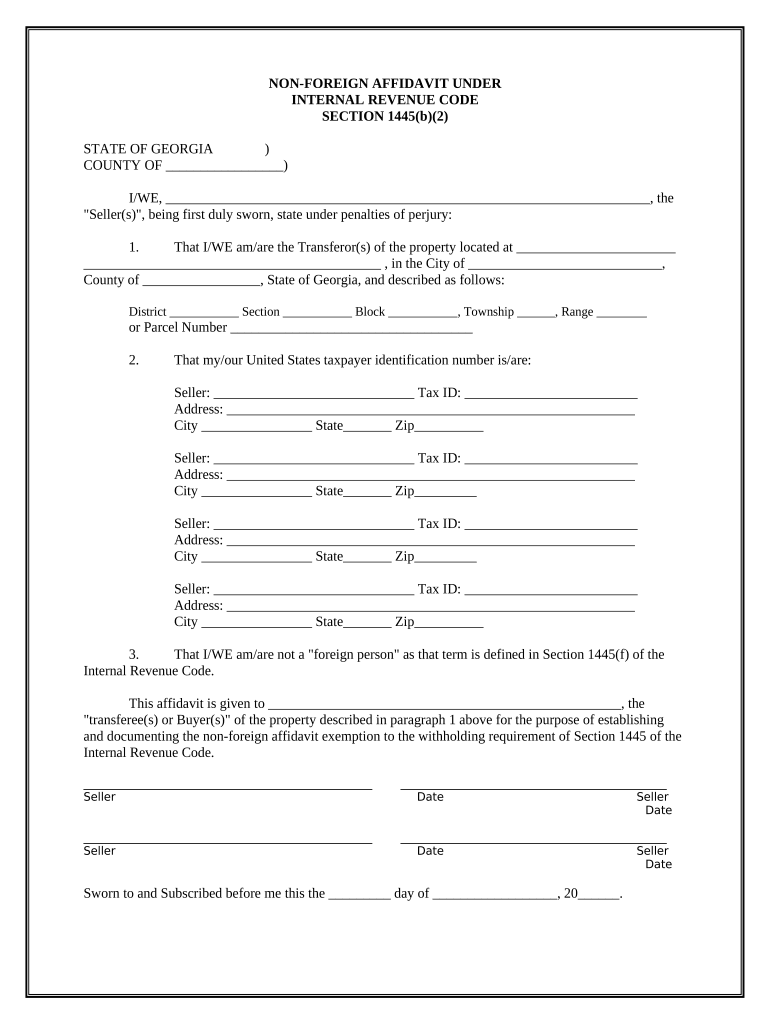

Understanding the Non-Foreign Affidavit Under IRC Form

A Non-Foreign Affidavit under IRC Form is a critical document utilized in real estate transactions, specifically designed for sellers who meet the criteria of a 'Non-Foreign Person' under the Internal Revenue Code (IRC) Section 1445. This guide will help you understand the purpose, components, and filing process of the non-foreign affidavit.

In essence, the affidavit serves to affirm that the seller is not a foreign person, thereby exempting the buyer from withholding tax obligations associated with foreign sellers. Now, let’s delve into the details.

What is a Non-Foreign Affidavit?

A Non-Foreign Affidavit is a sworn statement that certifies the seller's status as a non-foreign individual or entity. It plays a significant role in confirming that the seller does not fall under the tax withholding requirements set forth in IRC Section 1445.

-

The affidavit is a legal document stating that the seller is a non-foreign person, allowing for a smoother transaction.

-

This affidavit helps avoid the withholding tax that buyers are obligated to impose on foreign sellers, effectively saving costs in transactions.

Eligibility criteria for submitting a Non-Foreign Affidavit

To submit a Non-Foreign Affidavit, the seller must qualify as a 'Non-Foreign Person' as defined by IRC Section 1445. This is generally defined as a U.S. citizen or resident alien.

-

Individuals or entities considered non-foreign typically include U.S. citizens and resident aliens.

-

The affidavit may be used under circumstances where a seller is selling property located in the United States.

Key components of the Non-Foreign Affidavit

The Non-Foreign Affidavit must contain specific details to be considered valid. These components ensure that the affidavit meets legal scrutiny and verifications.

-

Required details include the property’s address, district, and section as necessary for identification.

-

The seller must provide their taxpayer identification number and mailing address.

-

A clear statement must affirm the seller's non-foreign status, which is the crux of the affidavit.

Step-by-step instructions for completing the form

Filling out the Non-Foreign Affidavit requires attention to detail to ensure all information is accurate, which can prevent delays in property transfer.

-

Make sure to accurately provide all seller names if there are multiple parties involved in the transaction.

-

Properly state the property details to avoid any disputes or confusion in the future.

-

Ensure the affidavit is signed by the seller and notarized in accordance with local laws to validate the document.

Common mistakes to avoid while filing

Errors in completing the Non-Foreign Affidavit can not only delay the transaction but could also lead to compliance issues. It's essential to be vigilant.

-

Omitting critical seller details can invalidate the affidavit and expose the buyer to withholding tax.

-

Neglecting to properly notarize the affidavit can lead to legal complications.

-

Misrepresenting one’s foreign status could result in severe penalties and potential audits by the IRS.

Potential consequences of failing to comply

Failure to comply with the requirements of the Non-Foreign Affidavit can lead to major legal and financial repercussions, emphasizing the importance of accuracy.

-

If the affidavit is not submitted correctly, the buyer may be required to withhold a percentage of the sales price.

-

Submitting a false affidavit could result in penalties including fines and legal action.

-

If you discover a mistake after submission, it’s advisable to consult with a tax professional immediately.

Utilizing pdfFiller for your Non-Foreign Affidavit needs

pdfFiller offers an efficient platform for creating, editing, and managing your Non-Foreign Affidavit, enhancing the overall document management experience.

-

Easily create and update your affidavit through user-friendly tools available on the pdfFiller platform.

-

Manage your documents in the cloud for easy access and collaboration during real estate transactions.

-

Collaborate efficiently with your team through pdfFiller’s shared documents feature.

Contact information for further assistance

For any additional questions regarding the Non-Foreign Affidavit, feel free to reach out to pdfFiller's customer support for personalized assistance.

-

Connect with pdfFiller's support team for inquiries, or assistance with your forms.

-

Access links to further resources and documentation to help you understand the filing process better.

How to fill out the non-foreign affidavit under irc

-

1.Access pdfFiller and log in to your account.

-

2.Search for the 'Non-Foreign Affidavit Under IRC' template in the document library.

-

3.Open the template to begin filling it out.

-

4.In the first section, provide the full name of the seller as it appears on the title deed.

-

5.Next, enter the seller's identification number, such as their social security number or tax identification number.

-

6.In the following section, specify the property address clearly, including street, city, state, and zip code.

-

7.Indicate that the seller is not a foreign person by checking the appropriate box or confirming verbally in the designated area.

-

8.Include the date of the affidavit and the seller's signature.

-

9.If applicable, ensure a witness signature or a notary public acknowledgment is included.

-

10.Review all fields for accuracy before submission, then save or print the completed affidavit as needed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.