Last updated on Feb 20, 2026

Get the free Business Credit Application template

Show details

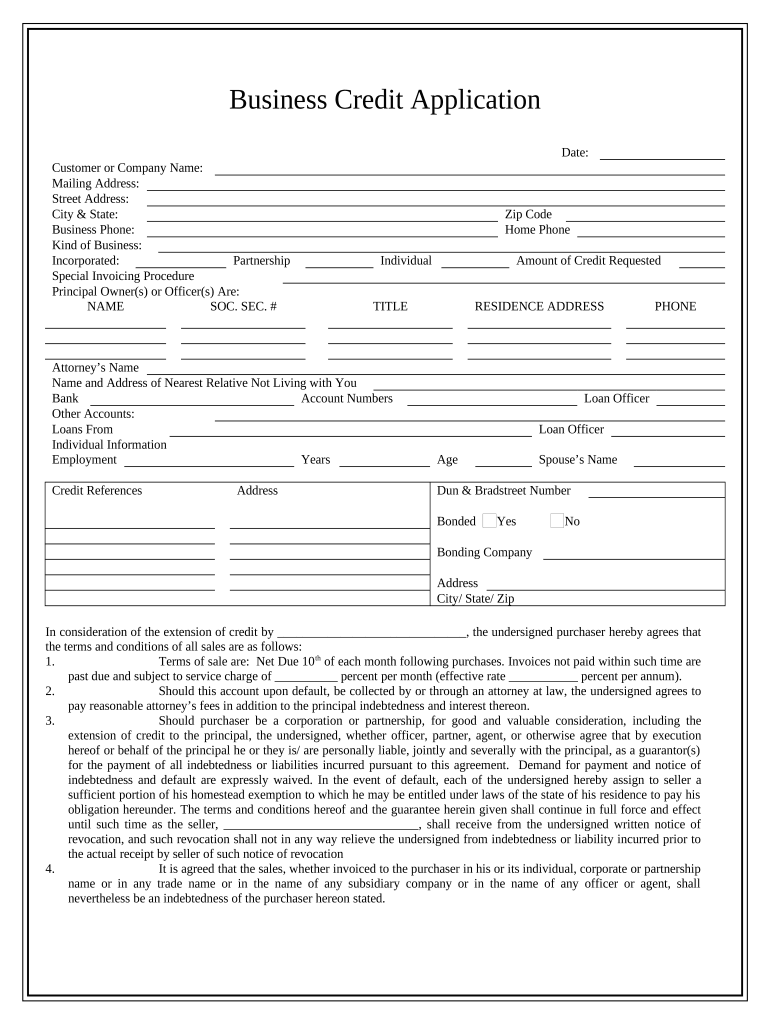

This is a credit application for obtaining credit at a business. Upon ordering, you may download the form in Word or Rich Text formats.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business credit application

A business credit application is a formal request by a company to obtain credit from a lender or supplier.

pdfFiller scores top ratings on review platforms

Great product and customer service

I have been using PDF filler for two years and I am very satisfied with the product. For the first time today, I could not figure something out and sent a question to customer service. Within a very short time I got a response that solved my question. Great customer service.

Kara was very helpful

Kara was very helpful, she explained to me about my problem and help me solve it.

very dependable

very dependable. anybody can trust pdfiller.

great app

Its easy and helps me with my work documents with no hassle

this web site is a life saver

topster

topexcelent

Who needs business credit application template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Business Credit Application Forms

How do business credit applications work?

A business credit application form is a crucial document used in B2B transactions to establish a line of credit for purchasing goods and services. Businesses must fill out this form to set credit terms and determine their creditworthiness. Providing accurate and complete information ensures a smoother approval process.

-

A business credit application aims to inform vendors about the applying business's financial health and credit reliability.

-

Common sectors involved include wholesale, manufacturing, and service-oriented businesses that offer goods or services on credit.

-

Accurate details within the application are vital; incorrect information can delay approval or result in denial.

What are the key components of a business credit application?

A thorough business credit application includes several essential components to provide a clear picture of the company's financial status. These components are crucial for credit providers to assess the risk associated with extending credit.

-

Details like customer or company name, business address, and primary contact number are fundamental.

-

Specifying the type of business (e.g., incorporated, partnership) helps credit providers understand the legal framework.

-

Including details about key owners or officers can positively impact the application by showcasing leadership credibility.

-

Providers often require financial information like credit references and the requested credit limit to assess risk.

How do you fill out the application step-by-step?

Filling out a business credit application form accurately is imperative. Each section, from basic information to financial data, must be managed carefully to avoid any misrepresentation.

-

Begin by carefully reading the instructions and filling each area logically, ensuring clarity.

-

Pay special attention to sections requiring employment history and bank details; these often influence credit approval.

-

Once completed, review all entries for accuracy and completeness before submission.

-

pdfFiller allows for online editing, facilitating corrections before finalizing and submitting the application.

What common mistakes should you avoid?

Mistakes during the completion of a business credit application can lead to significant delays or rejection. Identifying these common pitfalls helps applicants present their information more effectively.

-

Leaving sections blank can raise red flags, causing institutions to question the integrity of your application.

-

Typos or inaccuracies may directly impact your credit assessment negatively.

-

Not reviewing entries can lead to oversights. Always double-check your details.

-

Using pdfFiller's automated checks can highlight potential errors before submission.

What should you know about terms and conditions?

Understanding the terms and conditions associated with a business credit application is essential for avoiding future complications. Standard terms, such as payment expectations, can directly influence the success of your business relationships.

-

Familiarize yourself with payment deadlines, interest rates, and any associated penalties.

-

Be aware that late payments can lead to increased charges and negatively impact your credit profile.

-

Understand the implications of personal liability for guarantors, as this can affect personal finances as well.

-

pdfFiller provides tools to review and electronically sign these terms, ensuring clarity and acceptance.

How is creditworthiness assessed?

Creditworthiness is evaluated based on multiple criteria extracted from a business credit application. Understanding these criteria can help businesses improve their chances of securing positive credit terms.

-

Lenders assess past payment histories, credit references, and Dun & Bradstreet numbers, among other factors.

-

Different industries may have varied assessment benchmarks, influencing credit decisions.

-

Current economic circumstances may also affect a lender's decision on extending credit.

-

Using pdfFiller allows businesses to present information in an organized and efficient manner, easing the evaluation process.

What are the post-submission steps?

Once a business credit application is submitted, businesses should understand the steps that follow, including possible timelines and future actions required.

-

Prepare to follow up within a specified timeframe to understand the status of your application.

-

Be ready to address either acceptance or denial feedback promptly, which may include additional documentation requests.

-

Maintaining up-to-date credit records is crucial for future applications or renewals.

-

Leverage pdfFiller's document management features for tracking submissions and organizing follow-up tasks.

What are tips for effective credit management?

Once approved for credit, effective management can foster strong relationships with creditors and facilitate ongoing business growth.

-

Ensuring all payments are made on time can lead to better credit terms in future transactions.

-

Building trust with creditors can encourage more flexible credit arrangements.

-

Utilize pdfFiller to manage credit documents collaboratively among teams, helping maintain clear records.

-

Employ credit wisely to enhance business growth while avoiding excess debt.

How to fill out the business credit application template

-

1.Download the business credit application form from pdfFiller.

-

2.Open the PDF in pdfFiller and review the fields that need to be completed.

-

3.Begin by entering your business name, address, and contact information in the designated fields.

-

4.Provide details about your business structure, including whether it is a sole proprietorship, partnership, or corporation.

-

5.Fill in your business's tax identification number and any required financial information, such as annual revenue.

-

6.Include the names and personal information of the owners or principal officers.

-

7.Be prepared to provide bank references and trade references if required on the form.

-

8.Review all entries for accuracy and completeness to avoid delays.

-

9.Submit the application via pdfFiller either by downloading it or sending it directly to the lender or supplier as instructed.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.