Get the free Living Trust for Husband and Wife with Minor and or Adult Children template

Show details

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is living trust for husband

A living trust for husband is a legal document that allows a husband to manage and distribute his assets while he is alive and after his death, without the need for probate.

pdfFiller scores top ratings on review platforms

Great service just wish it can convert to a word file to make it easier to fill in the blanks

I enjoy all the features and being able to pick were to save my files and what kind of file type.

Good application; it's taking me a bit to become more familiar with all it can do.

apprecated being aable totype in entry lines on a real estate contract

For the times i needed pdfFiller, it served me well,...

For the times i needed pdfFiller, it served me well, but it is not that easy yet for me to use as I am not aware of all te the tools it provides me.

easy to use

easy to use, navigate, and understand

Who needs living trust for husband?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Living Trust for Husband Form

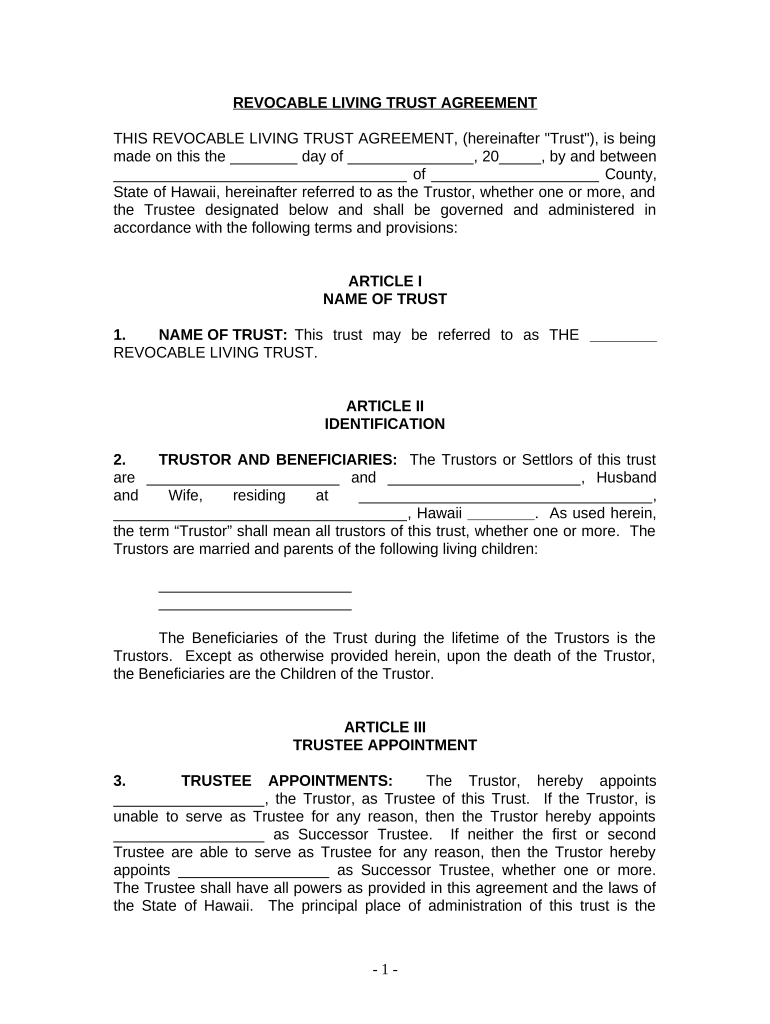

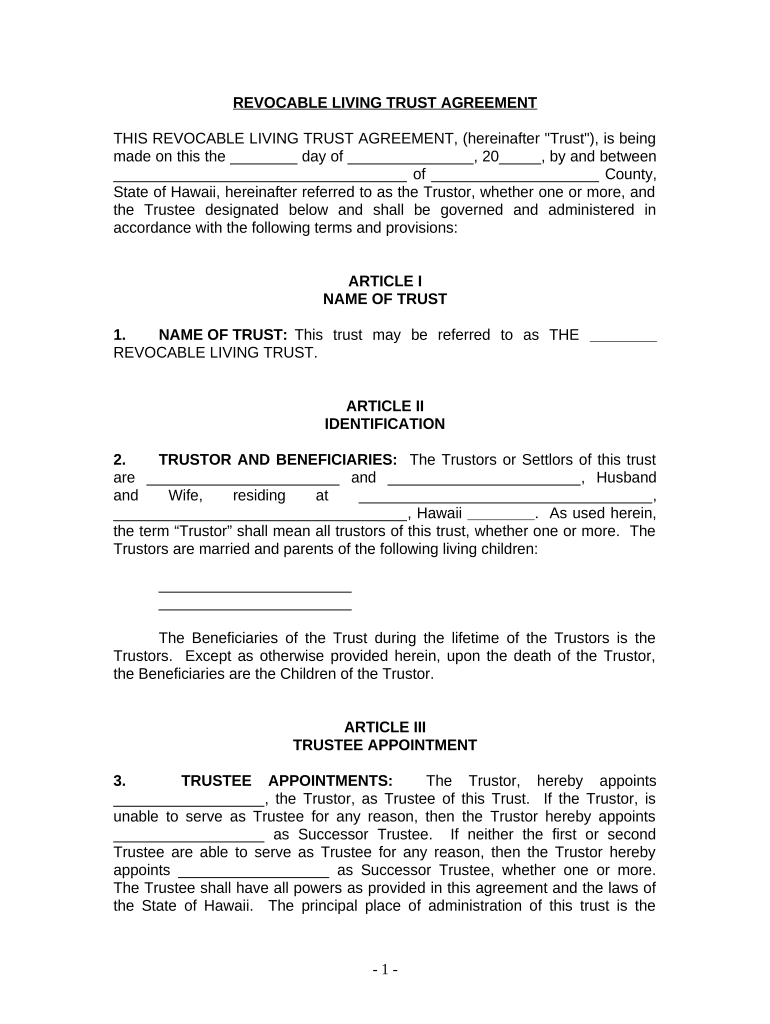

How does a revocable living trust work?

A revocable living trust is a legal document that allows a person, known as the trustor, to place assets into a trust during their lifetime, where they can manage them. This form remains flexible, as the trustor can modify or revoke it at any time until they pass away. The primary purpose is to simplify estate planning by avoiding probate, which can be a lengthy and costly process.

What are the key components of a revocable living trust agreement?

-

The trustor is the person creating the trust, while trustees manage it. It is essential to clearly define who these individuals are to avoid confusion.

-

Beneficiaries are those who receive benefits from the trust. Clearly outlining their rights helps ensure smooth distributions.

-

In case the primary trustee is unable to fulfill their duties, a successor trustee must be designated. This ensures continuous management of the trust assets.

How do you fill out the living trust form?

-

Begin by entering the full names and addresses of the trustor and any appointed trustees. This establishes the primary parties involved.

-

Choose an explicit name for the trust and indicate its effective date. This clearly identifies the document for legal and administrative purposes.

-

Clarify how and when beneficiaries will receive assets. This can include regular distributions or specific bequests pending certain triggers.

What are the advantages of establishing a revocable living trust?

-

Assets in a revocable living trust can bypass probate, resulting in quicker distributions and maintaining the privacy of financial matters.

-

Trustors can alter or dissolve the trust as needed, which is beneficial for accommodating changes in family or financial circumstances.

-

A revocable living trust allows for specific directions regarding the care and financial support of minors or dependents.

What are the disadvantages and considerations?

-

Creating a trust may require legal fees or costs related to asset retitling, which can add up depending on your situation.

-

While living trusts provide some protection, they do not shield assets from creditors' claims as effectively as other vehicles.

-

Trustors must actively manage the trust and update it with any significant life changes, such as marriage or the birth of a child.

When should you consider using a revocable living trust?

-

If you possess significant assets or wish to provide for minor children, a living trust is an excellent choice for managing distributions.

-

Evaluate your total assets and financial goals to determine if a revocable living trust aligns with your estate planning needs.

-

Define what you want to achieve with your estate plan, whether it's avoiding probate, providing for loved ones, or ensuring privacy.

How can pdfFiller assist with your living trust documents?

-

pdfFiller provides an easy-to-use platform where users can find, fill out, and save their living trust documents securely.

-

The platform features interactive tools that allow you to edit, sign, and collaborate with other parties, simplifying document management.

-

Your trust documents can be securely stored in cloud storage, making access and management seamless from any location.

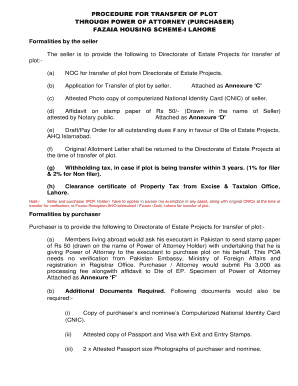

What compliance considerations exist for residents of Hawaii?

-

Hawaii has unique regulations regarding living trusts that may affect how they should be constructed and managed.

-

Ensure that you know the legal obligations in Hawaii, which may include specific language and documentation when creating trusts.

-

It’s highly advisable to consult an attorney knowledgeable in Hawaii's estate planning laws to ensure compliance and optimize your trust.

Conclusion and next steps

In conclusion, understanding how to create a living trust for husband form can significantly help in managing your estate and ensuring your wishes are honored. We encourage you to utilize pdfFiller for form creation and management, offering features tailored for seamless interaction and storage. If you feel uncertain about any aspect of the process, consider seeking professional assistance for personalized guidance.

How to fill out the living trust for husband

-

1.Begin by gathering all relevant financial documents, including property deeds, bank statements, and investment accounts.

-

2.Open the PDF template for the living trust for husband and read through the introduction to understand its purpose.

-

3.Fill in the husband's full legal name and address in the designated fields at the top of the document.

-

4.Identify and list all assets to be included in the trust, making sure to provide accurate descriptions and values.

-

5.Designate a successor trustee who will manage the trust if the husband is unable to do so, including their name and contact information.

-

6.Specify any instructions for asset distribution upon the husband's death, detailing how the assets should be divided among beneficiaries.

-

7.Review the completed document for accuracy, ensuring all information is correct and complete.

-

8.Sign the trust in the presence of a notary to validate the document, following any specific state requirements.

-

9.Store the executed trust in a safe place and inform trusted individuals, such as the successor trustee, of its location.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.