Get the free Living Trust Property Record template

Show details

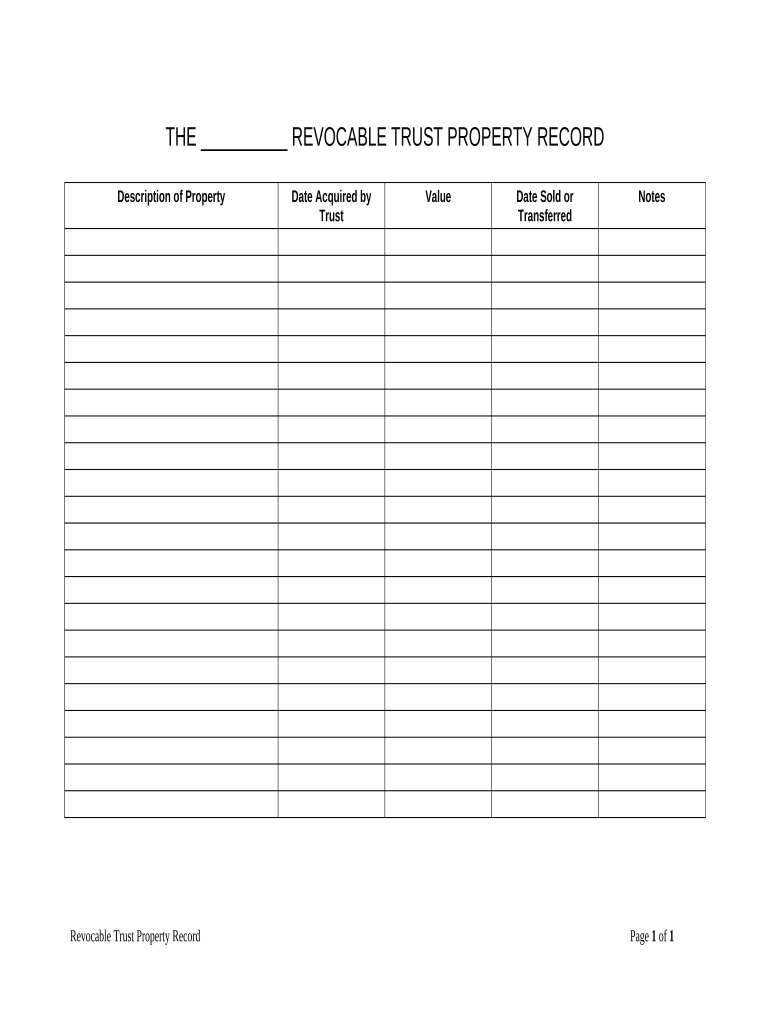

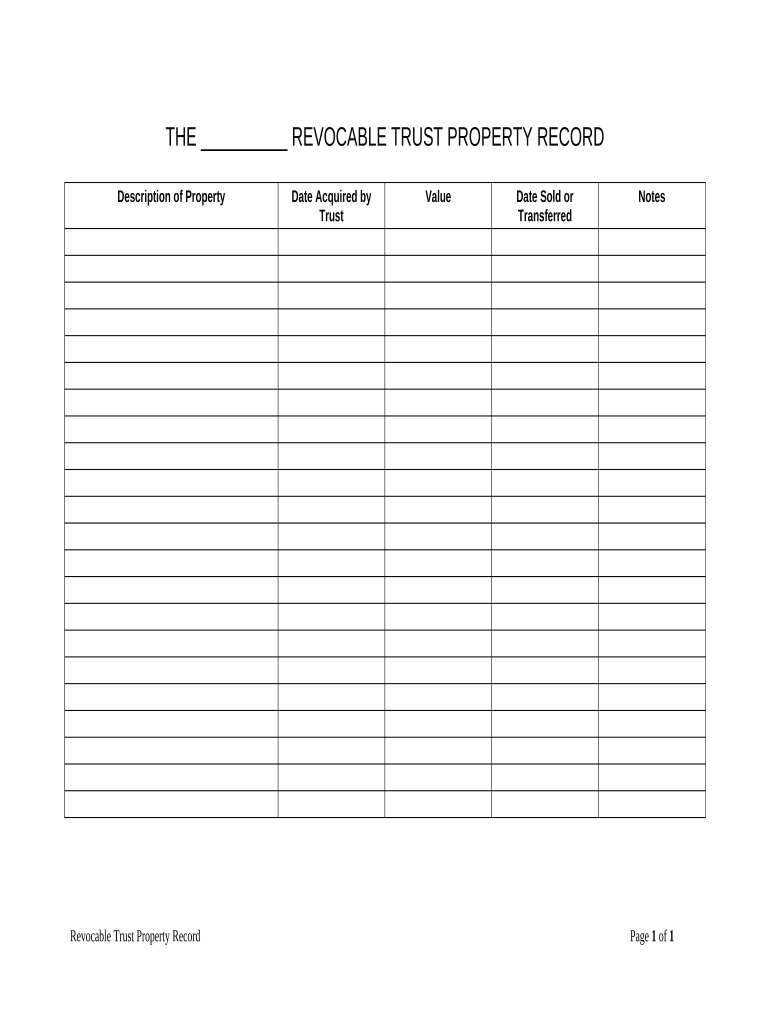

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is living trust property record

A living trust property record is a legal document that outlines the properties held in a living trust and their respective details.

pdfFiller scores top ratings on review platforms

INGENIOUS APPLICATION!! Easy to use and is exactly what you need to make a PDF file come to life!

Editing it was not as easy as filling in the original form

Seems like a quality product. My company provides

Takes some time to get used to, and a little pricey, but acceptable. Will look around for cheaper alternatives when it comes to renewing subscription.

Incredibly easy to use with a load of features that make editing PDFs easy.

Easy to use no time at all to adjust to figuring out the layout and process of using the system and the trial is great to see if you are applicable with using it highly recommended.

Who needs living trust property record?

Explore how professionals across industries use pdfFiller.

How to fill out a living trust property record form

Filling out a living trust property record form is crucial for effective estate planning. This guide provides detailed steps to ensure accuracy and compliance with legal standards.

What is a living trust property record form?

A living trust property record form is a document that outlines the properties held within a revocable trust. It is essential for maintaining accurate property records, enabling smooth transitions of asset management in estate planning.

Why is it important to maintain accurate property records in a living trust?

Accurate property records are vital for several reasons. They help in avoiding disputes over ownership, ensuring that beneficiaries receive the intended assets, and assisting trustees in managing and distributing properties effectively according to the trust’s terms.

What are the practical applications of this form in estate planning?

The living trust property record form serves various practical purposes, such as documenting property acquisitions, assessing their values, and facilitating the proper transfer of assets upon the grantor's death. By keeping this form updated, individuals ensure a smooth estate settlement process.

What are the key components of the living trust property record?

Understanding the essential elements of the living trust property record is critical for thorough documentation.

-

Include detailed information about each property, such as its address and type.

-

This serves to clarify which assets have been placed into the living trust every time the trust is updated.

-

Tracking the acquisition date helps in monitoring the trust’s assets over time.

-

Assessing the property's worth is necessary for equitable distribution among beneficiaries.

-

Documenting transactions ensures the trust reflects current assets accurately.

-

This area allows for additional comments or specific details that might be helpful.

How do you complete the living trust property record form?

Completing the living trust property record form requires careful attention to detail.

-

Collect deeds, tax assessments, and any previous trust documents related to the property.

-

Ensure all details are entered correctly to avoid future complications.

-

If applicable, gather signatures from relevant parties to validate the document.

-

Utilizing online tools can enhance the efficiency of filling out forms.

How can interactive tools help in filling out your form?

Employing interactive tools enhances the accuracy and ease of creating your living trust property record form.

-

Templates provide a structured format which guides you through the required sections.

-

Tailor the form according to specific needs or unique property details.

-

E-signatures simplify the process of obtaining necessary approvals.

What common challenges might arise in completing the form?

When filling out the living trust property record form, various challenges may arise.

-

Providing accurate descriptions can be difficult, especially for properties with unique features.

-

Determining the correct market value may require professional appraisals.

-

Missing signatures or improperly dated documents can lead to legal issues later.

What are the best practices for managing your living trust documents?

Efficient management of living trust documents ensures that they remain up-to-date and secure.

-

Periodically review the record to ensure all acquisitions and sales are documented.

-

Use secure cloud-based platforms, like pdfFiller, to keep your documents safe against unauthorized access.

-

Plan how future property changes will be documented to maintain continuity.

What are the next steps after completing your living trust property record?

After filling out the form, it's important to know the subsequent steps for effective management.

-

Make sure the completed form is filed with the appropriate legal entities to maintain authenticity.

-

Learn how recorded documents interface with state laws and personal liability.

-

Set protocols for sharing documents with legal advisors or family members involved in trust management.

How to fill out the living trust property record

-

1.Open the PDF file for the living trust property record.

-

2.Begin by entering the name of the trust at the top of the document.

-

3.Fill in the address of the property included in the trust, including city, state, and zip code.

-

4.List the legal description of the property; this may require a separate deed or title document.

-

5.Indicate the value of the property as of the date of the record.

-

6.Identify the trustee's name and contact information for someone responsible for managing the trust.

-

7.For multiple properties, repeat the previous steps for each additional property, ensuring clarity and accuracy for all information.

-

8.Review all entered information for correctness and completeness before saving the document.

-

9.Save and/or print the completed living trust property record for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.