Get the free Iowa Installments Fixed Rate Promissory Note Secured by Residential Real Estate temp...

Show details

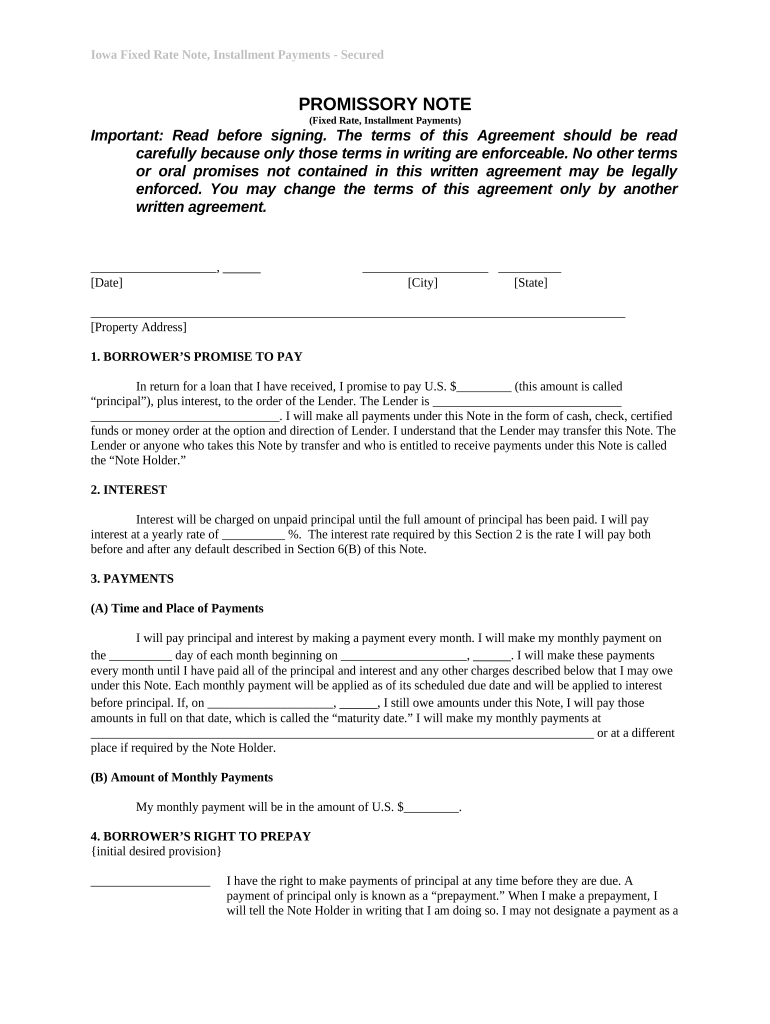

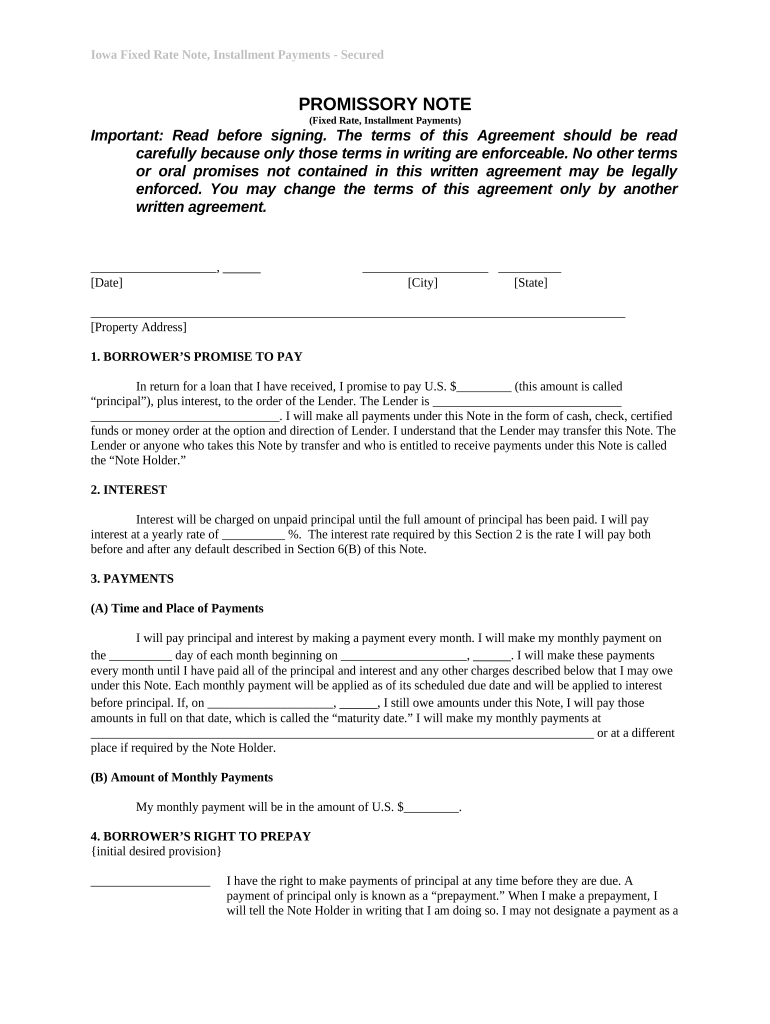

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is iowa installments fixed rate

Iowa installments fixed rate refers to a structured loan repayment plan in Iowa with a consistent interest rate over a set period.

pdfFiller scores top ratings on review platforms

VERY GOOD ,IT IS A LITTLE HARD TO FIGURE OUT BUT IAM LEARNIG LOVE TO HAVE A PHONE # TO TALK TOO SOME ONE

Provided files that otherwise would require me to physically write information in, this can be seen unprofessional to some businesses. Worth every penny

It worked very well and allowed me to save a Cal-Fire form that they don't allow you to save once you close it.

So far - so good. going to take a little more time.

It's been good, but i'd like to learn about more of the features.

I have only used PDF filler once (941) form. I have not been able to find other (state required ) forms.

Who needs iowa installments fixed rate?

Explore how professionals across industries use pdfFiller.

How to navigate the Iowa fixed rate installment payments form

What are Iowa fixed rate installment payments?

Iowa fixed rate installment payments are structured payments made over a specified period at a predetermined interest rate. They provide predictable payment amounts, allowing borrowers to plan their finances effectively. Understanding the essential components can help you navigate the paperwork more easily.

Understanding the definition of installment payments

Installment payments refer to the division of a total amount owed into smaller, manageable sums paid periodically. This structure benefits both lenders and borrowers, offering a clear repayment timeline.

What are fixed rate notes?

Fixed rate notes are legal documents that outline the terms of a loan where the interest rate remains constant throughout the term. This characteristic provides stability in payments, making them easier to manage.

Why are written agreements important?

Written agreements serve as a formal record of the terms and conditions of the loan. They protect both the lender's and borrower's interests by preventing misunderstandings or disputes.

What are the key components of the Iowa fixed rate note?

-

This section outlines the borrower's commitment to repay the borrowed amount, ensuring accountability.

-

It is critical to clearly define the parties involved in the transaction to avoid legal ambiguities.

-

The note must specify acceptable payment methods such as cash, checks, certified funds, or money orders.

How is interest calculated on the fixed rate note?

Interest calculation on fixed rate notes typically involves applying a specific percentage to the remaining loan balance over time. This means understanding how the interest accumulates and the difference between principal (the original loan amount) and interest (the cost of borrowing money).

What happens during default?

In case of default, the lender may impose additional interest or penalties, significantly increasing the overall amount due. It’s crucial for borrowers to understand the repercussions outlined in the note to avoid severe financial consequences.

What is the payment schedule and process?

-

Payments typically commence on a designated date, with subsequent payments made at agreed-upon intervals.

-

Payments are first applied to interest before reducing the principal, a common practice.

-

Late payments might incur fees and negatively affect the borrower’s credit score.

How to navigate the Iowa installments fixed rate form?

Navigating the Iowa installments fixed rate form can be straightforward if you follow a structured approach. Ensure that you have all required information and verify details correctly to avoid common mistakes.

Steps to fill out the form

-

Have all relevant details ready, such as personal information and loan terms.

-

Adhere to the guidelines specified in the form to complete it correctly.

-

Double-check the filled-out form for accuracy before submission.

What are common mistakes to avoid?

-

Missing out on small details can lead to complications or processing delays.

-

Ensure you select valid payment methods as described in the note.

-

All required signatures must be included for legal validity.

What tools are available for document management?

Utilizing tools like pdfFiller can enhance document management considerably. Its features for PDF editing, eSigning, and document collaboration are invaluable for streamlining the process, especially when working with teams.

How does pdfFiller support cloud-based access?

With pdfFiller, users can access and manage documents from anywhere, ensuring flexibility and convenience. This cloud-based feature allows for easy collaboration and sharing among team members.

What are Iowa regulations related to fixed rate notes?

Iowa has specific regulations regarding fixed rate notes that govern their use. Adhering strictly to these regulations is critical not only to ensure compliance but also to protect the interests of both parties involved.

What are the implications of non-compliance?

Failing to comply with Iowa regulations could result in legal repercussions and could make agreements unenforceable. It is advisable to seek legal or professional guidance for complex situations.

How to fill out the iowa installments fixed rate

-

1.Access the document template on pdfFiller.

-

2.Click the 'Upload' button to load your Iowa installment fixed rate form.

-

3.Begin filling out your personal information such as name, address, and contact details in the designated fields.

-

4.Enter the loan amount you are requesting and select the duration for repayment from the dropdown menu.

-

5.Input your annual income and employment details as prompted on the form.

-

6.Review the fixed interest rate options and select your preferred rate from the available choices.

-

7.If applicable, provide information regarding any collateral or additional requirements specified in the form.

-

8.Once all fields are filled accurately, review the entire document for any errors or missing information.

-

9.Save your progress frequently using the 'Save' option to avoid data loss.

-

10.Finally, ensure that you have signed the document electronically and submit it as per the guidelines provided by the lender.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.