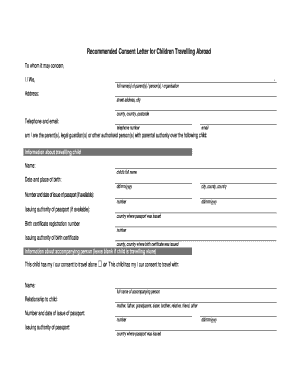

Get the free Notice of Default for Past Due Payments in connection with Contract for Deed template

Show details

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of default for

A notice of default for is a formal notification to a borrower that they have failed to meet the terms of their loan agreement, usually indicating impending foreclosure proceedings.

pdfFiller scores top ratings on review platforms

overall exp.was good except#3 where C,and D, kept interchanging

I like the forms they are very helpful for my business

Very easy to use and to find what I was looking for.

I appreciate the ability to find a form that fits my needs. It makes my job faster and easier.

The site is a bit slow, and often will freeze during filling. Otherwise it is well worth the $72.00 I paid although it was supposed to be a free trial for 30 days.

Awesome. I was able to send my out of town clients their contracts and have them signed very quickly and it was all very painless on both ends!

Who needs notice of default for?

Explore how professionals across industries use pdfFiller.

How to Navigate a Notice of Default for Form Form

Understanding how to manage a notice of default for form form is crucial for both borrowers and lenders. A notice of default indicates that a borrower has failed to fulfill obligations within a loan agreement.

This guide aims to empower you to successfully navigate the forms and processes involved. You will learn everything from understanding the notice to filling it out correctly.

What is a Notice of Default?

A notice of default is a formal declaration that a borrower has not met the terms outlined in a loan agreement. This notification typically marks the beginning of the foreclosure process.

-

It is a legal notice indicating that a borrower has defaulted on their mortgage obligations.

-

The notice serves to inform the borrower of the missed payment(s) and lends clarity to the next steps involved in the resolution process.

-

Understanding terms like 'default,' 'lender,' and 'borrower' is essential for interpreting the notice.

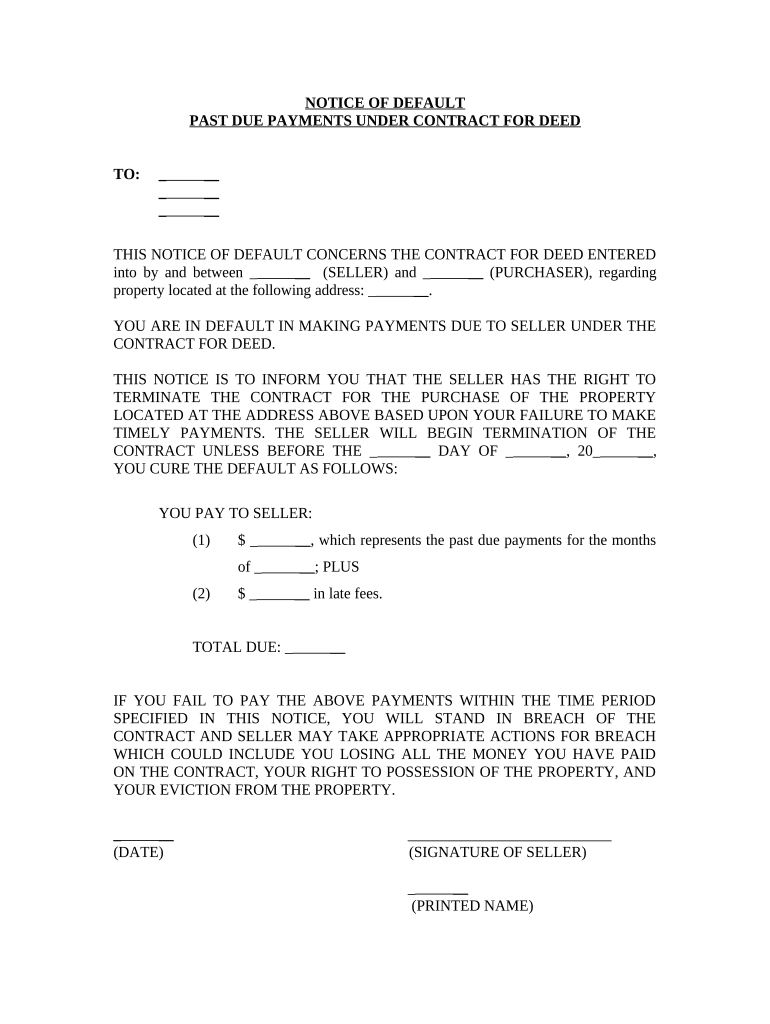

Details of the Default

A notice of default includes critical components that clarify the situation for both parties involved.

-

The notice must clearly identify both the lender and borrower to avoid confusion about who is involved.

-

This section typically includes the address of the property and specifics of the loan agreement.

-

This highlights the amount missed in payments and often, the total balance owed to rectify the default.

How to fill out a notice of default?

Filling out a notice of default requires careful attention to detail and accuracy.

-

Follow the prescribed steps meticulously to ensure compliance with legal requirements.

-

Utilize pdfFiller's online tools to efficiently complete forms and manage documents from a central platform.

-

Double-check all information for correctness, as mistakes can lead to legal complications.

What happens when you get a default notice?

Receiving this notice triggers an array of potential outcomes that both borrowers and lenders must be aware of.

-

Neglecting to address the notice may result in foreclosure proceedings.

-

Both parties have specific rights by law, which must be adhered to during this period.

-

Further legal repercussions may ensue if the notice is not addressed promptly and properly.

Caution

When handling a notice of default, being vigilant is key to minimizing risk.

-

Be mindful of potential scams and misinformation, particularly regarding your rights and options.

-

Failing to respond or misunderstanding the timeline of actions can lead to significant issues.

-

Addressing the notice promptly can facilitate more manageable solutions and avoid escalating consequences.

How to manage a Notice of Default

Finalizing the management of a notice of default is imperative to resolving any difficulties.

-

Ensure that all details are correct and up-to-date before taking next steps.

-

All involved parties should sign the document, adhering to any legal signing protocols.

-

Exploit pdfFiller’s electronic signature capabilities for a streamlined and efficient submission process.

How to fill out the notice of default for

-

1.Access pdfFiller and log in to your account.

-

2.Search for 'notice of default' in the templates section and select a suitable form.

-

3.Begin filling out the form by entering the borrower's full name and contact information in the designated fields.

-

4.Input the property address that is the subject of the loan default.

-

5.Specify the loan details, including the loan number and the amount owed.

-

6.Outline the terms of default and any relevant dates, ensuring that they are accurate and clearly stated.

-

7.Attach any necessary documentation by using the upload function, which could include loan agreements or payment records.

-

8.Review all entered information for clarity and accuracy, correcting any mistakes as needed.

-

9.Once finalized, save the document to your pdfFiller account and choose the option to print or send it to the borrower via email.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.