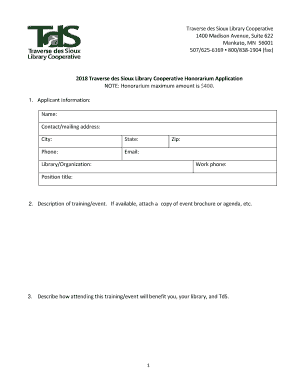

Get the free Living Trust for Husband and Wife with Minor and or Adult Children template

Show details

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

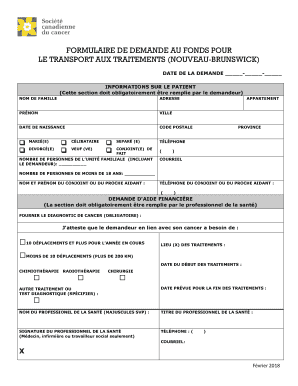

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is living trust for husband

A living trust for husband is a legal document that allows a man to manage and distribute his assets during his lifetime and after death, effectively bypassing probate.

pdfFiller scores top ratings on review platforms

Logging issue troubleshoot

I was having issue logging into pdfFiller with the password that I remember, at the same time could not receive any email to reset my password. Harmhon, the live chat agent from pdfFiller, has patiently understand my situation. Although most of the time is user's issue that they don't check on junk mail or they have some instruction/rules listed in their setting. But Harmhon is able to figure that my email address was actually not being whitelisted in your company whitelist. That being said, after Harmhon inserted me into the whitelist, i am able to login without any issue again. I really appreciate Harmhon's patient and service. He is definitely a precious asset to pdfFiller! Keep up the good work!

Everyone should use this.

My life is so much easier with this pdFiller.

Satisfied but no longer need service

I have been satisfied with the subscription and have used it with my work, however I am retiring the end of September and will no longer need this subscription

Easy to use and edit

Easy to use and edit. Great tools to use.

Very good features and easy to use.

IF YOU HAVE DOCUMENTS TO BE FILLED OUT…

IF YOU HAVE DOCUMENTS TO BE FILLED OUT OR SIGNED, THIS IS DEFINETLY THE PROGRAM TO USE. ITS EASY TO GET AROUND. THE PROGRAM DOES EXACTLY WHAT IT SAYS.

Who needs living trust for husband?

Explore how professionals across industries use pdfFiller.

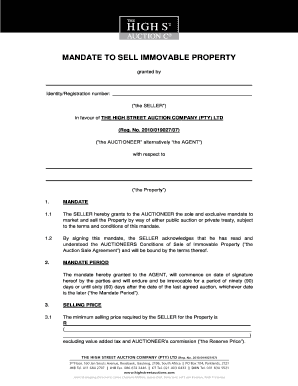

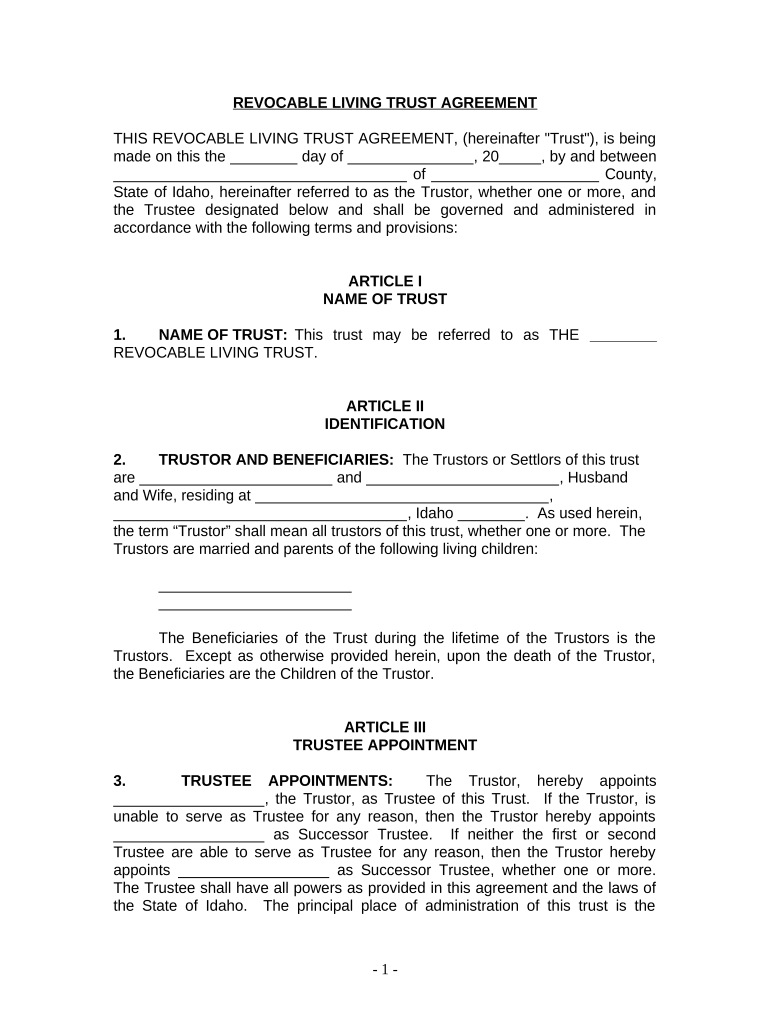

Living Trust for Husband Form Guide

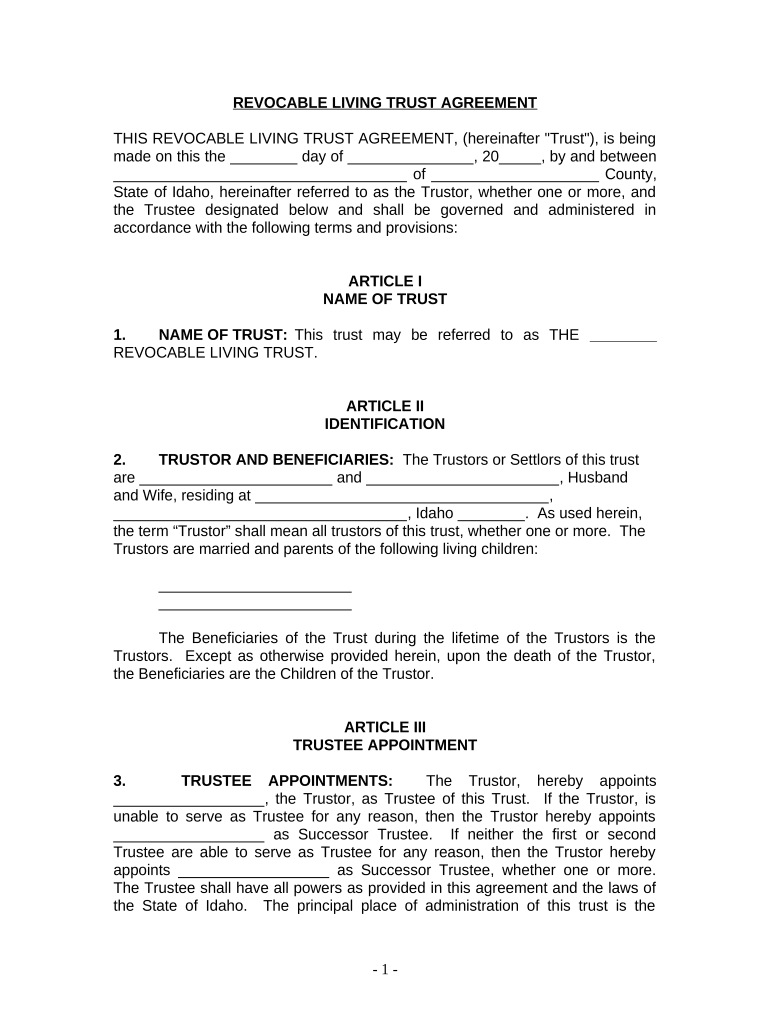

Filling out a living trust for husband form allows couples to secure their assets effectively. A revocable living trust is a crucial estate planning tool that can provide flexibility and control over wealth distribution. This guide will help you navigate the complexities of creating this important document.

What is a revocable living trust?

A revocable living trust is a legal document that allows you to place your assets into a trust during your lifetime. It can be modified or revoked at any time as long as you are alive and competent. This type of trust helps manage your property, providing a clear directive for how your assets should be distributed after your death.

-

A revocable living trust is a trust that can be changed or canceled by the grantor. It allows the grantor to retain control of their assets while alive.

-

The main purpose of a revocable living trust is to manage your estate and provide clear instructions for asset distribution.

-

Revocable trusts can be altered by the grantor, while irrevocable trusts cannot be changed once established, often providing tax advantages and asset protection.

What are the advantages of a revocable living trust?

Creating a revocable living trust offers numerous advantages that can significantly impact estate planning. Flexibility in management, along with the privacy it provides, makes it a desirable option for many couples.

-

You can easily alter your trust as your financial situation changes, ensuring your estate plan stays relevant.

-

Assets held in a revocable living trust bypass probate, allowing for a quicker and more private transfer to heirs.

-

Unlike a will, which becomes public record during probate, a living trust maintains the privacy of your estate and its beneficiaries.

What potential disadvantages should you consider?

While there are many benefits to a revocable living trust, it's essential to be aware of its limitations before proceeding. Understanding these drawbacks will help you make a more informed decision.

-

Establishing a living trust can involve legal fees and ongoing administrative costs. Make sure to evaluate these expenses against the potential savings from avoiding probate.

-

Having a trust may affect your eligibility for certain government benefits, including Medicaid. It is advisable to consult with a financial advisor.

-

Managing a trust can be more complex than simply owning property outright. It requires diligence in record-keeping and ongoing management.

When should you use a revocable living trust?

Determining when to create a revocable living trust is a crucial aspect of your estate planning strategy. Understanding the right time can help ensure the smooth management and transfer of your wealth.

-

If you have significant assets, a living trust provides a structured way to manage and distribute your wealth.

-

A revocable living trust can help minimize tax liabilities by allowing for strategic estate management.

-

For families wishing for a smooth transition and minimal disruption to asset management after death, a living trust is ideal.

How do you fill out the living trust for husband form?

Filling out the living trust for husband form requires careful attention to detail. Follow these steps to ensure accuracy and completeness in your application.

-

1. Begin by gathering all necessary documentation about your assets. 2. Review your spouse's information as well as your own. 3. Fill out the form accurately and clearly.

-

Make sure to include all relevant information such as full legal names, addresses, and descriptions of the assets you intend to place in the trust.

-

Inaccuracies can lead to significant legal issues. Double-check all entries to avoid complications during the trust execution phase.

How to edit and sign the form on pdfFiller?

pdfFiller simplifies the process of editing and signing important documents. Here's a breakdown of how to use the platform.

-

Log in to pdfFiller, select 'Upload Document', and choose your trust form to begin editing.

-

Use text boxes, checkmarks, and signature fields to complete your form. The platform offers user-friendly tools that adapt to various document types.

-

pdfFiller allows you to eSign documents securely, ensuring that you meet legal requirements efficiently.

What are best practices for managing your trust effectively?

Managing your revocable living trust requires ongoing attention and updates. Implementing best practices will help you ensure that your trust remains relevant and effective.

-

Regularly update your trust to reflect any changes in assets, beneficiaries, or life events such as marriage or divorce.

-

Conduct annual reviews to ensure your trust aligns with your current wishes and financial situation.

-

Utilize pdfFiller's collaborative features to manage your trust documents efficiently, allowing for shared access with relevant parties.

What interactive tools and resources are available?

Leveraging interactive tools can enhance your experience and provide better management of your trust-related documents.

-

Access the digital living trust form directly on pdfFiller for an efficient editing experience.

-

Use pdfFiller's tracking features to monitor any amendments made to your documents, maintaining a clear audit trail.

-

Reach out to pdfFiller's support team if you have questions regarding your documents or need additional assistance.

How can you stay connected and updated?

Staying informed about legal resources and community discussions can further empower you in managing your estate planning needs.

-

Join pdfFiller's newsletter to receive the latest updates on legal practices and resource availability.

-

Engage with our community to share experiences and gather insights on best practices in estate planning.

-

Explore other estate planning forms on pdfFiller for a comprehensive approach to your documentation needs.

How to fill out the living trust for husband

-

1.Visit pdfFiller and create an account or log in.

-

2.Search for 'living trust for husband' in the template library.

-

3.Select the template that suits your needs and open it.

-

4.Fill in your personal information, including your full name and address.

-

5.Provide details about the assets you want to place in the trust, such as property, bank accounts, and investments.

-

6.Designate your husband as the primary beneficiary and outline your wishes for asset distribution.

-

7.Review the document for accuracy and completeness before finalizing.

-

8.Save the completed form and choose to print it or send it directly to the relevant parties.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.