Last updated on Feb 17, 2026

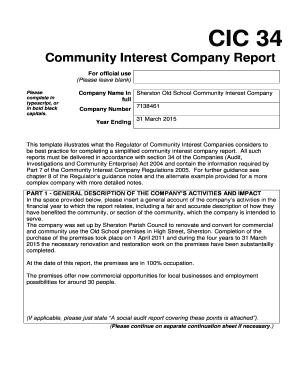

Get the free Individual Credit Application template

Show details

This is a credit application for obtaining credit from an individual. Upon ordering, you may download the form in Word or Rich Text formats.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a formal request submitted by a person seeking approval for a loan or credit from a financial institution.

pdfFiller scores top ratings on review platforms

But the important thing is they indicate that it is free to use online, but they demand that we subscribe to make a charge, then we do not have the link to cancel

My need for a Blumberg standard lease was satisfied, however the number of typographical errors in the form were surprising and correcting them caused a change in the font!! Very frustrating!

I enjoy the program, Only problem I've had is it will not run in Google Chrome.

If I have Adobe Fill n Sign do I need this

Just love PDF filler and so do my clients

excellent but it needs some improvement to copy and paste the information for certain forms like 1099 misc

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

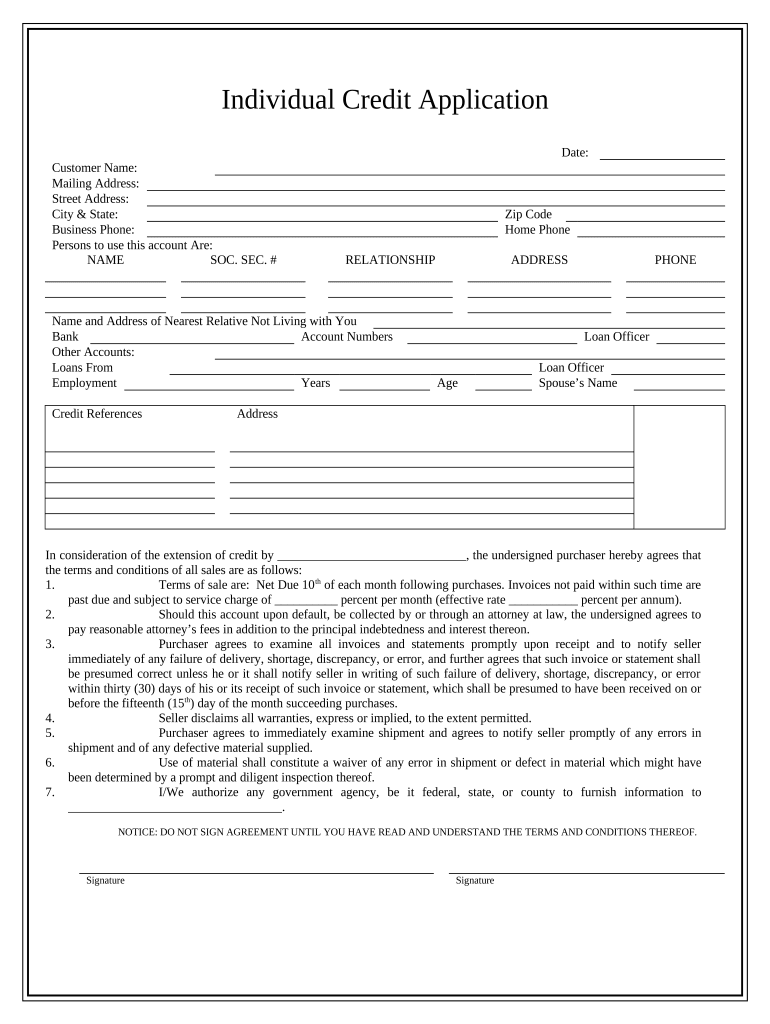

Comprehensive Guide to Filling Out the Individual Credit Application Form

Filling out an individual credit application form can be a straightforward process if you are well-prepared. Whether applying for a loan or a credit card, this guide will walk you through all the necessary steps to complete the form accurately.

What is an individual credit application form?

An individual credit application form is a document that financial institutions use to evaluate the creditworthiness of applicants. The purpose of the form is to gather essential information about an individual's financial background, helping lenders make informed decisions. Providing accurate and complete details boosts your chances of approval.

-

The form serves to assess your financial capability and repayment history, which are crucial for the lender's risk evaluation.

-

Incorrect or incomplete information can lead to delays or denials of your application, making it vital to double-check your entries.

-

You might need this form when applying for a personal loan, credit card, or a rental commitment.

What are the key components of the individual credit application form?

Understanding the essential components of the form is vital for adding necessary details effectively. Each section plays a role in painting a complete picture of your financial health.

-

You will typically be asked for your name, mailing address, phone number, and social security number.

-

This includes listing individuals authorized to use the account, which clarifies who has access to the credit line.

-

Expect to provide details like bank account numbers, credit references, and any existing loans to give the lender a complete financial overview.

How do you fill out the individual credit application form?

Filling out the application form requires attention to detail and organization. By following a step-by-step process, you can ensure that all areas are properly addressed.

-

Begin with your full name, address, and contact information. Accuracy here is crucial for further communication with the lender.

-

Include current employment status, position held, and monthly income. This data is essential for evaluating your ability to repay.

-

Outline any terms of sale or payment agreements to clarify your financial obligations, which help lenders gauge potential risks.

What critical considerations should you keep in mind when submitting your application?

Being vigilant about your submission can save you from unnecessary complications later. Here are some essential considerations.

-

Be aware of any service charges that may apply and the associated due dates to avoid penalties.

-

Quickly review all invoices related to your application process to catch discrepancies early.

-

Failure to comply with specified terms can result in delays or denials of your application.

How can pdfFiller help you manage your credit application?

Utilizing pdfFiller can simplify the process of managing your individual credit application form significantly. The platform offers features that enhance collaboration and ease of use.

-

You can easily edit your application form and sign it digitally, saving time and increasing efficiency.

-

Invite team members to collaborate on submissions so that everyone can contribute to getting the application just right.

-

Access and manage your documents from any location, ensuring you can make changes whenever necessary.

What legal and compliance notes should you consider?

Being informed about legal aspects surrounding credit applications is crucial for safeguarding yourself. Compliance ensures that you follow necessary regulations and protect your data.

-

Familiarize yourself with laws like the Equal Credit Opportunity Act (ECOA), which governs fair lending practices.

-

It’s essential that your personal information is protected to prevent fraud and identity theft.

-

Legal issues can arise from providing misleading information, making accuracy critical for your application.

How to fill out the individual credit application template

-

1.Access pdfFiller and upload the individual credit application form.

-

2.Begin with your personal information: enter your full name, address, date of birth, and Social Security number accurately.

-

3.Provide your employment information, including your job title, employer's name, and income details.

-

4.Fill in financial data like monthly income, existing debts, and credit history or score if required.

-

5.Specify the loan amount you are requesting and the purpose of the loan in the designated sections.

-

6.Review all entered information for accuracy and completeness, checking for typos or missing data.

-

7.Sign and date the form electronically using pdfFiller's signature tool.

-

8.Save your application and choose to print or submit it electronically as required by the lender.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.