Last updated on Feb 20, 2026

Get the free Indiana Unsecured Installment Payment Promissory Note for Fixed Rate template

Show details

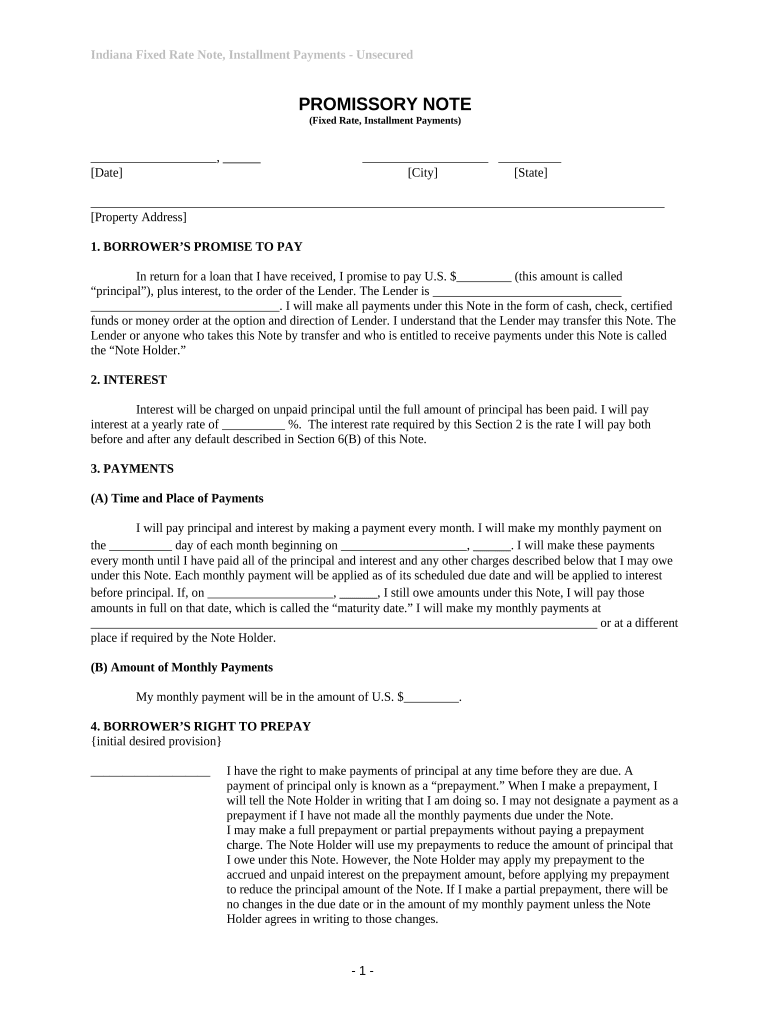

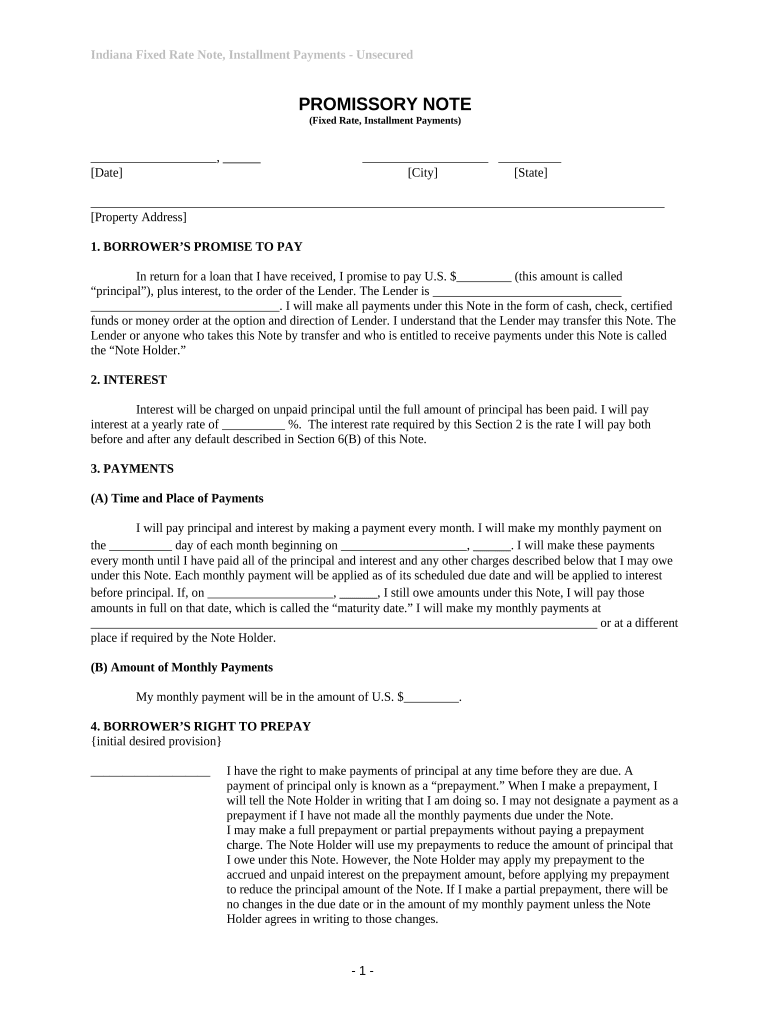

This form is a Promissory Note for the state of Indiana. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indiana unsecured installment payment

An Indiana unsecured installment payment is a financial agreement allowing borrowers to repay loans in fixed installments without requiring collateral.

pdfFiller scores top ratings on review platforms

The PDRfiller is so convenient and easy to use.

It is fine. I just can't keep paying each month, right now.

Managing the signature was difficult and took many attempts. Something near satisfaction was accepted. Otherwise, this app saved me time and made this task easier to complete. Thanks to PDFfiller.

Hard to get used to, and probably a lot of features we are not taking advantage of for lack of know-how, but very reliable and handy. We mostly use it to send for signature.

I like very much for me is very convenient because I need to fill forms that I don't have to go and buy for separate

I love using your forms!! Great experience 1

Who needs indiana unsecured installment payment?

Explore how professionals across industries use pdfFiller.

Indiana Unsecured Installment Payment Form Guide

How to fill out an indiana unsecured installment payment form?

Filling out an Indiana unsecured installment payment form requires understanding its key components, including personal information and loan details. Begin by accurately entering all required fields, ensuring clarity in the amounts and terms specified. Whether you are documenting a payment plan for personal loans or other debts, following these guidelines will help facilitate an efficient process.

What is the indiana fixed rate note?

The Indiana Fixed Rate Note serves as a legal document outlining loan details and repayment agreements. It is pivotal for both lenders and borrowers, as it specifies the conditions under which the loan is granted. Understanding terms like principal (the amount borrowed), interest (the cost of borrowing), and the roles of the lender provide a comprehensive picture of the obligations involved.

-

An unsecured installment payment form is a document that outlines the agreement for borrowing money without collateral. It lays out the terms and conditions for both lender and borrower.

-

The primary purpose is to legally define the repayment structure, ensuring that both parties adhere to agreed-upon terms. It provides security to the lender and clarity for the borrower.

-

Principal refers to the original sum of money borrowed, while interest is the additional cost incurred over time. The lender is typically the institution or individual who provides the funds.

What are the core components of the payment form?

Each Indiana unsecured installment payment form contains critical fields that must be filled out accurately. These fields ensure that all necessary information is conveyed to prevent any potential disputes.

-

These fields establish the context of the agreement, providing transparency regarding where the loan originates and under what terms.

-

This section details the borrower's promise to repay the loan, emphasizing the legal commitment being made.

-

Clearly outlining the lender's identity and rights ensures that both parties understand their responsibilities and legal options throughout the repayment process.

How do interest rates and payment structures work?

Interest rates and payment structures are fundamental to understanding an unsecured installment payment form. The way interest is calculated can vary significantly, affecting the total repayment amount significantly.

-

Interest calculations are typically based on the principal loan amount, with additional assumptions often made regarding the duration of repayment.

-

Fixed interest rates remain constant throughout the loan term, while variable rates may fluctuate based on market conditions, impacting monthly payments.

-

Late payments can lead to penalty fees and may also result in increased interest rates, complicating repayment if defaults occur.

What should you know about monthly payments and payment terms?

Understanding how monthly payments are structured is essential for managing an unsecured installment payment effectively. This will ensure timely payments and help avoid complications.

-

Payments can often be scheduled monthly or bi-weekly, depending on what is agreed upon in the payment form. Choosing the right method can enhance manageability.

-

The maturity date signifies when the final payment is due, marking the end of the repayment period and the release of any obligations.

-

Calculating the monthly payment amount based on loan terms, interest rates, and duration of the loan helps establish a clear budgeting strategy.

How can you use pdfFiller for effective document management?

Utilizing pdfFiller can significantly enhance the management of your Indiana unsecured installment payment forms. It offers convenient tools for online editing and signing, creating a streamlined process.

-

With pdfFiller, you can easily upload your payment form and make necessary adjustments without hassle.

-

Collaborate with others seamlessly, utilizing eSigning features that allow multiple parties to sign documents electronically.

-

pdfFiller's cloud storage ensures that your documents are accessible from any device, allowing you to manage them flexibly.

What compliance and legal considerations should you be aware of?

Having a solid understanding of compliance and legal considerations is crucial in the context of unsecured installment payments. Regulations can differ from state to state, and knowing your rights can prevent misunderstandings.

-

Each state has specific regulations governing unsecured loans, including interest limits and required disclosures.

-

It's vital to know your rights as either a borrower or lender to ensure all parties are treated fairly throughout the loan process.

-

Always retain copies of your signed payment forms and any correspondence related to the loan as legal backups.

How to fill out the indiana unsecured installment payment

-

1.Access pdfFiller and upload your Indiana unsecured installment payment document.

-

2.Begin by filling in your personal information, including your name, address, and contact details at the top of the form.

-

3.Next, provide details about the loan, such as the amount borrowed and the installment terms offered by the lender.

-

4.Fill in the repayment schedule, specifying the frequency of payments, such as weekly or monthly, and the total duration of the repayment period.

-

5.Include any necessary signatures where indicated to validate their agreement to the terms of the installment payment.

-

6.Review the entire document for accuracy and completeness; ensure all information is correct and unsigned areas are filled appropriately.

-

7.Once reviewed, save your work and choose the option to either print or electronically submit the form based on your needs.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.