Last updated on Feb 20, 2026

Get the free Indiana Installments Fixed Rate Promissory Note Secured by Personal Property template

Show details

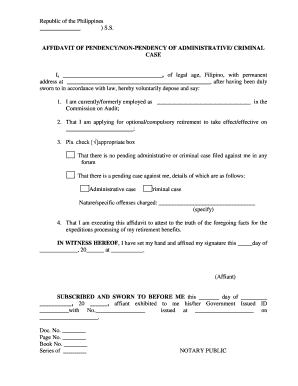

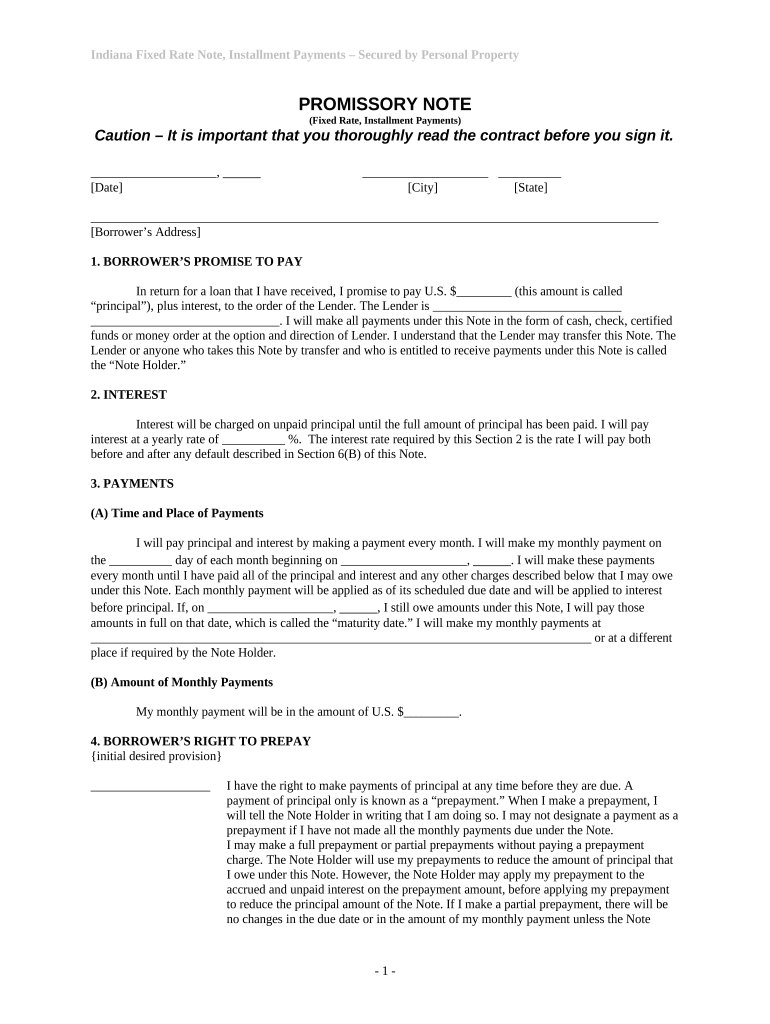

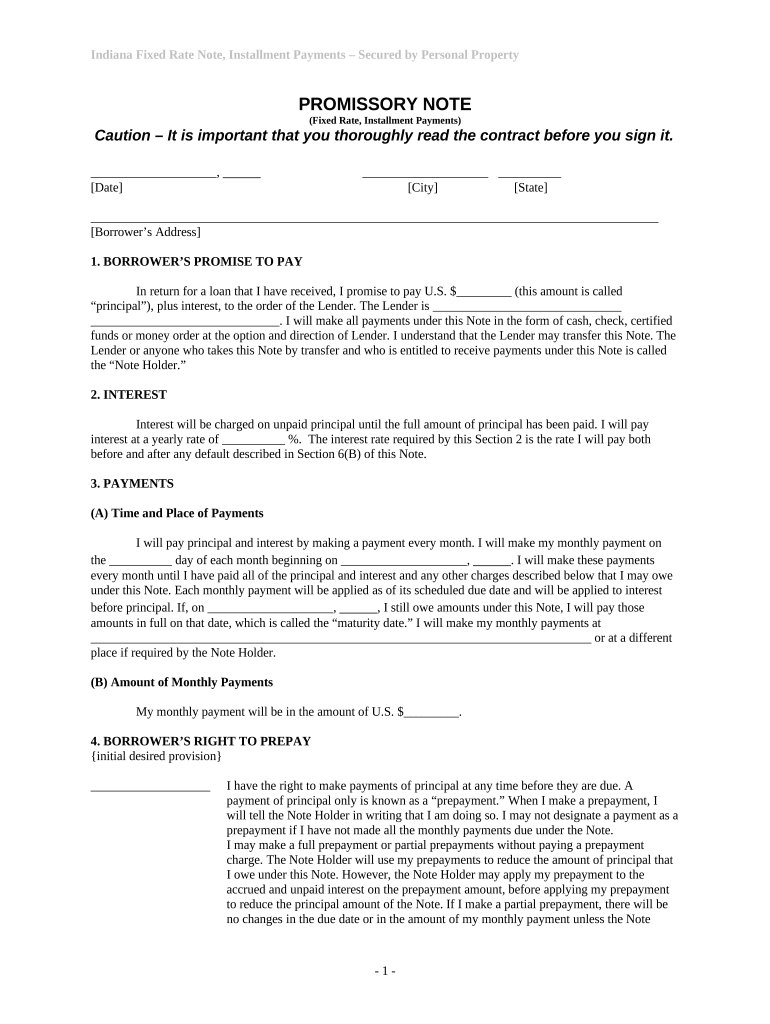

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indiana installments fixed rate

An Indiana installments fixed rate is a financial agreement to repay borrowed money in fixed amounts over a specified term, applicable in Indiana.

pdfFiller scores top ratings on review platforms

This app has been a wonderful asset. It allows me to take care of business on the road without toting reams of paperwork. Highly recommend

It is nice, but I would like it on my desk top

fast sand easy for a first time user, than you for developing this program

PDF filler is easy to use and great tool

Flexible, easy to use, well supported, fully featured.

I am frequently frustrated with pdfs. This takes the sting out because even I can navigate!

Who needs indiana installments fixed rate?

Explore how professionals across industries use pdfFiller.

Understanding the Indiana Fixed Rate Installment Payments

How to fill out an Indiana fixed rate installment payments form

Filling out an Indiana fixed rate installment payments form is straightforward. You need to provide your personal details, specify the loan amount, and understand the repayment terms including the interest rate and payment schedule. Using platforms like pdfFiller simplifies this process, allowing for easy editing and e-signing of the document.

What are fixed rate installment payments?

Fixed rate installment payments are a type of financing agreement where borrowers repay a loan through equal payments over a set period at a predetermined interest rate. This structure helps individuals manage their budget as monthly payments remain constant, which is vital to avoid financial surprises. They are commonly used in various financial products, including auto loans and personal loans.

What are the key elements of the Indiana fixed rate note?

An Indiana fixed rate note contains several critical components that borrowers must understand.

-

This section outlines the borrower's obligation to repay the loan, detailing principal and interest amounts over the term. Understanding these commitments is essential to avoid defaults.

-

The document contrasts fixed versus variable interest rates, clarifying how interest is calculated and the implications of defaulting on payments. Borrowers should recognize these terms to navigate their obligations effectively.

How are payments structured?

Payment structures typically involve a defined schedule detailing how often payments are due, often on a monthly basis. It's crucial to understand how each payment contributes to the principal and interest, ensuring transparency about the repayment process.

-

Payments are usually made monthly, with specific due dates noted in the agreement. Familiarizing oneself with these dates prevents late fees and penalties.

-

Late payments can incur fees and negatively impact credit scores. Understanding these consequences is essential for maintaining a healthy financial status.

What role does the lender play?

Lenders facilitate the provision of loans, taking on significant legal rights. They play a crucial role in the enforcement of repayment terms and rights related to the promissory note.

-

The lender may be a bank, credit union, or private individual. Identifying the lender is vital for understanding who enforces loan terms.

-

Lenders hold the right to collect payments and, in case of default, may initiate legal action. Understanding these rights can equip borrowers with knowledge about their obligations.

How can fill out and manage the Indiana fixed rate note form?

pdfFiller simplifies accessing the Indiana fixed rate note form. Users can fill out, edit, and sign the form online, streamlining the document management process.

-

Users can quickly find the Indiana Fixed Rate Note form on pdfFiller, easing the initial step of document management.

-

pdfFiller provides a straightforward guide for filling out the form, enhancing user experience and ensuring accurate submissions.

What common fees and penalties should be aware of?

Understanding fees and penalties is crucial in the repayment of loans. Various costs can arise during the life of an installment payment agreement.

-

These fees are typically additional charges incurred when payments are not made on time. Awareness of these fees can help in managing payments.

-

Non-compliance can expose borrowers to legal actions or higher financial penalties. Understanding potential penalties promotes responsible borrowing.

How do compare payment terms and interest rates?

Comparing the terms and rates from various institutions is essential for optimizing loan choices. Insights into current market conditions can guide borrowers in choosing favorable agreements.

-

Current tax rates can influence your total financial obligations regarding installment loans. Consult professionals to understand these impacts.

-

Researching trends in fixed-rate loans in Indiana can present advantageous options. Keeping informed facilitates better financial decisions.

How to fill out the indiana installments fixed rate

-

1.Download the Indiana installments fixed rate PDF form from pdfFiller.

-

2.Open the form in pdfFiller.

-

3.Begin by entering your personal information including name, address, and contact details in the designated fields.

-

4.Fill in the loan amount you are applying for and the term of the loan.

-

5.Specify the fixed interest rate that you have agreed upon in the relevant section.

-

6.Review any additional terms or conditions, and ensure all required checkboxes are marked as applicable.

-

7.If required, include a co-borrower's information by filling out their details in the provided sections.

-

8.After completing all necessary fields, review the document for accuracy.

-

9.Once satisfied, save the document and proceed to submit or print it based on your needs.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.