Last updated on Feb 20, 2026

Get the free Indiana Small Business Accounting Package template

Show details

This Small Business Accounting Package contains many of the business forms needed to operate and maintain a small business, including a variety of accounting forms. These forms may be adapted to suit

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is indiana small business accounting

Indiana small business accounting refers to the financial management and recordkeeping practices required for businesses operating in Indiana to ensure compliance and effective financial oversight.

pdfFiller scores top ratings on review platforms

AMAZING FOR ALL OF YOUR DOCUMENT NEEDS.

I have tried many pdf editors as I work with several different forms in the Real Estate Industry. Pdf-filler takes the cake by far! It is simple, easy to learn, and has an entire library of ready made forms. This is my go to for any and all of my document needs.

I lost a very important document and…

I lost a very important document and thank you God for Dee OMG not only found the document but helped me save and print Dee was sent by God to help me today and your company should fill proud you have Dee as an employee. Pam Sweeton

excellent i love it and would highly…

excellent i love it and would highly recommend

Good, thus far

Awesome

Great functionalities, but it is expensive in my case due to the exchange to Brazilian Real.

Who needs indiana small business accounting?

Explore how professionals across industries use pdfFiller.

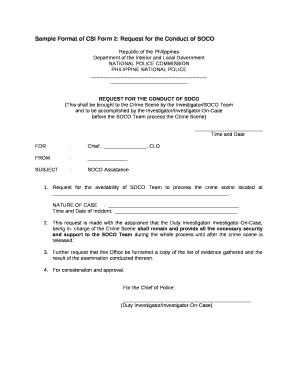

Comprehensive Guide to Indiana Small Business Accounting Forms

Navigating the world of accounting forms for small businesses in Indiana can be daunting. However, understanding the essential forms and how to fill them out can streamline your financial management processes and ensure compliance. This guide explores crucial accounting forms specifically tailored for small businesses operating in Indiana.

What are the essential forms for Indiana small business accounting?

-

A statement that summarizes revenues, costs, and expenses during a specific period, providing insights into profitability.

-

Helps track overdue payments to vendors, ensuring you meet your financial obligations on time.

-

Offers a snapshot of your company’s financial health by detailing assets, liabilities, and equity.

-

Records all cash transactions to maintain accurate cash flow management.

-

Facilitates the approval process for payments, ensuring proper documentation and transparency.

-

Monitors incoming payments to effectively manage cash flow and billing processes.

How should you fill out and manage accounting forms?

Data accuracy is paramount when completing accounting forms. Mistakes can lead to severe consequences, including financial penalties or inaccurate financial reporting. To minimize errors, consider using digital platforms like pdfFiller, which allows for easy data entry and editing.

-

Ensure all required fields are filled out accurately, including dates, amounts, and descriptions.

-

Conduct periodic reviews of your forms to ensure compliance and accuracy. Consistency in record-keeping aids in financial audits.

-

Using tools like pdfFiller can streamline the editing, signing, and management processes, allowing for easier document collaboration.

What are Indiana's compliance requirements for small business accounting?

Indiana's regulatory landscape outlines specific requirements for small business accounting. Understanding these regulations is essential to avoid non-compliance issues that could lead to penalties. Key points include knowing the deadlines for filing various financial reports and maintaining standardized accounting practices.

-

All businesses must adhere to state-specific accounting regulations involving financial reporting and bookkeeping.

-

Maintain awareness of important filing deadlines to ensure timely compliance and avoid late fees.

-

Businesses must keep detailed records for a specified period, which varies based on state requirements.

How can pdfFiller aid in document management?

pdfFiller offers a comprehensive suite of features that enhance document management for small businesses in Indiana. Users can create, edit, sign, and manage forms remotely through a cloud-based platform. This capability supports efficient collaboration and document tracking, essential for small business operations.

Why is it important to understand Indiana small business accounting forms?

Understanding Indiana small business accounting forms not only aids in compliance with local regulations but also enhances financial transparency and operational efficiency. Proper documentation allows businesses to analyze financial performance effectively, ensuring informed decision-making.

How to fill out the indiana small business accounting

-

1.Download the Indiana small business accounting form from the provided link or access it through pdfFiller.

-

2.Open the PDF file in pdfFiller and sign in to your account or create a new account if you don’t have one.

-

3.Begin by filling in the business name, address, and contact information at the top of the form.

-

4.Enter the business type in the designated section; this could include classifications like LLC, corporation, etc.

-

5.Complete the income section by detailing all revenue streams for your business, ensuring to list them clearly and accurately.

-

6.Proceed to the expenses section, where you will categorize and list all the costs incurred by your business during the accounting period.

-

7.Double-check all entered information for accuracy, ensuring that numbers and categories are correctly filled.

-

8.Once satisfied with the details, save the document.

-

9.Finally, submit the form according to Indiana state regulations or print it for your records. You can also share it directly from pdfFiller if required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.