Last updated on Feb 20, 2026

Get the free Limited Liability Company LLC Operating Agreement template

Show details

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is limited liability company llc

A limited liability company (LLC) is a flexible business structure that combines the benefits of both a corporation and a partnership, providing liability protection for its owners while allowing for pass-through taxation.

pdfFiller scores top ratings on review platforms

sweet

Very easy use!

Autosave features are very helpful. Additional secure features would improve the product.

It has improved my job performance, by making my work easier.

Fairly good

Great tool for everyday with the best editing features

Who needs limited liability company llc?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Limited Liability Company () Forms on pdfFiller

How to fill out a limited liability company form?

Filling out a limited liability company (LLC) form requires careful attention to detail. Users must provide essential information, such as the LLC name, members, and governing structure, which varies by state. Utilizing pdfFiller allows you to easily fill, edit, and collaborate on LLC forms, ensuring compliance with local regulations.

What are limited liability companies (LLCs)?

Limited Liability Companies (LLCs) combine the advantages of a corporation with those of a partnership. They provide personal liability protection to their owners, known as members, meaning members’ personal assets are shielded from business debts and lawsuits. Furthermore, LLCs offer flexible management structures and pass-through taxation, which makes them attractive for many entrepreneurs.

-

An LLC is a distinct business entity that provides liability protection to its owners.

-

Members of an LLC are generally not personally liable for the entity's debts.

-

LLCs can choose how they want to be taxed—either as a partnership or as a corporation.

What are Kansas guidelines?

Kansas law governs the formation and operation of LLCs through the Kansas Revised Limited Liability Company Act. This act covers essential compliance requirements that every entrepreneur must adhere to when establishing their LLC in Kansas. Understanding these guidelines is crucial to ensure your business operates lawfully and efficiently.

-

Filing the Articles of Organization is a fundamental step, requiring specific documentation to be submitted to the Kansas Secretary of State.

-

LLCs must adhere to annual reporting requirements and maintain accurate records of member information.

What are the steps to form your limited liability company ()?

Forming your LLC is a straightforward process that requires you to complete several steps systematically. Begin by selecting a unique name that complies with Kansas regulations, ensuring it includes 'LLC' or 'Limited Liability Company.' Next, draft and file the Articles of Organization, and establish an Operating Agreement that outlines the structure and management of the LLC.

-

The name must be unique and should not infringe on existing trademarks.

-

This document legally establishes your LLC and must be filed with the state.

-

While not required, this document clarifies management roles and operational procedures.

How to draft your operating agreement?

An Operating Agreement is a key document that outlines the ownership and organizational structure of your LLC. It details the responsibilities of members, management roles, and operational guidelines, essential for smooth business functioning. Including specific provisions can also aid in tax management and legal compliance.

-

Clarify the roles of managers and members to prevent operational confusion.

-

Include provisions for dispute resolution, profit sharing, and member responsibilities.

How does pdfFiller help with forms?

pdfFiller offers powerful tools to manage your LLC documents online. Through its platform, users can easily edit, eSign, and collaborate on forms, thereby streamlining the filing process. The ability to access documents from any location enhances productivity, making document management hassle-free.

-

Modify your documents easily with pdfFiller’s user-friendly editing features.

-

eSign your LLC forms effortlessly without the need for physical paperwork.

-

Engage team members through its collaborative platform to ensure everyone is on the same page.

How to maintain compliance after formation?

Maintaining compliance after forming your LLC is crucial for operational sustainability. This includes understanding annual reporting requirements in Kansas, ensuring the Operating Agreement is updated, and properly managing any member or operational changes. Failure to comply can result in penalties or even dissolution of the LLC.

-

Submit necessary annual reports by the deadlines to keep your LLC in good standing.

-

Regularly review and revise the Operating Agreement to reflect changes within the LLC.

-

Notify the state of any changes in membership or business operations promptly.

What are additional document tools available on pdfFiller?

In addition to LLC forms, pdfFiller provides various tools for business owners. From customizable templates to interactive resources aimed at simplifying document creation, these tools enhance efficiency and ensure your business is well-equipped to handle any documentation needs.

-

Access a library of documents specifically designed for business purposes.

-

Utilize online tools to customize your legal documents to suit your specific needs.

-

Find links to helpful resources that guide you through the LLC formation process.

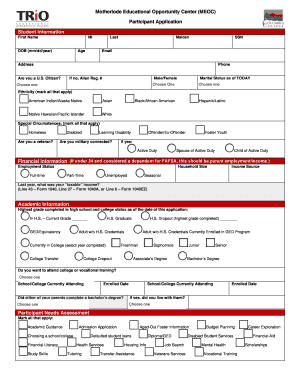

How to fill out the limited liability company llc

-

1.Visit pdfFiller and log in or create an account.

-

2.Search for the 'Limited Liability Company (LLC) Application' template.

-

3.Select the appropriate state-specific LLC form from the search results.

-

4.Fill out the basic information sections: business name, address, and owners' details.

-

5.Provide information regarding the registered agent responsible for receiving legal documents.

-

6.Outline the LLC's purpose and ensure compliance with state requirements. Include any additional provisions if necessary.

-

7.Review all completed sections for accuracy and completeness prior to submission.

-

8.Once everything is correctly filled, save your document.

-

9.Follow the prompts to submit your completed LLC application to the relevant state agency or print it for mailing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.