Last updated on Feb 17, 2026

Get the free Kansas Installments Fixed Rate Promissory Note Secured by Residential Real Estate te...

Show details

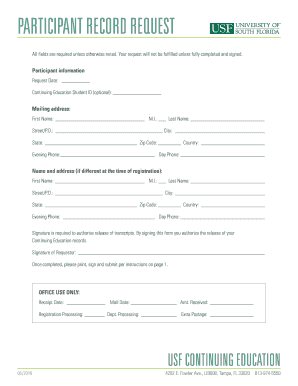

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is kansas installments fixed rate

Kansas installments fixed rate refers to a financial agreement that allows borrowers in Kansas to repay a loan in fixed monthly amounts over a specified period.

pdfFiller scores top ratings on review platforms

Works for what I needed, a bit high priced.

It beats my hand writing. I would be nice if it did the calculations also. But you can't have everything. I'll probably be only using this for my state tax. There on line program stinks.

It would get 5 stars if you could email more then one attachment.

trying to learn what all of the features are with this program. We just purchased a corporate account for agents in our insurance office to use and we would be more than interested in a webinar on all the features

you program has met all my needs up to this point

I HAD TO USE THIS FOR 1500 AND UB-04, IT MADE THE FORM VERY EASY TO FILL OUT WITH THE STEP BY STEP PROCESS

Who needs kansas installments fixed rate?

Explore how professionals across industries use pdfFiller.

How to fill out a Kansas installments fixed rate form effectively

Understanding the Kansas installments fixed rate form

The Kansas installments fixed rate form is vital for establishing clear payment expectations between borrowers and lenders. It is structured to facilitate fixed payment schedules that do not fluctuate over time, allowing borrowers to manage their finances effectively. Understanding the components of this form is crucial for ensuring legal compliance and achieving clarity in lending agreements.

-

The primary purpose of this form is to provide a clear repayment schedule and delineate the responsibilities of both parties.

-

This includes information about the loan amount, terms, interest rate, and repayment schedule.

-

This note is especially important in Kansas as it conforms to state regulations and ensures legal standing.

What are the crucial sections of the fixed rate installment note?

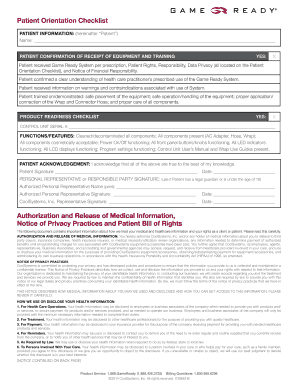

Several vital sections must be filled out correctly in the fixed rate installment note to protect both the lender and borrower. Each segment of the form plays a significant role in defining expectations and obligations.

-

The borrower explicitly promises to pay back the amount borrowed under the agreed terms.

-

Detailing how the borrowed amount and interest will be applied during each payment cycle.

-

Clarifies the responsibilities and rights of both parties involved in the agreement.

How are interest rates and payments calculated?

Interest on fixed rate installment loans is calculated on the unpaid principal amount, meaning that as the borrower makes payments, the total interest payable decreases. Various factors influence these rates, including whether the loan is fixed or adjustable.

-

Interest is usually defined in terms of an annual percentage rate (APR) and is typically expressed monthly on the remaining balance.

-

Fixed rates remain the same throughout the term, while adjustable rates may fluctuate based on market conditions.

-

Failure to meet payment obligations can escalate the interest rates and lead to legal claims.

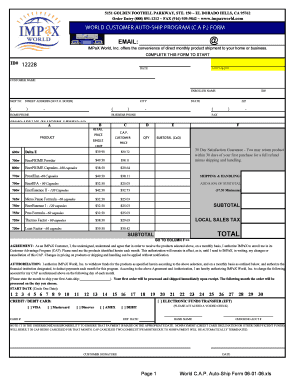

What does a monthly payment breakdown look like?

Monthly payments are crucial for maintaining the workflow of any fixed rate installment loan. Each payment is systematically applied to the principal and accumulated interest.

-

Payments are typically made monthly, with specified deadlines outlined in the agreement.

-

Payments are subsequently divided, with portions allocated to interest and principal.

-

Each payment structure includes a maturity date when the loan will be considered fully repaid.

What payment options are available for fixed rate forms?

Understanding the payment options available can streamline the process of managing fixed rate installment notes. Commonly accepted forms vary but generally include reliable and verifiable methods.

-

Payments may be made through cash, checks, or certified funds depending on the lender’s requirements.

-

Establish clear procedures on how payments should be made to avoid missed payments.

-

Lenders may direct borrowers to adjust payment locations, which must be clearly outlined in the agreement.

How do you fill out the Kansas installments fixed rate form?

Filling out the Kansas installments fixed rate form requires attention to detail and accuracy. A step-by-step guide aids individuals in completing the form correctly to ensure all required information is present.

-

Follow structured instructions closely to navigate through the sections of the form.

-

Be aware of typical errors, such as missing signatures or incorrect figures.

-

Leverage interactive features to easily edit and manage the form digitally.

How can pdfFiller manage your fixed rate form?

Using digital tools can transform how one manages the Kansas installments fixed rate forms. pdfFiller offers capabilities that simplify and enhance document processing.

-

Utilize pdfFiller’s tools for easier completion and submission of forms.

-

Share and collaborate on documents with team members seamlessly to ensure everyone stays informed.

-

Efficiently manage documents with cloud-based sharing options and electronic signing features.

What compliance and legal considerations are relevant in Kansas?

Navigating the local laws concerning fixed rate notes is essential to avoid legal disputes. Compliance ensures that both parties are protected under Kansas law.

-

Understand the laws governing installment loans in Kansas to ensure compliance.

-

Ensuring compliance safeguards both lender and borrower from future legal issues.

-

Reviewing legal ramifications and ensuring protective measures are in place during transactions.

How to fill out the kansas installments fixed rate

-

1.Open the pdfFiller platform and locate the 'Kansas Installments Fixed Rate' document.

-

2.Download the PDF template if necessary, or directly open it in pdfFiller.

-

3.Begin by entering your personal information such as name, address, and contact details at the top of the form.

-

4.Insert the loan amount you are requesting in the designated field, ensuring it aligns with your financial needs.

-

5.Specify the fixed interest rate you wish to negotiate, referring to current market rates if needed.

-

6.Fill in the repayment term, indicating how many months or years you plan to pay back the loan.

-

7.Review all details for accuracy, ensuring that all required fields are completed.

-

8.Click the 'Save' option to store your filled document and the 'Send' button to submit it to the necessary parties for processing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.