Last updated on Feb 20, 2026

Get the free Satisfaction, Release or Cancellation of Mortgage by Corporation template

Show details

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Kansas by a Corporation. This form complies with all

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is satisfaction release or cancellation

A satisfaction release or cancellation is a legal document that acknowledges the fulfillment of a debt or the termination of a contract.

pdfFiller scores top ratings on review platforms

it is awesome

Easy and user friendly

Made my job 100% easier

Made my job 100% easier. Felt like throwing all my pens in the air!

Excelent

Excelent experience, very powerful tool

cacelled free trial

cacelled free trial, quick and easy

everything is fine

Who needs satisfaction release or cancellation?

Explore how professionals across industries use pdfFiller.

The Ultimate Guide to Completing Your Satisfaction Release or Cancellation Form

How to effectively fill out a satisfaction release or cancellation form

Filling out a satisfaction release or cancellation form is essential in confirming that a mortgage has been paid off and that the lender no longer has a claim on the property. This guide will provide you with crucial insights and step-by-step instructions to ensure accurate completion and filing.

Understanding the satisfaction of mortgage form

The satisfaction of mortgage form serves as a legal document confirming that a mortgage obligation has been fulfilled, thereby releasing the lien placed on the property.

-

This form indicates that the debt has been paid in full, allowing the borrower to receive clear title to the property.

-

It's a crucial step in the process of finalizing a mortgage, as it protects both the borrower and the lender.

-

Understanding terms like 'lien', 'mortgagee', and 'mortgagor' is important for accurate form completion.

What components make up the satisfaction of mortgage form?

A properly completed satisfaction of mortgage form comprises several key components that must be accurately filled out to be valid.

-

Common fields include loan details, borrower names, and the lender's information.

-

Understanding sections like company information, acknowledgment of consideration and property description is critical.

The company information section should include the corporation name of the lender. Acknowledgment of consideration confirms the mortgage has been satisfied, while the details of the original mortgage outline the specifics of the loan, including the original amount and repayment dates.

-

Most jurisdictions require a notary public to verify the document, adding a layer of authenticity.

How do complete the satisfaction of mortgage form?

Completing the satisfaction of mortgage form can be straightforward if you follow a structured approach.

-

Begin by filling out the borrower's information, followed by lender details, before confirming the mortgage has been satisfied.

-

Avoid leaving fields blank or providing inconsistent information that could complicate the processing of your form.

-

Double-check that all names are spelled correctly and that property descriptions are precise.

What are the necessary steps for submitting the satisfaction of mortgage form?

After completion, submitting the satisfaction of mortgage form is the next critical step in ensuring your mortgage is officially recognized as satisfied.

-

Typically, you need to file this form with the Register of Deeds in the county where the property is located.

-

Different counties may have varying requirements, so it’s advisable to check local regulations.

-

Be prepared for potential fees associated with filing, which can vary by jurisdiction.

What should you expect after filing the satisfaction of mortgage form?

After filing, there are important steps you should follow to ensure that everything is completed properly.

-

Verify with the Register of Deeds to confirm the form has been officially recorded.

-

This document is proof that your mortgage has been formally satisfied.

-

Store your satisfaction document in a safe place as it serves as vital evidence of the mortgage release.

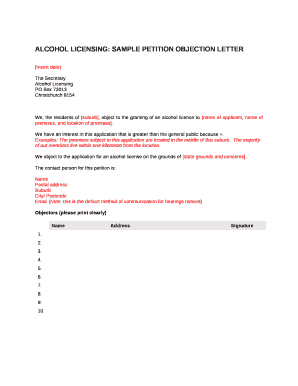

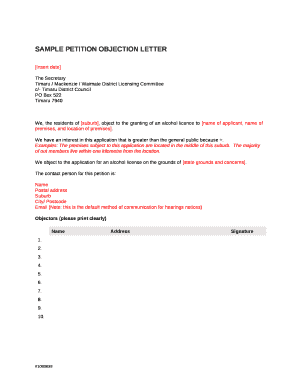

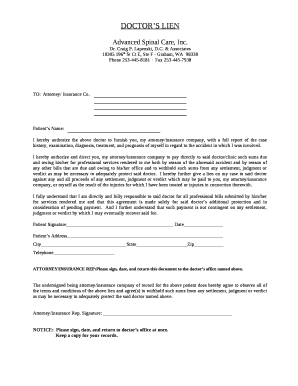

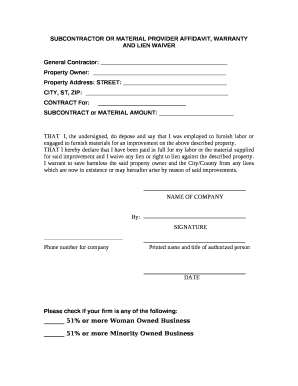

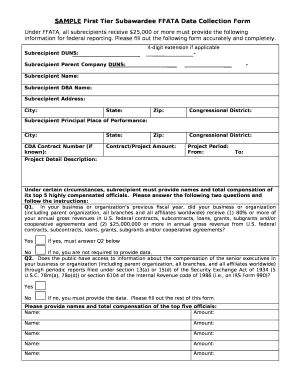

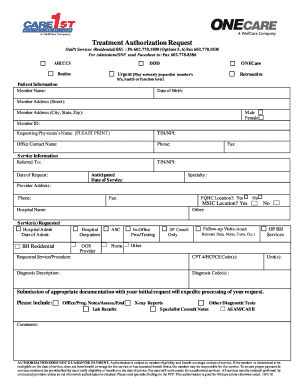

Sample satisfaction of mortgage form

Having a visual reference can make the process of filling out the form easier. Below is an overview of a sample satisfaction of mortgage form.

-

See how the form should look once properly filled out, including all necessary fields.

-

Important sections are marked to help users easily identify where to input their information.

-

Understanding the purpose of each field ensures you provide the correct information.

How to fill out the satisfaction release or cancellation

-

1.Open pdfFiller and upload the satisfaction release or cancellation document.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in your name and contact information in the designated fields.

-

4.Provide the recipient's name and address, ensuring accuracy.

-

5.Enter details about the original agreement, including dates and amounts involved.

-

6.Indicate the reason for the cancellation or satisfaction clearly.

-

7.Include signatures; ensure that both parties sign and date the document.

-

8.Review the filled form for any missing information or errors.

-

9.Save the completed document to your pdfFiller account or download it for distribution.

-

10.Optionally, consider sending a copy to the other party to confirm the release or cancellation.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.