Last updated on Feb 20, 2026

Get the free Satisfaction, Release or Cancellation of Mortgage by Individual template

Show details

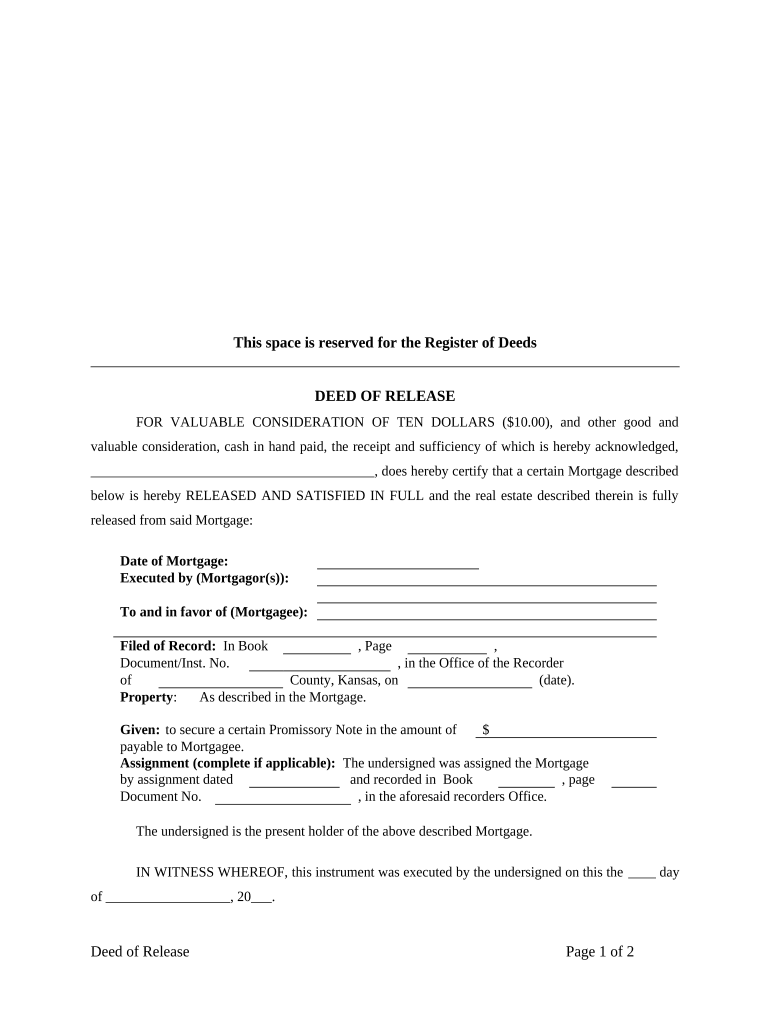

This form is for the satisfaction or release of a mortgage for the state of Kansas by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is satisfaction release or cancellation

A satisfaction release or cancellation is a legal document that formally acknowledges the completion of obligations under a contract or debt agreement, thereby releasing the parties from further claims.

pdfFiller scores top ratings on review platforms

Overall, good. Was not familiar with photo insert feature. Don't know if there were instructions, but got it accomplished. Pretty intuitive.

I had to amend my 2014 federal taxes, and when I went in to the form, it brought me onto your site. I filled out the form and went to print when I found out that there was a cost for the program. I only needed the program for a short amount of time. I will be cancelling the program as soon as my amended tax forms are completed and the IRS is satisfied.

Same me time to repeat filling up similar forms. More presentable using type written form than a handwritten one.

Would like to learn how to save several copies of the same document - one for each customer, so I don't have to change that information each time.

It's been the perfect software for filling out government documents!

It is a great product. I only needed it once however. Would have used more if needed.

Who needs satisfaction release or cancellation?

Explore how professionals across industries use pdfFiller.

Satisfaction Release or Cancellation Form Guide

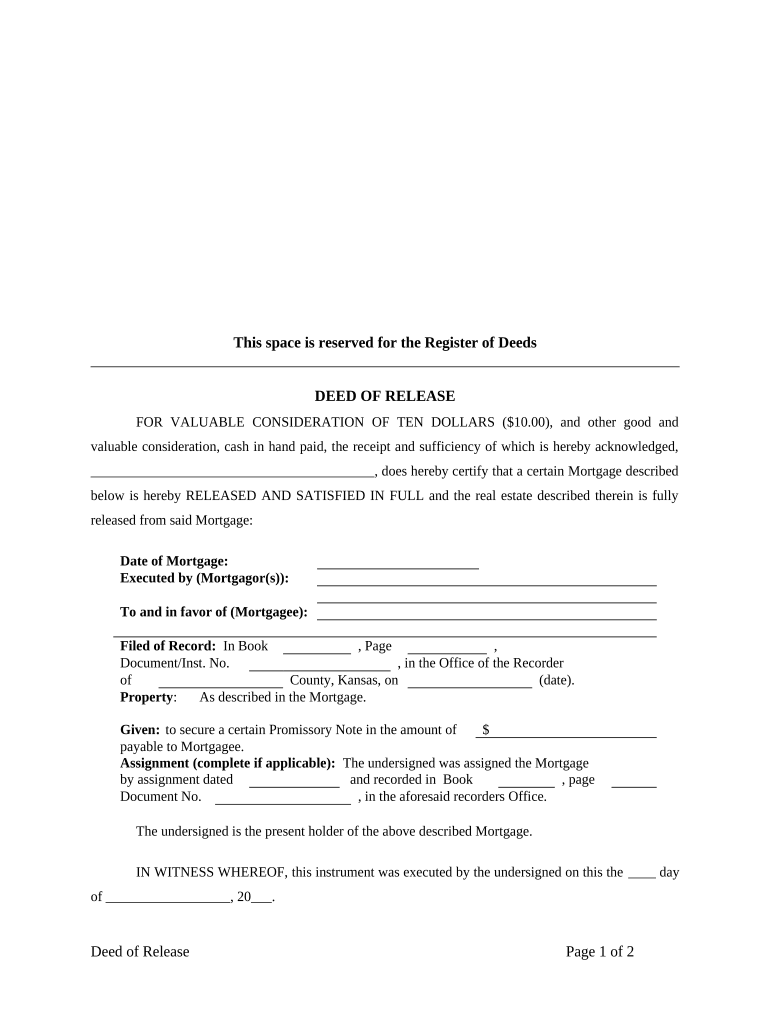

What is the satisfaction of mortgage form?

The satisfaction of mortgage form serves as an official document acknowledging that a mortgage obligation has been fulfilled. This form is crucial in formalizing the release of mortgage liens on properties. It typically arises when property owners have fully paid off their mortgages, allowing them to clear the title for future transactions or sales.

-

It legally verifies that a mortgage has been satisfied, releasing the lien from a property.

-

Formalizing the release protects the owner’s rights, ensuring the property is free from financial encumbrances.

-

Commonly used after full mortgage payment, refinancing, or when assets are transferred.

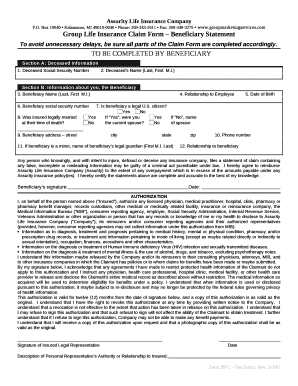

What elements are included in a satisfaction of mortgage form?

The satisfaction of mortgage form contains critical data necessary for its validity. Understanding these elements is crucial for accurate completion and submission. This section ensures you know what to expect when viewing or filling out the form.

-

Fields like Date of Mortgage and details about both Mortgagor(s) and Mortgagee are essential for legal clarity.

-

Details about the property and original promissory note must be accurately inputted to link the form to the correct mortgage.

-

Generally, the completed form needs notarization and possibly witness signatures for validation.

How can you fill out the satisfaction of mortgage form?

Filling out the satisfaction of mortgage form can be streamlined with tools like pdfFiller. Here's a detailed guide on how to complete the form accurately, ensuring all fields are filled correctly.

-

You can access the satisfaction of mortgage form through pdfFiller, which offers various editing options.

-

Follow each section's instructions meticulously to ensure completeness and accuracy.

-

Once completed, review your entries for accuracy to prevent delays in processing.

What are the steps for submitting your satisfaction of mortgage form?

Submitting the satisfaction of mortgage form must be done correctly to ensure legal recognition. Follow these steps to properly file your form with the Register of Deeds.

-

Submit the completed form directly to the local Register of Deeds office for processing.

-

Be aware of any associated filing fees as these can vary by jurisdiction.

-

Most local offices allow you to track the status of your submission for peace of mind.

What should you consider post-submission?

After filing the satisfaction of mortgage form, several considerations come into play. Knowing what to expect can help you navigate this phase confidently.

-

Understand the typical processing timelines and what to expect regarding document return.

-

Always request a stamped copy of the filed form for your records to retain proof of satisfaction.

-

Post-filing responsibilities change as property ownership is now clear of prior mortgage obligations.

What are the typical questions regarding the satisfaction of mortgage process?

Understanding the satisfaction of mortgage process can alleviate confusion and empower you to manage your mortgage responsibilities. This section addresses common inquiries to clarify the process.

-

The Satisfaction of Mortgage Form should be used when a mortgage has been fully paid to release the lien.

-

A Satisfaction of Mortgage formally acknowledges debt repayment, while a Deed of Reconveyance pertains to transferring property back.

-

pdfFiller provides comprehensive document management features to streamline the satisfaction of mortgage process.

How can you use a sample satisfaction of mortgage form?

Using a sample satisfaction of mortgage form can guide you through the filling process, providing a clear reference point.

-

Refer to a completed form to familiarize yourself with typical information required.

-

Note important sections that often trip up first-time filers.

-

Follow the sample closely, making sure to adapt the unique details of your situation.

How to fill out the satisfaction release or cancellation

-

1.Open pdfFiller and upload the satisfaction release or cancellation template.

-

2.Fill in the debtor's name, address, and contact information at the top of the document.

-

3.Enter the creditor's name, address, and contact information in the designated section.

-

4.Include the details of the obligation being satisfied, such as the amount and date of payment.

-

5.Clearly state that the obligation has been satisfied and that the creditor relinquishes all claims.

-

6.Add the date on which the satisfaction or cancellation is being executed.

-

7.Include spaces for signatures of both the debtor and creditor, along with the date of signing.

-

8.Review all the information for accuracy before saving changes.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.