Get the free Final Notice of Default for Past Due Payments in connection with Contract for Deed t...

Show details

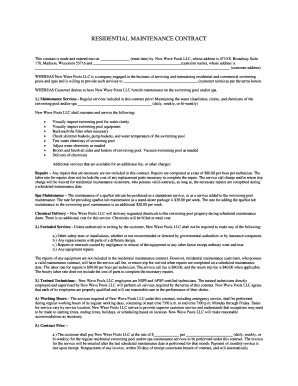

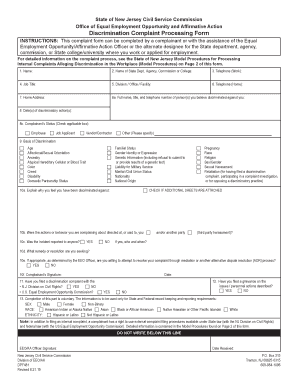

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

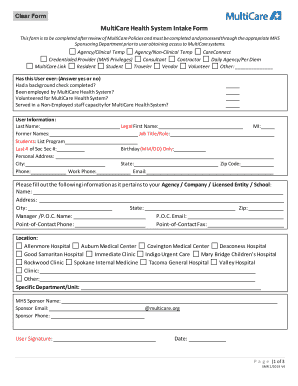

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is final notice of default

A final notice of default is a formal communication sent to a borrower indicating that they have failed to fulfill their loan obligations and that foreclosure proceedings may be initiated.

pdfFiller scores top ratings on review platforms

Easy and intuitive. Have been looking for this type of app.

good apply some compliced but this app help me

the biggest difficulty I have is when I am trying to re-order documents (move them left or right) -- it is just very difficult to see them. I wish the functionality allowed for enlarging the docs so that I could see what it is.

Love the product, but would like a better digital signature section . . . Right now the email client/messaging is a little clumsy and customers are not able to properly sign and return docs digitally. They are too often still having to scan. Thanks.

Difficult to go back into a saved doc and edit

Easy to use. Works great with Google Drive.

Who needs final notice of default?

Explore how professionals across industries use pdfFiller.

Understanding the Final Notice of Default Form

What is a Final Notice of Default?

A Final Notice of Default is a formal notification sent to borrowers indicating their failure to fulfill payment obligations under a loan agreement. This document serves as a critical step in the foreclosure process, as it alerts the borrower of the existing default and outlines subsequent actions that could be taken. Understanding its implications is significant for both sellers and purchasers within real estate and finance sectors.

-

It is a final warning that a borrower has defaulted on their payment obligations, prompting necessary legal actions.

-

To formally notify the borrower of their default and provide them with an opportunity to remedy the situation before further actions are taken.

-

The seller may have the right to initiate foreclosure, while the purchaser risks losing their property; both parties should consider legal counsel.

What are the key components of the Final Notice of Default Form?

A comprehensive Final Notice of Default form should include critical information to ensure clarity and legal validity. Each element serves a purpose in documenting the default condition and protecting the interests of all parties involved.

-

These should include names, addresses, and any relevant contact information to identify involved parties.

-

The exact location of the property at question must be clearly specified to avoid miscommunication.

-

A detailed account of the missed or late payments, along with dates and amounts owed, must be included.

-

Information about potential legal actions, including foreclosures, should be explicitly stated to inform the borrower of risks.

How can you fill out the Final Notice of Default Form?

Filling out the Final Notice of Default form requires careful attention to detail to avoid costly mistakes. Here’s a step-by-step approach to ensure accuracy.

-

Start by entering all required party information; ensure property details and payment issues are documented clearly.

-

Avoid leaving any sections blank or failing to provide accurate descriptions; double-check all entries.

-

Utilize sample forms as references to understand the formatting and content required.

What are the major considerations when issuing a Notice of Default?

Issuing a Notice of Default involves several critical risk factors that sellers must consider. Understanding the potential fallout will help in preparing more effectively.

-

Issuing a notice can escalate tensions and lead to legal disputes; sellers should evaluate the potential consequences.

-

Borrowers may seek loan modifications, counseling, or explore refinancing to avoid foreclosure.

-

Each state has specific timelines for filing notices and responses; awareness of these is crucial for compliance.

What details are required in the Notice of Default?

To ensure that the Notice of Default is effective, it must include specific details, spelling out the borrower's obligations and the lender's rights.

-

A clarity about the exact payments in default must be included, illustrating any timeline of defaults.

-

Fees accrued from delays must be clearly stated to prevent confusion regarding the total amount owed.

-

Inform the borrower of their rights and the repercussions of failing to remedy the default, including possible foreclosure.

What happens after receiving a Default Notice?

Receiving a Default Notice triggers specific actions for the borrower. Understanding these can provide clarity on next steps.

-

The borrower may face foreclosure if the situation is unresolved; they risk losing their property.

-

The seller may have the right to pursue foreclosure or terminate the agreement, depending on the jurisdiction.

-

Borrowers should seek legal advice, explore loan modifications, and respond promptly to the notice.

Utilizing pdfFiller for your Final Notice of Default Form

PDFfiller offers tools that can simplify the process of managing your Final Notice of Default form. With its user-friendly platform, you can ensure your document is both accurate and professionally managed.

-

Easily upload your form; use editing tools to complete necessary fields and eSign securely.

-

Invite team members to collaborate on document management, ensuring compliance and efficiency.

-

pdfFiller employs advanced security protocols for protecting sensitive information throughout the document process.

How to fill out the final notice of default

-

1.Open the final notice of default template on pdfFiller.

-

2.Enter the date at the top of the document, which should reflect when the notice is being issued.

-

3.Input the borrower's full name and address in the appropriate fields.

-

4.Specify the loan details, including the loan number, the amount overdue, and any other relevant information.

-

5.Clearly state the default terms, citing the specific obligations that have not been met.

-

6.Include a deadline for the borrower to rectify the default, typically a specified number of days from the notice date.

-

7.Provide a clear warning about potential legal actions that may follow if the default is not cured.

-

8.Add your name, title, and contact information as the lender or representational entity issuing the notice.

-

9.Review the filled document for accuracy and completeness.

-

10.Save the document and print it for mailing to the borrower or for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.