Get the free Quitclaim Deed from Corporation to LLC template

Show details

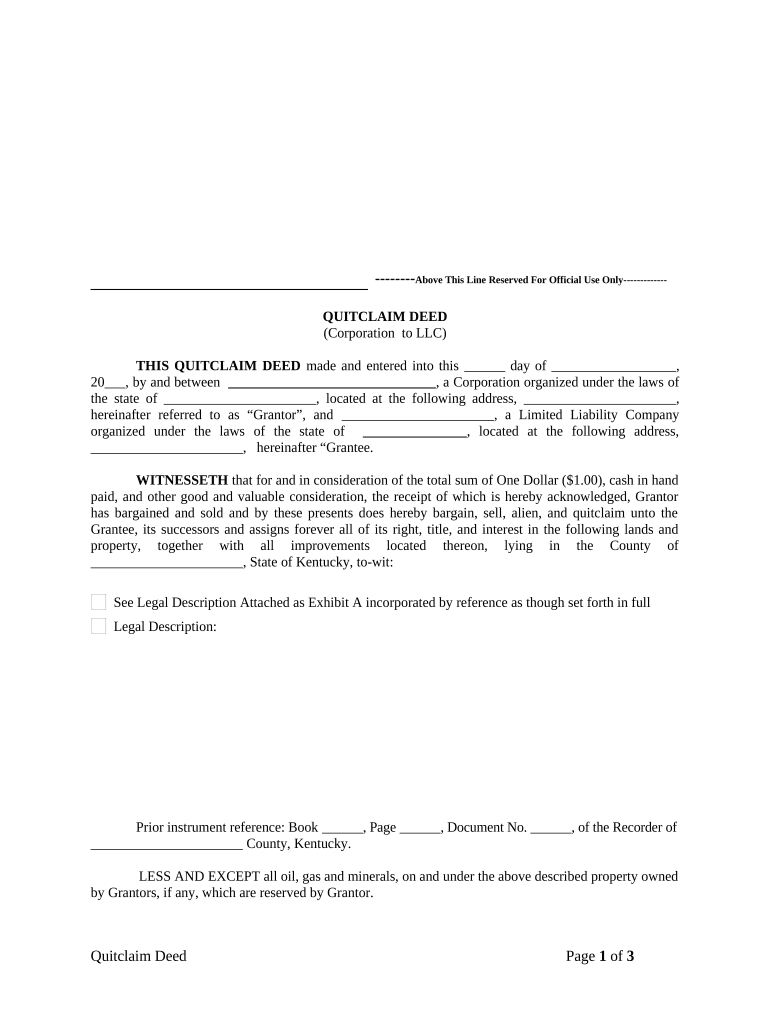

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is quitclaim deed from corporation

A quitclaim deed from a corporation is a legal document that transfers any ownership interest the corporation may have in a property without guaranteeing that the title is clear or valid.

pdfFiller scores top ratings on review platforms

Very easy to use. I was able to email my sign documents without any problems. Thank you!

excellent

Satisfied

Great

This is an excellent tool. It made my life easier for editing and making pdf documents.

So far ok.

Who needs quitclaim deed from corporation?

Explore how professionals across industries use pdfFiller.

Quitclaim deed from corporation form guide

How to fill out a quitclaim deed from corporation form

Filling out a quitclaim deed from a corporation involves a few structured steps. This guide offers a comprehensive overview of the process and highlights key considerations to make the transfer of property seamless and efficient.

Understanding quitclaim deeds

A quitclaim deed is a legal instrument used to transfer ownership rights in property. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor owns the property or that they can convey ownership. They're often used when the parties know each other well, such as in family transactions, or when the parties agree on the transfer without needing extensive verification.

-

A quitclaim deed is a document that transfers whatever interest the grantor has in a property to the grantee.

-

Unlike warranty deeds, which provide assurances about the title, quitclaim deeds offer no guarantees, making them ideal for low-stakes transfers.

-

Quitclaim deeds are frequently utilized in divorce settlements, transfers between family members, and corporate property transfers, especially when the property history is clear.

Benefits of using a quitclaim deed

The quitclaim deed offers several advantages for both grantors and grantees. It allows for quick property transfers without the lengthy processes associated with other deed types.

-

Grantors can quickly relinquish their claim to a property, which may expedite transactions in urgent scenarios.

-

Grantees gain immediate ownership rights, simplifying the overall transfer process, especially in friendly agreements.

-

Using a quitclaim deed is often less costly than other deed types due to fewer legal requirements and complexities.

Step-by-step guide to filling out a quitclaim deed form

Completing a quitclaim deed from a corporation requires attention to detail. Each section must be filled out correctly to ensure the validity of the document.

-

Clearly state the names of the Grantor (the corporation) and Grantee (the individual or entity receiving the property).

-

Include complete corporation details and the address of the Grantor to establish legal identities.

-

Similarly, provide the details and address of the Grantee to confirm their identity in the transaction.

-

Clearly state the consideration amount, which is the value being exchanged for the transfer.

-

Use a specific legal description of the property; this may include parcel numbers or any relevant identifiers.

-

Note any required information for proper recording in the local county documentation to finalize the deed legally.

Common pitfalls and how to avoid them

Filling out a quitclaim deed can be straightforward, but it's essential to steer clear of common missteps to ensure a smooth transfer.

-

Errors can occur, such as missing signatures, incorrect legal descriptions, or failing to notarize the document, which may invalidate the deed.

-

Double-check all information before submission. It's advisable to cross-reference property details with public records.

-

Having the quitclaim deed notarized and witnessed can provide an extra layer of legal security, ensuring its acceptance in court if required.

State-specific requirements for quitclaim deeds

Laws governing quitclaim deeds can vary from state to state. For example, in Kentucky, specific terminology and filing instructions must be observed for the deed to be valid.

-

While the core function of a quitclaim deed remains the same, requirements such as notarization protocols may differ.

-

Understanding specific legal terms used in your state is crucial for effective preparation of the deed.

-

Be sure to research the filing and recording requirements in your county and state to ensure compliance with local laws.

Interactive tools and resources on pdfFiller

pdfFiller offers a user-friendly platform to assist with the editing and management of quitclaim deeds. Its capabilities enable you to focus on completing your legal documents efficiently.

-

The platform allows users to edit their quitclaim deed forms easily, ensuring all information is accurately updated.

-

With the e-signature feature, users can quickly and securely sign documents from anywhere, making the process more efficient.

-

For teams, pdfFiller supports collaborative efforts in property transfers, centralizing document management and approval processes.

How to fill out the quitclaim deed from corporation

-

1.Access pdfFiller and upload the quitclaim deed template.

-

2.Enter the corporation's name as the grantor in the designated field.

-

3.Provide the full name of the grantee who will receive the property.

-

4.Input the property description including address, parcel number, or legal description.

-

5.Specify any applicable conditions or limitations regarding the transfer.

-

6.Include the date of the transfer in the appropriate section.

-

7.Have an authorized representative of the corporation sign the deed where indicated, ensuring proper title and authority.

-

8.In some cases, include a witness signature or notarization if required by local laws.

-

9.Finally, submit the completed document for filing with the appropriate government office.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.