Last updated on Feb 20, 2026

Get the free Individual Credit Application template

Show details

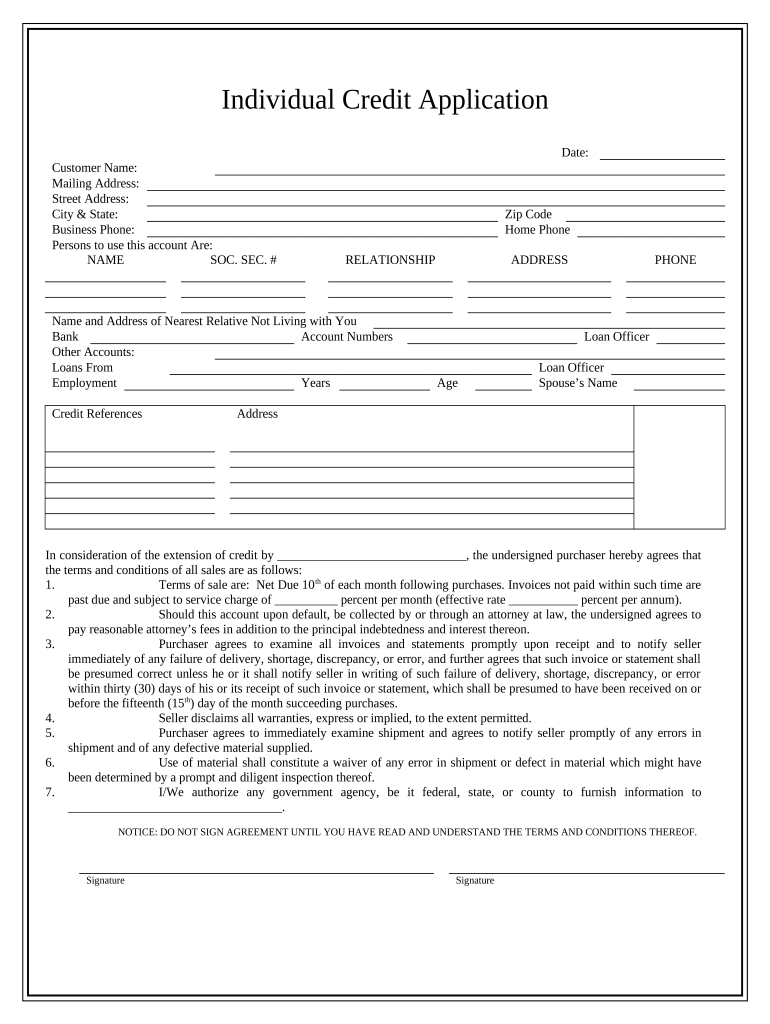

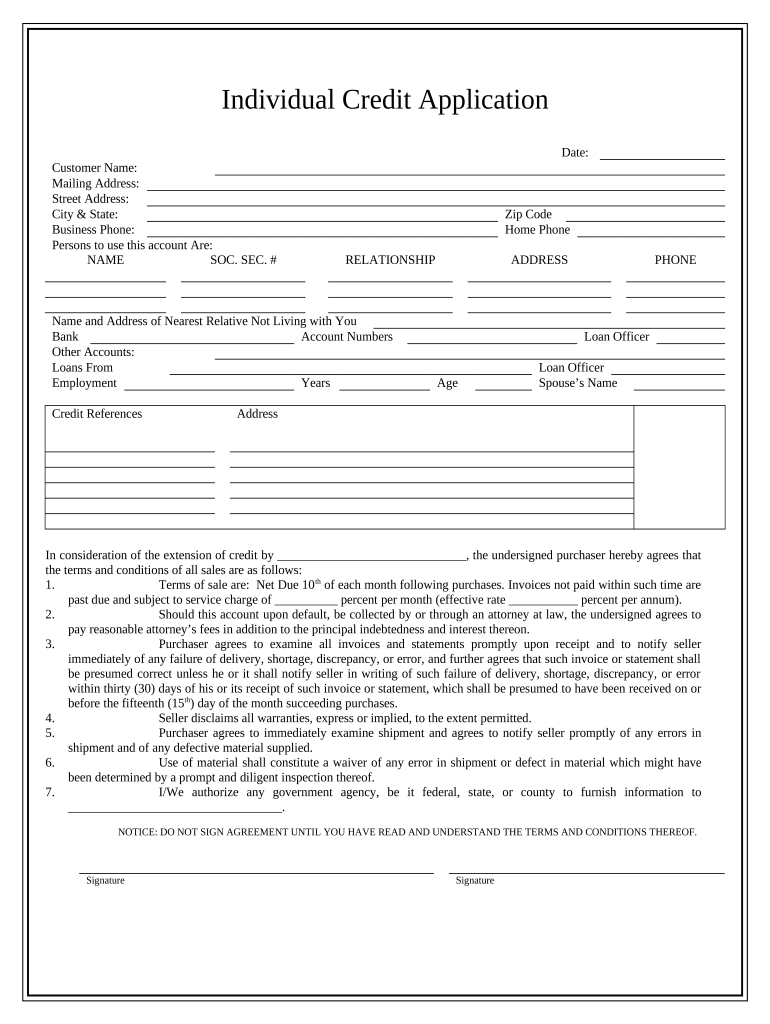

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is individual credit application

An individual credit application is a formal request for credit made by a single person, usually a consumer, seeking to borrow money or obtain a credit line from a lender.

pdfFiller scores top ratings on review platforms

Very easy to use and has the forms you need

I like the idea of being able to fill in forms online.

Thank you

easy to use but need webinar to see how to upload forms

I like it, but there are alot of processes to go through, rather than just fill/print.

Comes in very handy when there are forms that you need for your business and they are not something that you have readily on hand.

I have never been able to create so many fillable forms with such great ease.

Who needs individual credit application template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Individual Credit Application Forms

How to prepare your individual credit application form?

To fill out an individual credit application form, start by gathering all the necessary documents, such as personal identification, proof of income, and relevant financial information. Ensure that you provide accurate details throughout the form, as discrepancies can lead to application rejection.

-

Collect necessary documents including ID and proof of income.

-

Accurately fill out all requested fields.

-

Review for any errors before submission.

What are individual credit application forms?

An individual credit application form is a document used by lenders to assess the creditworthiness of potential borrowers. It collects critical information that enables lenders to make informed decisions regarding credit approvals. Accurate detail entry is vital as mistakes can result in delays or denials.

-

The document required by lenders to evaluate your creditworthiness.

-

Ensures the lender can make informed decisions based on reliable information.

-

Typically required when applying for a credit card, loan, or mortgage.

What are the core components of the individual credit application form?

The core components of the individual credit application form include essential personal information and financial history. Key elements consist of your personal identification details, recent employment history, current bank account numbers, and information about any existing debts.

-

Includes your name, address, and contact details.

-

Requires bank account details, employment history, and income sources.

-

List of contacts who can vouch for your creditworthiness.

How do you complete the application step-by-step?

Completing an individual credit application form involves a systematic approach. Begin by gathering all necessary personal and financial documents, then proceed to fill out the form’s sections in order. It’s crucial to check for errors and ensure all required fields are completed.

-

Ensure you have all personal and financial documents ready.

-

Complete each section in order, starting with personal details.

-

Review the completed form to avoid common mistakes.

Can you edit and customize your credit application form?

Yes, you can efficiently edit and customize your individual credit application form using tools like pdfFiller. This digital platform allows you to interact with fields easily, ensuring that your form is completed accurately and promptly. Electronic forms offer distinct advantages over traditional paper forms.

-

Utilize pdfFiller to edit, fill, and sign your application digitally.

-

Interactive fields simplify the completion process.

-

Electronic forms provide easier storage, sharing, and editing options.

What are common problems encountered with credit application forms?

When filling out individual credit application forms, applicants often face issues such as inaccuracies and missing information. If your application is denied due to errors, knowing how to address these issues is essential. Taking the right steps can help you effectively resubmit your application.

-

Mistakes in personal or financial details can lead to rejection.

-

Know how to respond if credit is denied due to application errors.

-

Tips for effectively correcting and resending your application.

How to manage and secure your completed credit application?

After completing your individual credit application form, managing and securing it is crucial. Using pdfFiller, you can save and store your application securely, ensuring that sensitive information remains confidential. The eSigning feature allows you to finalize the document and send it safely.

-

Store your completed form securely using pdfFiller.

-

Best practices to ensure your sensitive information stays private.

-

Securely sign and send your application to the lender.

What are the legal considerations for your credit application?

Understanding the Equal Credit Opportunity Act (ECOA) and other regulations is vital when submitting individual credit application forms. These laws ensure fair treatment in credit applications and necessitate compliance from lenders. Familiarizing yourself with these regulations can protect your rights as an applicant.

-

Learn how the ECOA affects your credit application rights.

-

Understand key regulations that lenders must follow.

-

Ensure your application complies with legal requirements.

How to fill out the individual credit application template

-

1.Open the PDF document of the individual credit application using pdfFiller.

-

2.Review the form to understand the required information before starting to fill it out.

-

3.Enter your personal information in the designated fields, including your full name, address, date of birth, and Social Security number.

-

4.Provide your employment details, such as your employer's name, job title, and length of employment.

-

5.Input your financial information, which may include your monthly income, expenses, and any existing debts.

-

6.Review each section of the application to ensure that all information is accurate and complete before submission.

-

7.Utilize the 'Save' function to keep a copy of your application in case you need to reference it later.

-

8.Submit the application through pdfFiller's submission feature or print it to send via traditional mail.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.