Get the free Quitclaim Deed from Individual to Two Individuals in Joint Tenancy template

Show details

This Quitclaim Deed from Individual to Two Individuals in Joint Tenancy form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is quitclaim deed from individual

A quitclaim deed from an individual is a legal document that transfers ownership of property from one person to another without guaranteeing the title against claims.

pdfFiller scores top ratings on review platforms

What a relief, this application is shamazing.

PDFfiller was a great source for forms. It has many different features which were easy to use once you learned them. The tutorial videos make it really easy.

very GOOD BUT COULD DO WITH MORE symbols and shape options

PDF FILLER IS SO EASY TO USE AND IT'S GREAT SERVICE.

Everything been find except I can cannot pull this up from another computer, or even what I have already did

Extremely easy to find the forms I needed, thank you.

Who needs quitclaim deed from individual?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Quitclaim Deed from Individual Form on pdfFiller

Filling out a quitclaim deed from an individual form involves understanding the document's purpose and components, ensuring accurate information transfer, and complying with related legal requirements.

What is a quitclaim deed?

A quitclaim deed is a legal document used to transfer ownership of real estate. It conveys any interest the grantor (seller) may have in the property to the grantee (buyer) without guaranteeing that the title is clear of claims.

Key characteristics of quitclaim deeds

-

Unlike warranty deeds, quitclaim deeds do not provide any guarantees about the property's title or ownership.

-

They are generally easier and quicker to fill out compared to other deed types.

-

Quitclaim deeds are often used between family members or in divorces.

What are the benefits of using a quitclaim deed?

-

They typically incur lower fees for processing and legal assistance.

-

They facilitate faster property transfer without extensive legal formalities.

-

Especially beneficial in estate settlements, divorce proceedings, or gift transfers.

What are the risks associated with quitclaim deeds?

-

The absence of guarantees can lead to potential disputes over property ownership.

-

If issues arise post-transfer, the grantee has limited legal claims against the grantor.

-

It's crucial to perform a title search to uncover any existing liens or claims.

How does the quitclaim deed process work?

The quitclaim deed process begins with identifying its necessity, determining eligibility, and understanding how it differs from other property transfer methods.

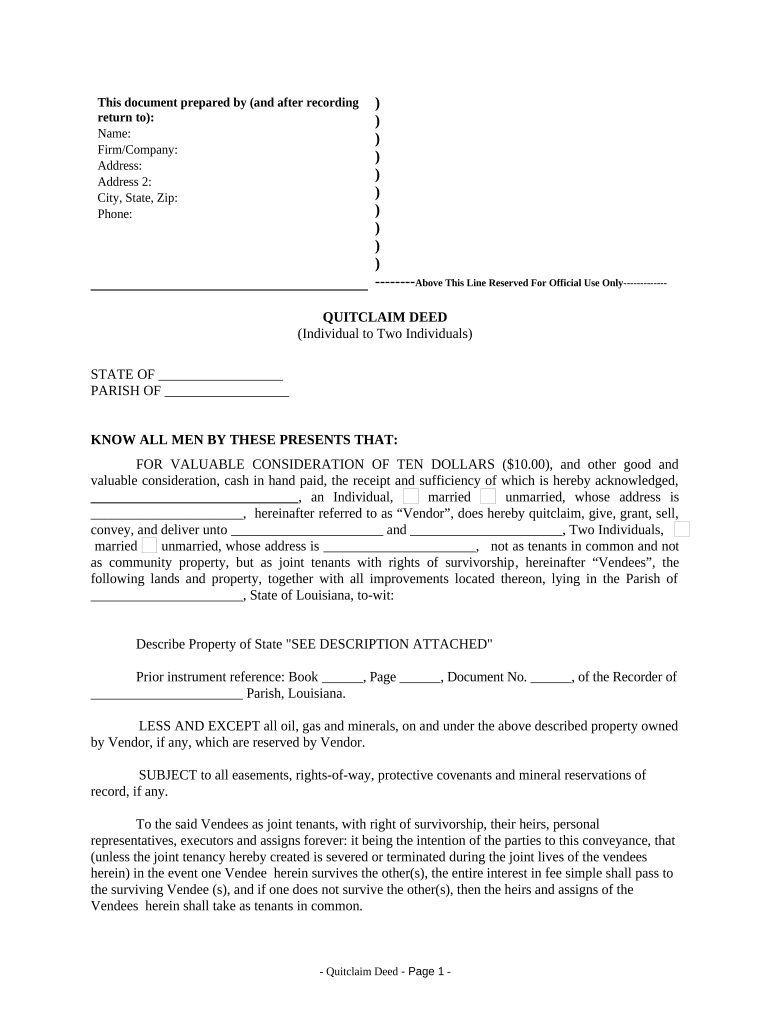

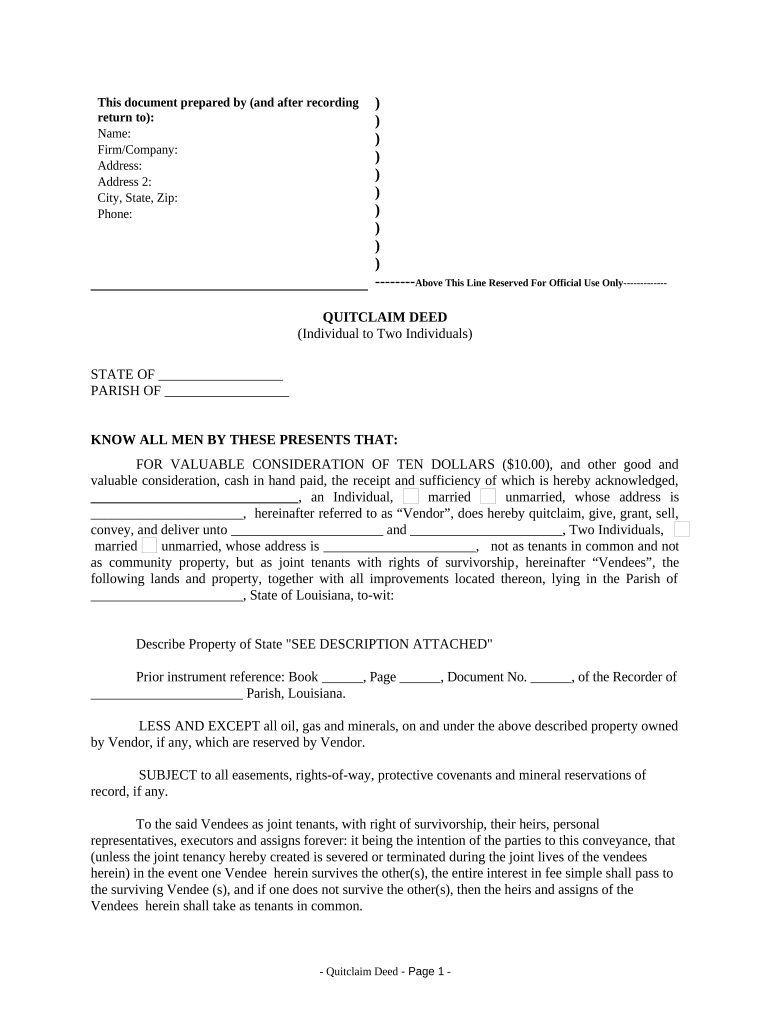

What are the key components of a quitclaim deed?

-

Details of the seller (grantor) and buyer (grantee) must be clearly stated.

-

A legal description of the property as per public records.

-

The value exchanged in the transfer, which can be monetary or non-monetary.

-

Both parties must sign the document, often requiring notarization.

What are the detailed instructions for filling out the quitclaim deed form?

-

Gather all necessary information about the grantor, grantee, and property details.

-

Access the quitclaim deed template on pdfFiller and fill out each section accurately.

-

Ensure the document is signed in front of a notary public.

-

File the completed deed with the appropriate county office and pay any associated recording fees.

What common mistakes need to be avoided when using a quitclaim deed?

-

Ensure all details are accurate to avoid legal complications.

-

Verify that the deed complies with local laws and recording requirements.

-

All parties must sign the document, and notarization is often required.

What does a sample quitclaim deed from an individual form look like?

A visual example of a completed quitclaim deed can help clarify the necessary components. It typically includes annotations for key sections, offering insights into customization options.

How can pdfFiller’s features enhance your quitclaim deed needs?

-

Utilize pdfFiller's interactive tools for easy form filling and editing.

-

Quickly comply with legal requirements using eSigning features.

-

Access and manage your documents efficiently with cloud-based solutions.

How to fill out the quitclaim deed from individual

-

1.Start by obtaining the quitclaim deed form from pdfFiller or an equivalent source.

-

2.Open the form in pdfFiller and familiarize yourself with the sections.

-

3.In the 'Grantor' section, enter your full legal name and address as the current property owner.

-

4.Next, navigate to the 'Grantee' section and input the full name and address of the person receiving the property.

-

5.Specify the property details in the designated area, including the legal description, street address, and Parcel ID if available.

-

6.To ensure accuracy, double-check that all names are spelled correctly and the information matches official records.

-

7.Include the date of the transfer in the appropriate field.

-

8.If applicable, have a notary public witness your signature to validate the deed.

-

9.After completing the form, save it and either print it for signature or share it electronically with relevant parties.

-

10.Finally, record the quitclaim deed with your county's recorder of deeds to finalize the transfer of ownership.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.