Get the free 497308958

Show details

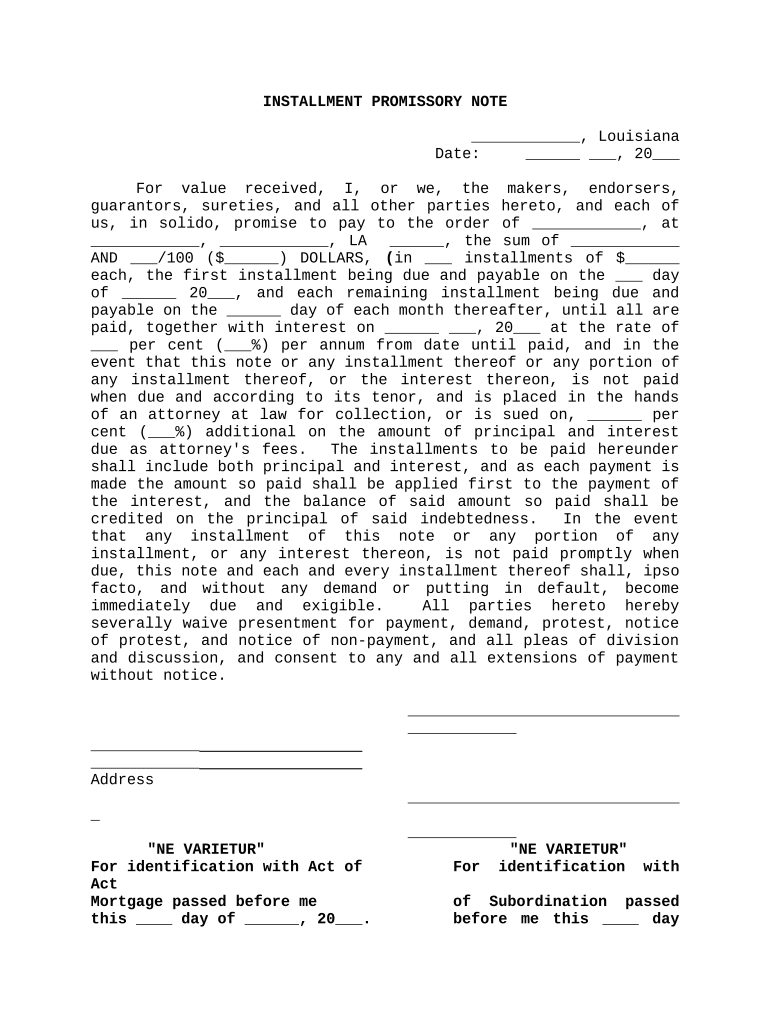

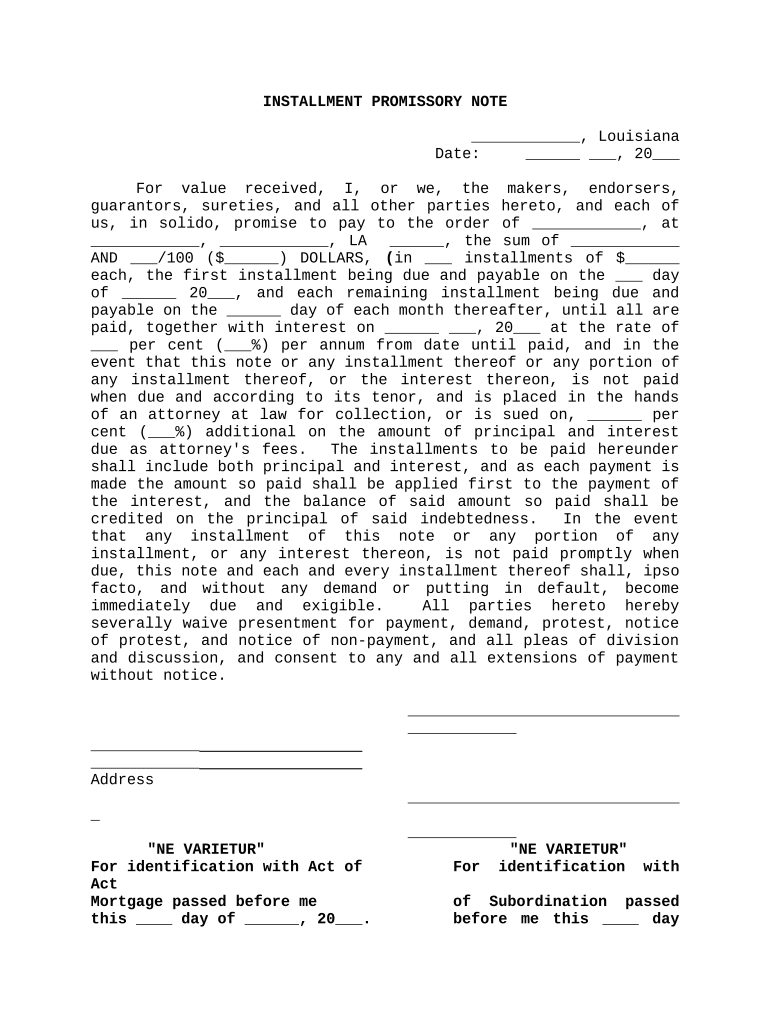

A promissory note is a written document in which a borrower agrees (promises) to pay back money to a lender according to specified terms. This is an example of an installment promissory note, in

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is installment promissory note ne

An installment promissory note NE is a legal document in which a borrower agrees to repay a loan in scheduled installments over a specified period.

pdfFiller scores top ratings on review platforms

Customer "Support" was outstanding. Addressed my "unsubscribing" issue without hassle. Prompt and courteous "support team" gets all A's.

Customer "Support" was outstanding. Addressed my "unsubscribing" issue without hassle. Prompt and courteous "support team" gets all A's.

Customer "Support" was outstanding. Addressed my "unsubscribing" issue without hassle. Prompt and courteous "support team" gets all A's.

Customer "Support" was outstanding. Addressed my "unsubscribing" issue without hassle. Prompt and courteous "support team" gets all A's.

Customer "Support" was outstanding. Addressed my "unsubscribing" issue without hassle. Prompt and courteous "support team" gets all A's.

I had a temporary need which was properly filled.

Who needs 497308958 template?

Explore how professionals across industries use pdfFiller.

Your comprehensive guide to the installment promissory note form

To fill out an installment promissory note form, gather necessary details like the lender's name, borrower's information, and specific loan conditions. Follow careful steps to ensure that all required components such as payment schedules and amounts are accurately documented.

What is an installment promissory note?

An installment promissory note is a financial document wherein the borrower promises to repay a specified sum of money to the lender through scheduled payments. This form typically includes critical elements like principal, interest rates, and a detailed payment schedule. Having such a legal document is crucial for establishing clear terms and ensuring both parties understand their obligations within financial transactions.

-

A formal agreement signifying the borrower's commitment to repay a loan.

-

Includes principal amount, interest rates, payment schedule, and borrower's and lender's details.

-

Provides a clear framework for repayment and legal protections for both parties.

How do fill out the installment promissory note?

Filling out the installment promissory note involves detailed steps to ensure accuracy. Start by filling in the lender's name and contact information, followed by the borrower's identity and their details. Next, state the loan amount and include terms regarding interest rates, payment schedules, and due dates to avoid ambiguities.

-

Clearly input the lender's full name and contact information.

-

Include the borrower's full legal name and any relevant contact information.

-

Specify the precise amount being borrowed by the borrower.

-

Detail the payment schedule, including due dates and installment amounts.

What are common errors in promissory note documentation?

Errors in promissory note documentation can lead to legal disputes and financial misunderstandings. Common mistakes include inaccurate interest calculations, missing essential details, or vague payment schedules. To avoid these inaccuracies, careful validation of all entries is paramount.

-

Double-check rates to prevent financial discrepancies.

-

Ensure all required personal and financial information is included.

-

Clarify payment terms and schedules to prevent misunderstandings.

What are legal considerations for installment promissory notes?

Legal considerations for installment promissory notes in Nebraska include understanding various regulations that govern loan agreements. It’s essential to have an attorney review the document to ensure it complies with state laws and reflects the actual agreement between the borrower and lender. Additionally, knowing the steps to take if the note goes into default can save both parties a lot of trouble.

-

Consider hiring an attorney to review your notes for compliance.

-

Familiarize yourself with Nebraska laws governing financial agreements.

-

Know the steps to follow if a borrower defaults on their payments.

How to manage your installment promissory note?

Managing your installment promissory note effectively can ensure timely payments and organized documentation. Using tools like pdfFiller allows for easy editing, signing, and collaboration on documents. Keeping track of upcoming due dates and payment records through online platforms enhances financial accountability.

-

Use pdfFiller to easily edit and format your promissory note.

-

Implement reminders and tracking for due dates using online tools.

-

Utilize collaborative tools for responsible communication among parties.

How to integrate eSignatures into your promissory note process?

Integrating eSignatures into the promissory note process can streamline approvals and enhance security. Using pdfFiller, users can eSign documents conveniently while complying with electronic signature laws in Nebraska. This modern approach is beneficial for both lenders and borrowers, promoting efficiency without compromising legal integrity.

-

Easily sign documents from anywhere without needing to print.

-

Understand the laws regarding electronic signatures in Nebraska.

-

Utilize pdfFiller's secure platform for signing sensitive documents.

How to fill out the 497308958 template

-

1.Open the PDF document for the installment promissory note NE on pdfFiller.

-

2.Begin by entering the date at the top of the document where indicated.

-

3.Fill in the borrower's name and address in the designated fields.

-

4.Next, input the lender's name and address in the appropriate sections.

-

5.Clearly specify the principal amount of the loan to be borrowed.

-

6.Indicate the interest rate that will be applied to the loan.

-

7.Define the repayment schedule, including the frequency of payments (monthly, quarterly, etc.) and the duration of the payment period.

-

8.Include details regarding any late fees or penalties for missed payments if applicable.

-

9.Review all entries for accuracy and completeness before finalizing the document.

-

10.Once confirmed, save the document and print if necessary for signatures.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.