Last updated on Feb 17, 2026

Get the free 497309138

Show details

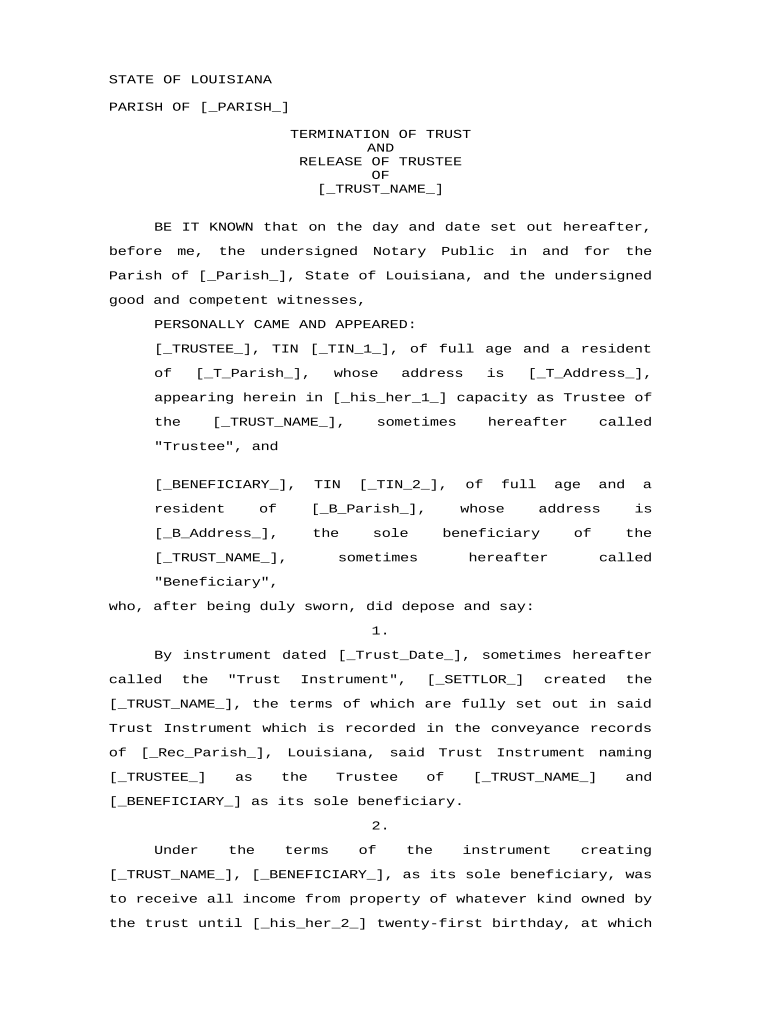

Trustee s name. Trustee s tax identification number. Parish of Trustee s residence. Trustee s address. As appropriate for Trustee. Beneficiary s tax identification number. Parish of Beneficiary s residence. STATE OF LOUISIANA PARISH OF PARISH TERMINATION OF TRUST AND RELEASE OF TRUSTEE OF TRUSTNAME BE IT KNOWN that on the day and date set out hereafter before me the undersigned Notary Public in and for the Parish of Parish State of Louisiana and the undersigned good and competent witnesses...PERSONALLY CAME AND APPEARED TRUSTEE TIN TIN1 of full age and a resident of TParish whose address is TAddress appearing herein in hisher1 capacity as Trustee of the sometimes hereafter called Trustee and BENEFICIARY TIN resident TIN2 full sole age beneficiary and a who after being duly sworn did depose and say By instrument dated TrustDate sometimes hereafter Trust Instrument SETTLOR created Trust Instrument which is recorded in the conveyance records of RecParish Louisiana said Trust Instrument...naming TRUSTEE as Under terms creating to receive all income from property of whatever kind owned by the trust until hisher2 twenty-first birthday at which time heshe was to become owner of all of the principal of said trust. Trustee and Beneficiary do hereby acknowledge that the term of TRUSTNAME has expired and that TRUSTNAME is now terminated. THUS DONE SIGNED at CityParish State Louisiana parties hereto having affixed their signatures together with me Notary and the undersigned witnesses...after due reading of the whole on this Date. Has in accordance with instrument creating TRUSTNAME disbursed all income from trust property to Beneficiary on an annual basis from the time of the Trust s inception to date and has retained the principal assets of the trust for disbursal on Beneficiary s twenty-first birthday which fact acknowledged by Beneficiary has now reached twenty-one years of age as may be seen by a certified copy of hisher2 birth certificate annexed hereto and made part...hereof. Trustee does hereby transfer set over and deliver to Beneficiary all of the assets movable and immovable and of every nature whatsoever all undistributed trust income of the trust said property and Item1 income that described heshe above received further complete accounting of the Trustee s administration of TRUSTNAME and is satisfied therewith and Beneficiary hereby releases from any liability arising out hisher1 administration of TRUSTNAME. WITNESSES NOTARY Notary Public form assumes...an intervivos trust that has immovable property as one of its assets thus requiring the trust instrument to be recorded in the parish in which the immovable property is located LA R*S* 9 2092. This document should also be recorded in any parish in which property is owned by the trust. WORD KEY PARISH TrustDate hisher2 Date NOTARY EXPLANATION Parish in which this document is signed* Name of the Trust as stated in Same as PARISH but not in caps. Address of Beneficiary. Date of instrument creating...trust. Person who created the trust. Describe first item* Describe second item* Describe third item* City and Parish in which this document signed* Date of execution* Notary before whom this document.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is termination of trust and

The termination of trust and document formally dissolves a trust agreement, relinquishing the trustee of their duties and distributing the trust's assets according to its terms.

pdfFiller scores top ratings on review platforms

It was really easy to fill out the forms and print them. Normally, I wouldn't spend money for this type of service, as I can just print the PDF document from the internet. This time, however, I just didn't want to have to write all the information. Also, if I wanted to make changes, I loved that I could change any field and not have to write over it (as I would have otherwise).

I signed up for a year. Now simple edit tool to use erase etc expects me to pay more and doesn't allow those tools. That, IMO is a bit too unfriendly. Allowing me to use for some time and then asking to pay for extended period of time would make sense to me as I would see a value in buying these additional editing tools/

my experience has been great with this web site

The app is simple and easy to use Customer service is impeccable. Ill be a customer for a long time

Good. But couldn't fix previous filled spaces in the document nevertheless I followed your instructions.

I have had to completely google each form as opposed to using the search engine.

Who needs 497309138 template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the termination of trust and form processes

How to fill out a termination of trust form

To fill out a termination of trust form, ensure you have the necessary trustee and beneficiary information ready. Complete the details accurately and ensure that the document is signed by a witness and a Notary Public to validate it.

Understanding trusts and their purpose

A trust is a legal arrangement where one party (the trustee) holds assets for the benefit of another (the beneficiary). The settlor creates the trust, outlining its purpose and the rules for managing assets. Trusts play a crucial role in estate planning by enabling property distribution under specific conditions.

-

The individual or entity managing the trust.

-

The person or group entitled to receive benefits from the trust.

-

The person who establishes the trust and defines its terms.

Why might someone choose to terminate a trust?

Several reasons may lead to the decision to terminate a trust. Beneficiaries may reach the age of majority, or the purpose of the trust might have been fulfilled, prompting its dissolution. Additionally, significant changes in personal circumstances or financial situations can lead to the trust no longer serving its intended purpose.

-

Once a beneficiary reaches adulthood, the trust may no longer be necessary.

-

If the objectives of the trust are met, it may be time to close it.

-

Life events such as divorce or financial difficulties can lead to trust termination.

What steps are involved in properly winding up a trust?

Winding up a trust involves several critical steps to ensure proper closure. Begin by reviewing the trust document to understand its terms. Then, determine how to distribute the assets, ensuring fair treatment of all beneficiaries. It is also essential to notify all parties involved, including beneficiaries and co-trustees, about the termination process.

-

Understand the terms and conditions under which the trust can be terminated.

-

Decide how to equitably distribute the trust's assets among beneficiaries.

-

Inform beneficiaries and co-trustees about the termination and distribution plan.

How to complete the termination of trust form

Filling out the termination of trust form requires attention to detail to ensure that all necessary information is accurately provided. Include the names and details of the trustee and beneficiaries, as well as the reasons for termination. Ensuring that the document includes a witness signature and notarization is vital for its legal validity.

-

Provide full legal name and contact information of the trustee.

-

List all beneficiaries and their respective shares in the trust.

-

signatures are needed to validate the termination officially.

What are the legal obligations and compliance requirements?

In Louisiana, there are specific legal obligations when terminating a trust. It's important to comply with state laws, which may require disclosures to beneficiaries and state authorities. Tax implications should also be considered, as terminating a trust might trigger tax consequences that need to be addressed.

-

Understanding state-specific laws governing trust dissolution is crucial.

-

All beneficiaries must be informed about the trust's termination and asset distribution.

-

Consider potential taxes that could arise from terminating the trust.

How does real estate factor into trust termination?

Real estate holdings can significantly impact the trust termination process. Transferring title to real estate requires adhering to local laws and regulations. Understanding the implications of these transfers is crucial for ensuring a smooth process.

-

Evaluate how properties held in the trust will be dealt with upon termination.

-

Follow the necessary legal steps to transfer titles correctly.

-

Ensure compliance with laws related to real estate transfers.

When should you consult a trust attorney?

Consulting a trust attorney during the termination process can be beneficial. Legal assistance can help avoid misunderstandings and disputes among beneficiaries. It's important to ask potential attorneys specific questions regarding their experience with trust issues to ensure you're making the right choice.

-

If disputes arise or complexities are present, professional guidance is recommended.

-

An attorney can guide you through legal obligations and procedures.

-

Inquire about their experience with similar cases and fees involved.

What are common pitfalls when winding up a trust?

Avoiding common mistakes during the termination of a trust is critical. Many face issues due to informal communication or lack of documentation. By staying organized and informed, the process can be significantly smoother.

-

Failure to properly communicate with beneficiaries can lead to disputes.

-

Maintain clear records and provide regular updates to involved parties.

-

Legal disputes can arise, leading to potential financial loss.

How can pdfFiller assist in the trust termination process?

pdfFiller offers a range of tools that facilitate the termination of trust processes. Users can easily edit and manage trust termination documents through the platform. Features like eSigning and collaboration tools simplify document management, ensuring a user-friendly experience for both trustees and beneficiaries.

-

Utilize pdfFiller to easily modify trust documents as needed.

-

Ensure quick and legal signing of your termination forms.

-

Work with attorneys or co-trustees seamlessly within the platform.

When should you seek professional guidance?

While terminating a trust can be managed independently, professional guidance is invaluable in complex situations. pdfFiller offers services that enable users to collaborate closely with legal experts, ensuring all obligations are met and reducing the chances of disputes.

-

Engage professionals when complications arise or when there are multiple beneficiaries.

-

Access tools that aid in document preparation and legal consultations.

-

Leverage the platform to work effectively with attorneys throughout the process.

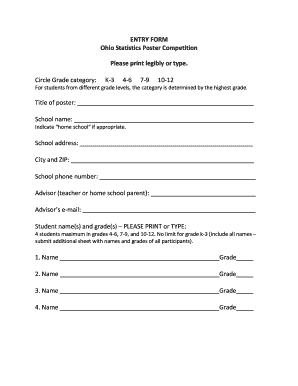

How to fill out the 497309138 template

-

1.Obtain the standard termination of trust and template from pdfFiller.

-

2.Open the document in pdfFiller and review the template for required sections.

-

3.Fill in the name of the trust at the top of the document.

-

4.Provide the date that the trust was established and the date of termination.

-

5.List the names and addresses of all trustees and beneficiaries.

-

6.Detail the distribution plan for the trust assets, following the trust agreement's provisions.

-

7.Include a statement confirming the agreement of all parties involved to terminate the trust.

-

8.Sign the document where indicated, ensuring all trustees sign and date it appropriately.

-

9.Review the completed document for accuracy and completeness before submitting it.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.