Last updated on Feb 17, 2026

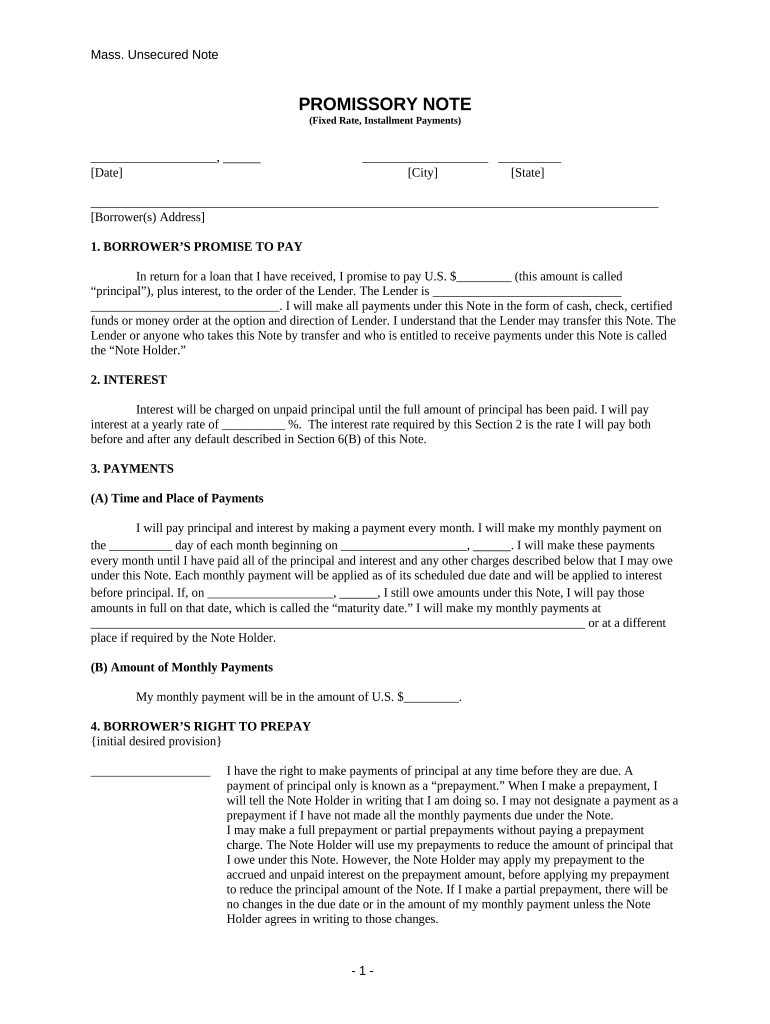

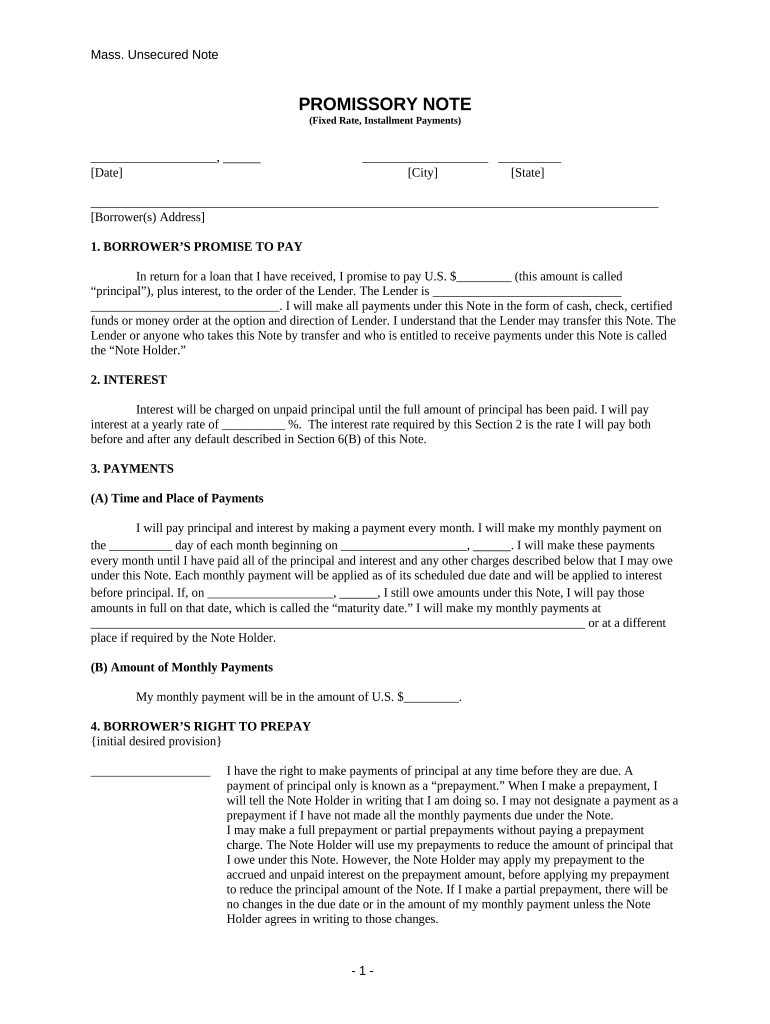

Get the free Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate template

Show details

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is massachusetts unsecured installment payment

Massachusetts unsecured installment payment refers to a type of payment plan that allows individuals to make regular payments on unsecured debts or obligations in the state of Massachusetts.

pdfFiller scores top ratings on review platforms

Love that I can edit save send and emails my work.

Good

Easy to use

It's been very helpful

very user friendly

There are some features still needed for me to learn

Who needs massachusetts unsecured installment payment?

Explore how professionals across industries use pdfFiller.

Massachusetts Unsecured Installment Payment Form Guide

How does the unsecured installment payment form work?

The Massachusetts unsecured installment payment form is designed for loans that are not backed by collateral. Its primary purpose is to outline the agreement between a borrower and lender regarding repayment schedules, interest, and other vital terms. Understanding this form is crucial for borrowers, as it lays down their obligations without the safety net of secured assets.

What are the key components of the Massachusetts unsecured note?

-

The principal is the original sum borrowed, while interest is the cost of borrowing this money. These figures should be clearly outlined to ensure borrowers know what they owe.

-

The lender provides funds based on the agreement, while the borrower must repay the amount based on the terms specified in the note, which must be understood by both parties.

-

Payments may vary and can include fixed monthly sums or flexible payments based on income, but all terms must be confirmed in the form.

How to fill out the unsecured installment payment form: step-by-step instructions

-

Provide essential personal details such as your name, address, and Social Security number to identify you as a borrower.

-

Clearly state the principal amount and the agreed-upon interest rate to maintain transparency in your agreement.

-

Accurately define the payment schedule, including due dates and how the installments will be structured to avoid confusion.

What are the monthly payment requirements for borrowers?

Understanding your payment frequency is crucial, as it affects budgeting. Typically, monthly payments must be regular and predictable. Failing to pay on time can lead to penalty fees, and understanding how interest accrues on late payments is essential for financial planning.

-

Payments are usually scheduled monthly, but it’s critical to confirm this with your lender.

-

Utilize a loan calculator to determine how much should be paid each month, factoring in principal and interest.

-

Be aware of the consequences of late payments, including fees and potential damage to your credit score.

How can you edit and manage your unsecured installment payment form with pdfFiller?

-

Easily upload your form to pdfFiller for straightforward editing and customizing as needed.

-

Adding legally accepted electronic signatures is a breeze, ensuring your documents are valid and official.

-

Utilize collaborative tools for team involvement, making it efficient to manage forms together.

What common mistakes should you avoid when completing the form?

-

Ensure all provided information is precise to avoid complications later.

-

Understand all terms to meet your legal obligations as a borrower.

-

Be aware of Massachusetts-specific regulations to remain compliant.

What additional considerations and compliance should you keep in mind in Massachusetts?

-

Familiarize yourself with the regulations governing unsecured notes in Massachusetts to protect your interests.

-

Be aware of potential tax obligations that may arise from unsecured installment loans, as these can affect your financial planning.

-

Consult local resources for legal guidance, ensuring your agreements are properly structured and enforced.

How to fill out the massachusetts unsecured installment payment

-

1.Begin by accessing the pdfFiller platform and locate the Massachusetts unsecured installment payment form.

-

2.Create a new document and upload the Massachusetts unsecured installment payment template, or select it from pdfFiller's form library.

-

3.Fill in your personal information at the top section, including your name, address, and contact details.

-

4.In the payment details section, specify the total amount owed and the desired installment payment plan breakdown, indicating how many months you wish to spread the payment over.

-

5.Include any relevant account numbers related to the debts being addressed.

-

6.Review the specific terms and conditions of the installment payment to ensure they match your agreement.

-

7.Once all fields are completed, use pdfFiller's tools to check for any errors and ensure all required information is accurate.

-

8.Save your document and choose the option to either print or electronically submit the form as necessary.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.