Last updated on Feb 17, 2026

Get the free Maryland Installments Fixed Rate Promissory Note Secured by Residential Real Estate ...

Show details

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is maryland installments fixed rate

The 'Maryland Installments Fixed Rate' is a financing agreement allowing residents to repay loans in fixed monthly installments.

pdfFiller scores top ratings on review platforms

I have tried many different PDF fillable forms... this one, BY FAR, is the easiest to use and I LOVE IT!

Very user friendly and looks like a very good lease form

Easy! But it's not free to use just to fill!

Really love the ease of filling out electronic forms with your website! What a difference it makes!

i loved this. i was confused though at first about whether i could use a free trial or if i would be charged. i would recommend highlighting the free trial offer upfront to get more people to use this great product.

This is excellent, I can't say more. I love it.

Who needs maryland installments fixed rate?

Explore how professionals across industries use pdfFiller.

Maryland Fixed Rate Installment Payments Overview

If you're looking to understand how to manage fixed rate installment payments in Maryland, you've come to the right place. This guide will help you navigate the Maryland fixed rate note process, highlighting important factors like eligibility, payment calculations, and compliance requirements.

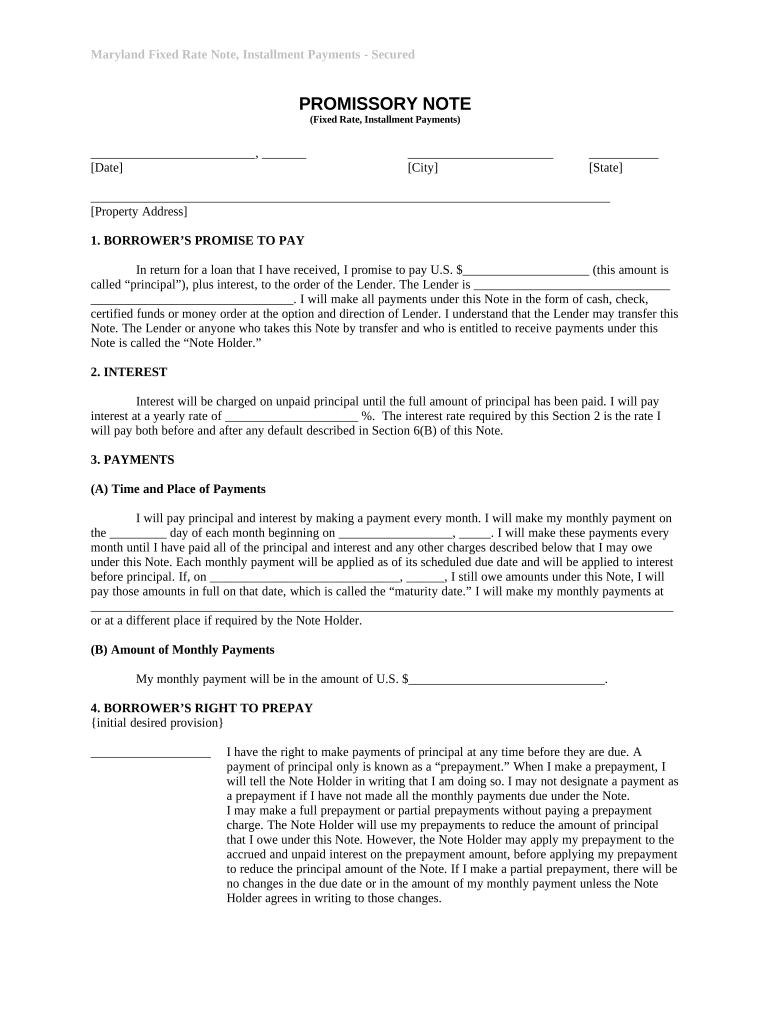

What is a fixed rate note in Maryland?

A fixed rate note is a legal document outlining a loan agreement where the interest rate remains constant throughout the life of the loan. This provides borrowers stability and predictability in payment amounts.

-

Consistency: With a fixed interest rate, your monthly payments won't fluctuate, making budgeting easier.

-

Security: This model shields borrowers from market interest rate increases.

-

Simplicity: Fixed rate loans tend to be easier to understand compared to variable options.

Why are installment payments important?

Installment payments play a crucial role in making loans manageable. They allow borrowers to pay back their loans in smaller, predictable chunks rather than a lump sum, making repayment feasible, especially in large loans.

How can pdfFiller help in managing your note?

pdfFiller is a comprehensive document management tool that simplifies the entire process of handling your fixed rate note. It offers features for writing, editing, signing, and securely storing your documents online.

What information is needed from the lender?

To proceed effectively, it's essential to identify your lender's full name and address. This is crucial for legal clarity and compliance under Maryland law.

-

Lender Name: A complete and accurate lender name is necessary for all documentation.

-

Address: The lender's address must be included to ensure the documents are valid.

What are the basics of fixed rate notes?

A fixed rate note comprises the principal amount borrowed, which is the original loan sum, and the interest that is charged on that loan. Understanding these components and how they interact is vital for borrowers.

-

Principal: This is the amount of money borrowed, which must be repaid.

-

Interest: The cost of borrowing expressed as a percentage of the principal.

-

Comparison: Fixed rates provide predictability, unlike variable rates that fluctuate with the market.

Who can qualify for a fixed rate note?

Eligibility for a fixed rate note in Maryland often hinges on several factors, including credit score and required documentation. Generally, those meeting basic lending criteria can qualify.

-

Basic eligibility: Most lenders will have criteria that applicants must meet.

-

Credit score: A higher score often improves eligibility and can lead to better rates.

-

Documentation: Provide necessary paperwork to demonstrate income and creditworthiness.

How do you calculate payments and interest?

Calculating your monthly installment payments is essential for budgeting. Most loans in Maryland will have an amortization schedule, which outlines payments throughout the life of the loan.

-

Monthly Payments: You can derive your monthly payments by using the loan amount, rate, and term.

-

Amortization: Understanding how your payments affect your principal and interest over time.

Using pdfFiller's customizable tools, borrowers can perform calculations easily and access amortization schedules, which can simplify their financial planning.

What associated fees can you expect?

Borrowers should be aware of common fees linked to fixed rate notes, which can add up significantly. These may include loan origination fees, processing fees, and more.

-

Loan Origination Fees: These are fees charged by lenders to process the loan application.

-

Processing Fees: Additional costs incurred during loan processing.

-

Monitoring Fees: Platforms like pdfFiller can help track these fees effectively.

What are the reporting requirements for fixed rate notes?

Both lenders and borrowers must adhere to specific documentation and reporting requirements for compliance. Understanding these regulations is essential to avoid penalties, especially within Maryland.

-

Documentation: There are specific documents required to verify the transaction.

-

Regulatory Compliance: Maryland law has unique requirements that must be met.

-

PdfFiller: Utilizing pdfFiller can streamline the creation of compliant documents.

What happens if you fail to file?

Failing to file requisite documentation can have serious legal implications. In Maryland, borrowers may face significant penalties for noncompliance, which can affect future borrowing opportunities.

-

Legal Implications: Non-filing can result in legal action against borrowers or lenders.

-

Potential Penalties: Maryland has specific penalties targeting non-compliance.

-

Compliance Tools: PdfFiller provides resources to ensure users meet all filing requirements.

How to become a home credit lender in Maryland?

The steps to becoming a licensed home credit lender in Maryland require understanding local laws and obtaining necessary registrations. This ensures compliance and legal standing.

-

Licenses: Identify what licenses are required under Maryland law for lenders.

-

Registration: Proper registration is crucial to operate legally.

-

Utilize pdfFiller: For managing documents, pdfFiller can assist with applications and forms.

How to engage with the lending community?

Engaging with the lending community ensures that you remain informed about evolving lending laws, especially in Maryland. Networking opportunities provide crucial insights.

-

Stay Updated: Follow relevant news sources or community boards for updates.

-

Network: Engage with other lenders or borrowers through networking events.

-

Use Social Media: Leverage platforms to connect with peers and share information.

What tools does pdfFiller offer for document management?

PdfFiller offers a range of interactive tools designed to simplify document management. From editing and signing to comprehensive tracking, these features enable users to handle their fixed rate notes effortlessly.

-

Editing Tools: Easy-to-use interface for modifying fixed rate notes.

-

Signing Capabilities: Securely e-sign documents for added convenience.

-

Document Storage: Store and access your fixed rate notes from anywhere.

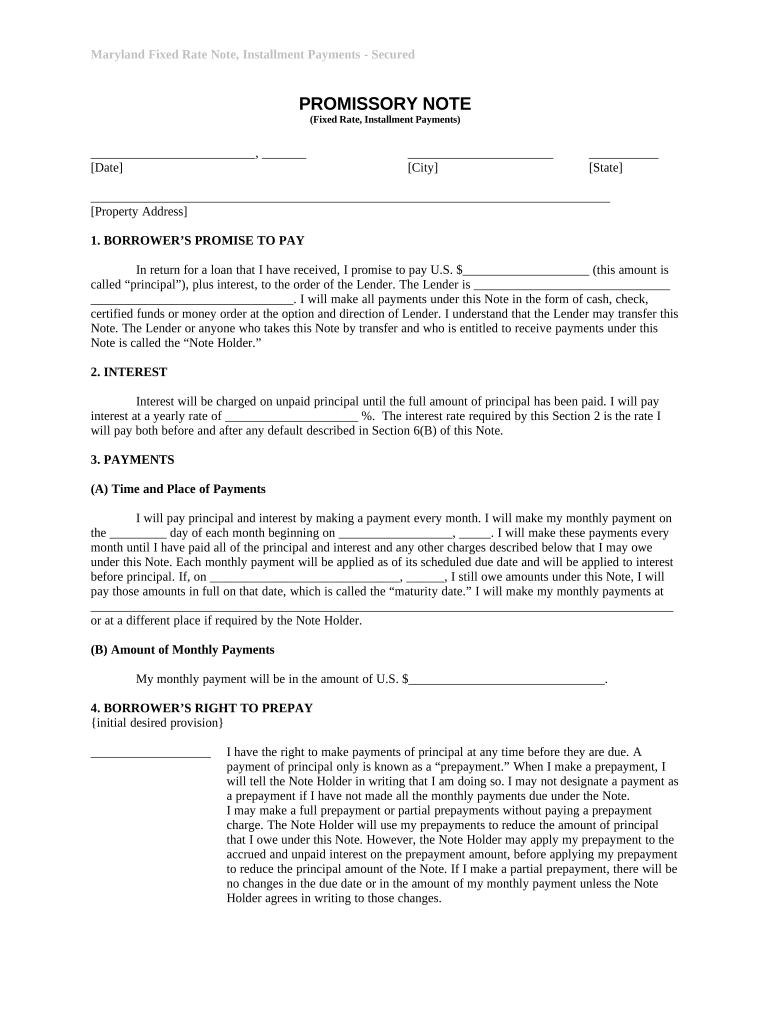

How to fill out the maryland installments fixed rate

-

1.Open the 'Maryland Installments Fixed Rate' form on pdfFiller.

-

2.Review the instructions at the top of the form for any specific requirements.

-

3.Fill in your personal information, including name, address, and contact details.

-

4.Enter the loan amount you wish to finance, ensuring it complies with any minimum or maximum limits indicated.

-

5.Specify the fixed interest rate in the designated field, if applicable.

-

6.Provide the start date for the loan repayment schedule.

-

7.Detail the duration for repayment, choosing your installment frequency (monthly, bi-weekly, etc.).

-

8.Review all entered information for accuracy before submission.

-

9.Save your completed form, either by downloading or storing it on pdfFiller.

-

10.Submit the form according to the instructions provided at the end of the document.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.