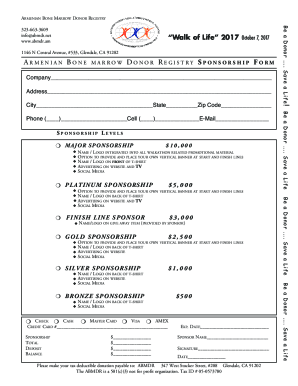

Get the free Maine Small Business Accounting Package template

Show details

This Small Business Accounting Package contains many of the business forms needed to operate and maintain a small business, including a variety of accounting forms. These forms may be adapted to suit

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

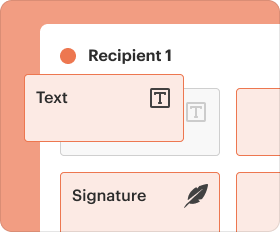

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is maine small business accounting

Maine small business accounting refers to the financial management practices tailored for small businesses operating in Maine, ensuring accurate tracking of income, expenses, and compliance with state regulations.

pdfFiller scores top ratings on review platforms

Great application!

Great So Far!

ok

Pretty Good

I love using PDF for court documents. it has helped so much, as I have horrible hand writing. looks so professional!

Excellent

Who needs maine small business accounting?

Explore how professionals across industries use pdfFiller.

Maine Small Business Accounting Form Guide

How to fill out a Maine small business accounting form

Filling out a Maine small business accounting form involves understanding the required documents and correctly entering the data. To ensure accuracy, familiarize yourself with common accounting terms and the specific forms you need. Utilize online tools like pdfFiller to streamline the process.

What are the accounting needs of small businesses in Maine?

Accounting is critical for small businesses in Maine, enabling business owners to track financial performance and adhere to legal requirements. The definition of accounting encompasses recording, summarizing, and analyzing financial transactions that impact your business. Understanding these aspects can alleviate common challenges, such as cash flow management and compliance with state regulations.

-

Ensures compliance with state and federal regulations, avoiding penalties.

-

Facilitates informed decision-making based on accurate financial data.

-

Helps in monitoring cash flow to maintain operational efficiency.

What forms are essential for Maine small businesses?

Maine small businesses benefit from a comprehensive accounting forms package tailored to meet their unique operational needs. These forms facilitate day-to-day accounting tasks, making it easier to monitor financial activities and stay organized.

-

Tracks revenue and expenses to determine profitability over a specific period.

-

Monitors due payments and their respective aging, ensuring timely vendor payments.

-

Illustrates the company’s financial position by detailing assets, liabilities, and equity.

-

Records cash flow by detailing all cash payments and receipts for easy tracking.

-

Keeps track of incoming payments, vital for managing cash flow effectively.

How to accurately fill essential accounting forms?

-

Define the time period for reporting, then accurately enter all revenue and expenses.

-

Ensure all accounts are listed with their invoice dates to calculate how long they’ve been outstanding.

-

Clearly distinguish between different asset types and accurately list all liabilities for a correct financial overview.

-

Record every disbursement against corresponding receipts for transparency.

-

Update this form daily to avoid missing important incoming transactions.

What tips can follow for efficient form completion?

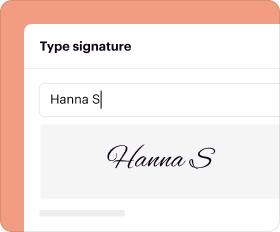

Adopt best practices for filling out your forms accurately. Being aware of common pitfalls can save time and enhance efficiency, such as verifying all entries before submission.

-

Double-check figures to minimize errors and discrepancies.

-

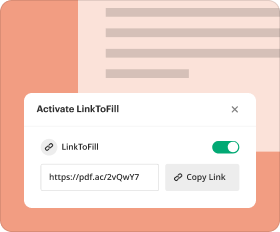

Platforms like pdfFiller enhance your form completion experience with easy editing and eSigning capabilities.

-

Keep your forms current to maintain compliance with changing business regulations.

Conclusion: How can pdfFiller assist in managing accounting forms?

Utilizing pdfFiller provides significant benefits for managing Maine small business accounting forms. This platform empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based solution, ensuring efficient document management capabilities.

How to fill out the maine small business accounting

-

1.Download the Maine Small Business Accounting form from pdfFiller.

-

2.Open the PDF in pdfFiller's editor interface.

-

3.Begin by entering your business name in the first field.

-

4.In the next section, input your business's address and contact information.

-

5.Move to financial sections, starting with your income sources. Enter your projected revenue accurately.

-

6.Proceed to the expense section. List all your business expenses in the provided fields, categorizing them appropriately.

-

7.Ensure that all entries include corresponding amounts and dates where applicable.

-

8.Review your entries for accuracy and completeness; use the 'Preview' function if available.

-

9.Once satisfied with your data, save your progress. Consider downloading a copy for your records.

-

10.Finally, submit or print the completed form as required.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.