Last updated on Feb 20, 2026

Get the free Business Credit Application template

Show details

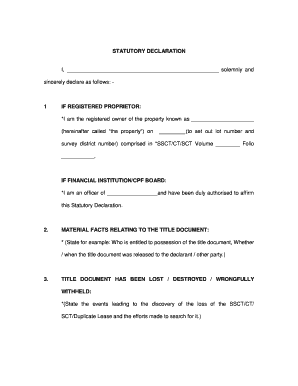

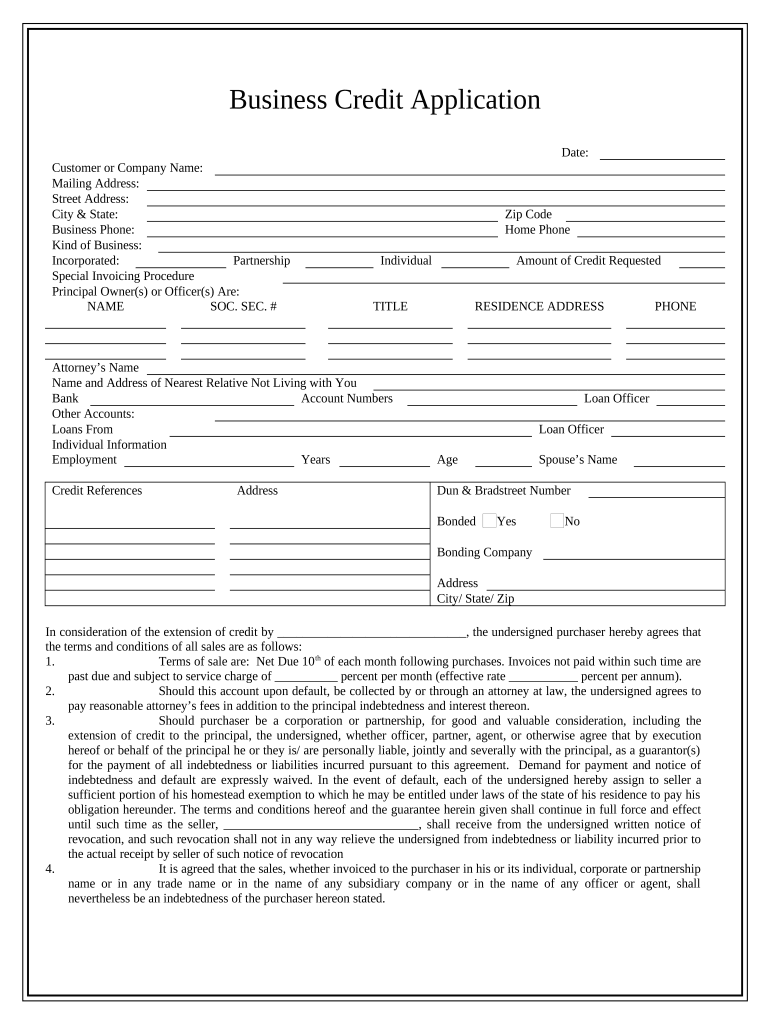

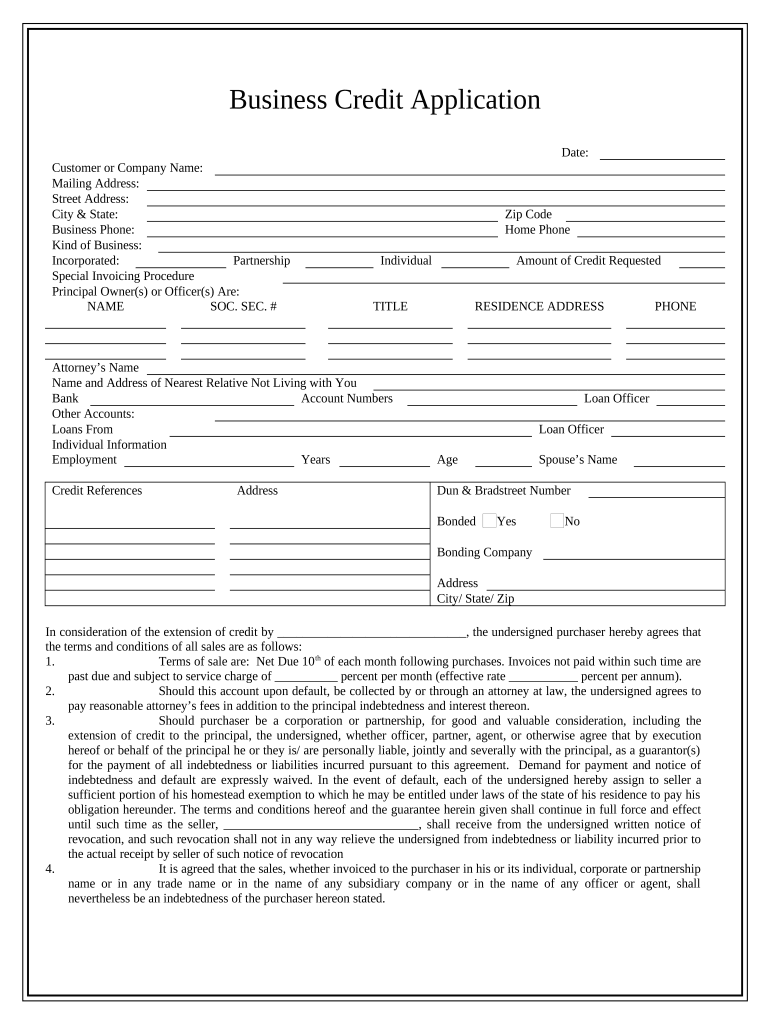

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business credit application

A business credit application is a formal request for credit or financing made by a business to a lender or financial institution.

pdfFiller scores top ratings on review platforms

Working good so far....just started but it seems to be doing just what we thought it should do. Easy to get around once you figure out where what is.

This site has saved me so much time! Love it!

Just what I needed. Saved time when time was short.

This is a Great service and I appreciate the Amazing Customer Service

It's not a hassle to use. Straight forward, up and functional immedately

VERY EASY TO FIND AND PRINT FORM, JUST LOVE IT

Who needs business credit application template?

Explore how professionals across industries use pdfFiller.

Business Credit Application Form Guide

How do fill out a business credit application form?

Filling out a business credit application form involves providing essential information about your business, financial status, and ownership details. Begin by accurately completing each section to ensure a smooth processing experience. This guide will break down the steps to help you navigate through the application effortlessly.

What is a business credit application?

A business credit application is a document that businesses complete to request a line of credit from a lender. This application is vital for both new and established companies as it helps establish creditworthiness and access necessary funding.

-

Understanding the impact of a business credit application can help secure better financing options and manage cash flow effectively.

-

Typically, a business credit application includes details about your company, financial history, and ownership information.

What sections are included in the business credit application form?

A business credit application form typically includes several key sections. Each of these plays a crucial role in providing the lender with the necessary information to assess your application.

-

Correct dating is essential for processing applications and tracking submissions.

-

You must accurately state your business name as it appears in official documents.

-

Providing separate mailing and physical addresses ensures legal clarity and proper communication.

-

Clarifying your business structure (e.g., incorporated or partnership) is vital for compliance.

-

Specify if your business requires customized invoicing to streamline billing processes.

-

Detail the principal owners including private information like names and addresses.

What financial information is required?

Providing accurate financial information is critical when completing a business credit application form. This data helps establish a clear picture of your business's financial health.

-

Indicate how much credit you need and justify it based on business needs.

-

Be cautious with your financial details; ensure they're provided securely.

-

Identify reliable references that can vouch for your creditworthiness.

-

A unique identifier that helps lenders assess your business entity.

What legal agreements and terms should understand?

Understanding the legal agreements and terms of sale referenced in a business credit application form is crucial to avoid future complications.

-

Recognize payment terms, including net due dates, which clarify when payments are expected.

-

Know your obligations in case of defaults and understand the collections process.

-

Business owners should be aware of personal liability implications concerning business debts.

-

Understand your rights and the options available in default situations.

How can pdfFiller assist in the application process?

pdfFiller offers a variety of tools to streamline the business credit application process. Utilizing its features can enhance your efficiency and document management.

-

Quickly adjust your business credit application with an easy-to-use interface.

-

Digitally sign the document for quicker submission and processing.

-

Easily share your application with team members for feedback via pdfFiller.

-

Manage your completed forms effectively with pdfFiller’s cloud-based solutions.

What interactive tools are available for applicants?

Leveraging interactive tools through pdfFiller can significantly enhance your application experience. These tools offer support at every stage of the process.

-

Utilize checklists to ensure you submit complete and accurate applications.

-

Access guided instructions to navigate the application process smoothly.

-

Receive timely alerts for application deadlines and follow-up actions.

-

Know that your sensitive information is protected while using pdfFiller.

How can troubleshoot common issues?

It's common to face issues when submitting a business credit application. Knowing how to troubleshoot them can save you time and frustration.

-

Be aware of typical mistakes, such as incorrect data or missing signatures.

-

If rejected, know the right steps to take to address the concerns raised.

-

Use pdfFiller’s support features for Help if you encounter technical challenges.

-

Access the platform's FAQ section to find solutions to common inquiries.

How to fill out the business credit application template

-

1.Download the business credit application form from pdfFiller.

-

2.Open the form in pdfFiller's editor.

-

3.Begin by entering your business name and contact information at the top of the application.

-

4.Provide details about your business structure (e.g., LLC, Corporation).

-

5.Input your Employer Identification Number (EIN) or Social Security Number (SSN) if applicable.

-

6.Fill out the section regarding your business address and duration of operation.

-

7.Include revenue and number of employees to reflect the size of your business.

-

8.Attach any required financial documents, such as tax returns or profit and loss statements, using the upload feature.

-

9.Review all entered information for accuracy and completeness before submission.

-

10.Submit the application electronically through pdfFiller or print it for mailing.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.